Qatar’s current account surplus may shrink to 6.2% of GDP in 2015 on lower hydrocarbon exports and prices, before stabilising in 2016-17, QNB has said in a report.

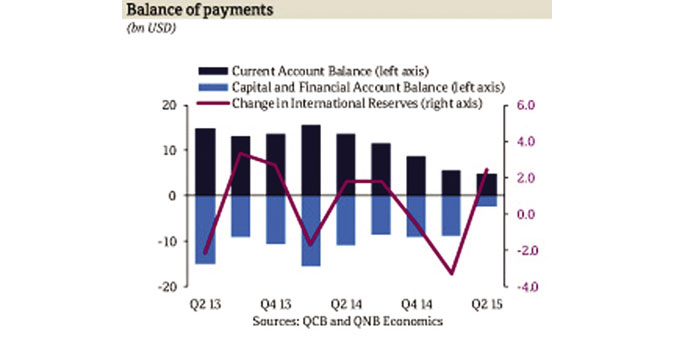

The overall balance of payments recorded a small surplus of $2.4bn in Q2, 2015, leading to an increase in international reserves, QNB said in its latest ‘monthly monitor’.

The current account surplus narrowed to $4.7bn (11.1% of GDP) in Q2 on lower hydrocarbon exports; the capital and financial account recorded a deficit of $2.4bn in Q2, 2015.

The report showed QCB real estate index rose 23.2% year-on-year in June.

The real estate price index reached its highest point in June 2015 since its introduction four years ago

“We expect real estate prices to continue their strong growth although at a more moderate pace on rapid population growth and higher per capita GDP,” QNB said.

The foreign merchandise trade surplus stabilised at $3.8bn in August, but it is down from $8.3bn a year earlier.

The year-on-year decline was mostly due to the fall in exports, which decreased by 39.9% year-on-year on lower oil prices; imports rose by 8.9% over the same period on rising domestic demand.

“We expect the merchandise trade surplus to shrink to $57.9bn in 2015 from $100.6bn in 2014 on lower oil prices,” the report said.

The report showed Qatar’s inflation slowed to 1.3% in August from 1.6% in July.

The slowdown in transportation inflation (2.6% in August versus 3.2% in July) and the fall in recreation and culture costs (-3.5% in August from -2.8% in July) offset the rise in food inflation (1.9% in August from 0.9% in July).

Meanwhile, housing and utilities inflation stabilised at 2.2% (2.3% in July).

“We expect inflation to remain subdued in 2015, averaging 1.7% for the full year, but it should pick up on the expected recovery in international food prices in 2016 and higher oil prices in 2017,” QNB said.