By Pratap John

Chief Business Reporter

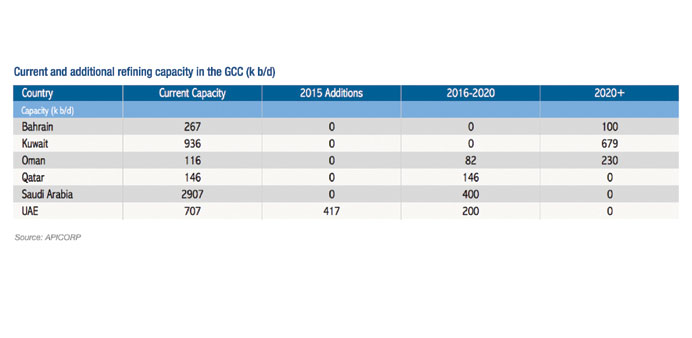

GCC countries are estimated to add nearly 830,000 bpd of refining capacity between 2016 and 2020 including 146,000 barrels per day (bpd) of condensate from Qatar’s Ras Laffan 2 plant, according to Apicorp Energy Research.

But Apicorp, which is partly owned by Qatar, said the oil-price collapse since mid-2014 has curbed investment over the medium term with some projects being pushed back and others cancelled.

The Saudi Arabia-headquartered financial institution anticipates only a handful of projects will come online within or shortly after their targeted completion date, with the Jazan project in Saudi Arabia and the United Arab Emirates’ Fujairah plant the major additions.

These will add 400,000 bpd and 200,000 bpd of capacity, respectively, between 2016 and 2020.

The Jazan refinery has been pushed back into 2018 while the Fujairah refinery, with a target completion date of 2016, is now expected to come online at around the same time.

The rest of the additions will come from the Ras Laffan 2 plant in Qatar, which will add 146,000 bpd of condensate capacity, followed by the Sohar expansion in Oman that will add 82,000 bpd to its existing capacity of 116,000 bpd.

The 230,000 bpd grassroots Duqm Refinery (a joint venture between Oman Oil Company and Abu Dhabi’s International Petroleum Investment Company) is also likely to come online in the early 2020s.

In addition, “much obscurity surrounds” Bahrain’s Sitra Refinery expansion plans, which aim to add 100,000 bpd to the existing 260,000 bpd.

“With all these factors in the background, we estimate that the GCC will add 830,000 bpd of refining capacity in 2016-20,” Apicorp said.

“Another wild card in the region is Iran,” Apicorp said. The 360,000 bpd Persian Gulf Star Refinery has been facing delays due to financing issues, but is still expected to come onstream within Apicorp’s medium-term horizon. Once it is fully operational, the country will not need to import gasoline, it said.

Iran is also planning to go ahead with some strategic projects such as the Siraf refinery complex with eight processing plants, each with a capacity of 60,000 bpd to be funded by the local private sector.

Projects often take three to four years to complete and, given financing constraints, Apicorp expects much of the extra capacity to come online after 2020.

With the increase in condensate production from the South Pars fields, Iran’s main focus will be on condensate splitters, which will particularly affect naphtha supplies, Apicorp said.