Santhosh V. Perumal/Business Reporter

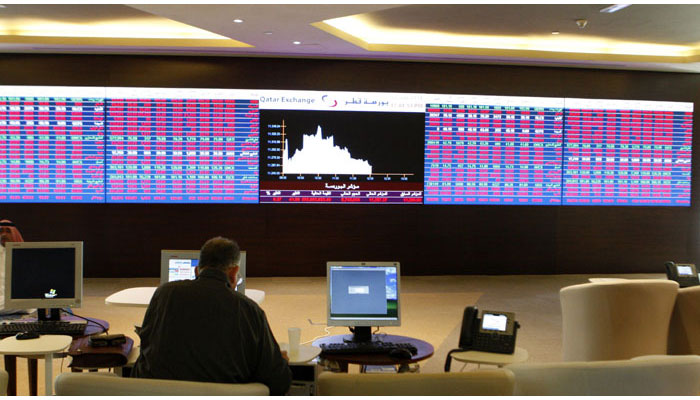

Buying support from local retail and institutions helped Qatar Stock Exchange on Monday gain 13 points for the second day but failed to break the 11,900 level.

Buying was more pronounced in the consumer goods, insurance, telecom and realty counters as the 20-stock Qatar Index rose 0.11% to 11,868.9 points amid lower overall trade volumes.

Higher net buying interests of foreign institutions and lower selling pressure from Gulf individual investors also helped in the overall bullish momentum in the market, which is however down 3.39% year-to-date.

The index that tracks Shariah-principled stocks was seen gaining faster than the other indices in the bourse, where trading was largely skewed towards the banking, real estate, telecom and industrials sectors, which together constituted about 85% of the volume.

Market capitalisation was up 0.1% or about QR1bn to QR622.26bn with micro, small and mid cap equities gaining 0.81%, 0.54% and 0.34% respectively; even as large caps fell 0.11%.

The Total Return Index rose 0.11% to 18,448.51 points, All Share Index by 0.19% to 3,154.27 points and Al Rayan Islamic Index by 0.35% to 4,520.11 points.

Consumer goods and insurance stocks gained 0.73% each, telecom (0.56%), realty (0.42%) and industrials (0.22%); while transport fell 0.64% and banks and financial services was unchanged.

Major gainer included Qatar National Cement, Aamal Company, Gulf International Services, Vodafone Qatar, Ooredoo, Dlala, QIIB, Woqod, United Development Company, Barwa, Mazaya Qatar and Ezdan; even as QNB, Qatar Islamic Bank, Nakilat, Mesaieed Petrochemical Holding and Qatari German Company for Medical Devices bucked the trend.

Domestic institutions turned net buyers to the tune of QR1.2mn against net sellers of QR7.98mn on Sunday.

Local retail investors’ net buying strengthened to QR11.06mn compared to QR4.18mn on October 11.

Non-Qatari institutions’ net buying also increased to QR12.74mn against QR10.87mn the previous day.

The Gulf Cooperation Council (GCC) individual investors’ net selling fell to QR4.12mn compared to QR9.03mn on Sunday.

However, the GCC institutions turned net sellers to the extent of QR7mn against net buyers of QR8.27mn on October 11.

Non-Qatari individual investors’ net profit booking perceptibly increased to QR13.87mn compared to QR3.51mn the previous day.

Total trade volume fell 36% to 8.65mn shares and value by 18% to QR343.38mn, while deals rose 5% to 5,418.

The telecom sector saw 69% plunge in trade volume to QR1.69mn equities, 62% in value to QR32.14mn and 32% in transactions to 631.

The consumer goods sector’s trade volume plummeted 37% to 0.59mn stocks, whereas value gained 53% to QR33.69mn and deals by 50% to 555.

There was 33% shrinkage in the real estate sector’s trade volume to 1.96mn shares, 36% in value to QR49.31mn and 27% in transactions to 671.

The industrials sector’s trade volume tanked 24% to 1.52mn equities and value by 16% to QR97.57mn, while deals were up 7% to 1,668.

However, the insurance sector’s trade volume tripled to 0.06mn stocks and value more than quadrupled to QR5.64mn on more than tripled transactions to 68.

The transport sector’ trade volume soared 77% to 0.69mn shares, value by 42% to QR23.37mn and deals by 41% to 411.

The banks and financial services sector reported 9% expansion in trade volume to 2.15mn equities, less than 1% in value to QR101.66mn and 34% in transactions to 1,414.

In the debt market, there was no trading of treasury bills and government bonds.