Bloomberg

Tokyo

An all-out attack on deflation, radical steps to boost the birthrate and a list of ways to rouse the economy ranging from welcoming foreign tourists to legalising casinos.

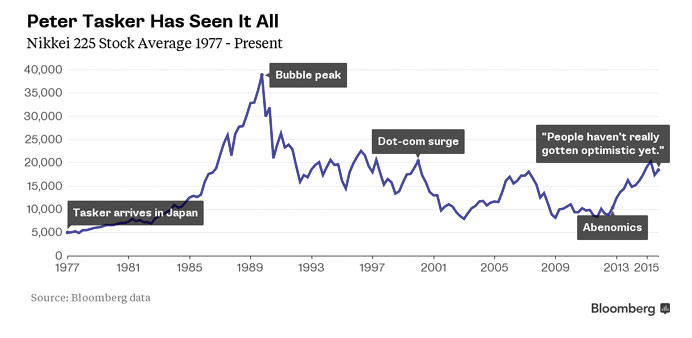

Those were the prescriptions for Japan, voiced by a robotic cat, more than a year before the birth of Abenomics. The medium was a manga comic commissioned by McKinsey & Co, and the author was Peter Tasker, long-time Japan hand and renaissance man. The equity strategist turned hedge-fund founder and novelist says he never imagined government policy would mirror his suggestions so quickly. He’s betting the nation’s equities will resume their ascent after dropping since August.

“At the time it seemed like an absolute fantasy,” said Tasker, 59, who has lived in Japan since 1977. “A lot of these things I wanted them to do, they’ve actually gone and done.” That’s why Tasker is keeping the faith with Prime Minister Shinzo Abe even as others question the success of his policy programme to revive Japan. The optimism is backed by hard cash.

His Japan-focused Arcus Investment, which oversees $1.5bn, delivered a total return of 343% through August from when he co-founded it in 1999, according to Tasker. That compares with a 47% return for the Topix index. A separate strategy started in 2002 has delivered a 236% gain, he said.

Since coming to power at the end of 2012, Abe has embarked on unprecedented quantitative easing in pursuit of a 2% inflation target. While that stopped the decline in consumer prices, reaching the goal has been scuppered by a fall in oil.

The premier has also relaxed visa requirements, with the number of visitors to the country repeatedly setting new highs.

In June Japan introduced rules for getting companies to stop clinging to cash. Last month, Abe announced population and birthrate targets. A bill to legalise casinos may be debated in the next session of parliament.

While Tasker says his fund’s gains largely came before Abe took office, he’s still bullish on Japanese stocks, citing attractive valuations, the overhaul of corporate governance and the eventual victory he expects in the battle to achieve inflation. In others’ doubts, he sees another reason to bet the 78% rally in the Topix under Abe has room to run.

“Bull markets only end when everyone is optimistic and everyone is in, and there’s nobody left,” said Tasker, who was an analyst and strategist with Dresdner Kleinwort Wasserstein for more than a decade before becoming a founding partner at Arcus. Many people still think Abe hasn’t delivered, he said.

“That just means it’s not over.”

Among the doubters is Sumitomo Mitsui Trust Bank’s Ayako Sera, who says with inflation still hovering near zero, she isn’t sure what Abe’s proponents are excited about in claiming an end to deflation is near. Just because things haven’t gotten worse since Abe took over doesn’t mean he knows how to revive Japan, she says.

“If they did nothing, deflation would have certainly continued and it would have been a terrible situation, so from that perspective I give them credit,” said Sera, a Tokyo-based strategist at the bank. “But that’s in the past. When we think about the future, it’s hard to get too optimistic.” Tasker says defeating deflation hinges on changing the public’s mindset, and this will take half a decade or more.

While calling for patience, he says Japanese stocks will do well in the meantime as the government succeeds in prodding companies to dole out more of their record cash holdings to shareholders.

The surge earlier this year that sent the Nikkei 225 Stock Average to its highest in 18 years is fundamentally different from previous rallies, he said.

“In 2000, the Nikkei went over 20,000. At that time corporate earnings were quite bad. Even so it went up a huge amount,” said Tasker. “This time, the market has gone up but corporate earnings have gone up more, which has resulted in valuations being compressed as opposed to expanding. That’s a sign that people haven’t really gotten optimistic yet.”