Bloomberg

Dublin

Irish billionaire Denis O’Brien’s surprise decision to pull Digicel Group’s share sale may frustrate his growth ambitions, disappoint creditors and hurt the bankers planning to feast on fees from the second-biggest initial public offering in the US this year.

The Bermuda-based company wanted to raise as much as $2bn in an IPO scheduled to price on Wednesday in New York. Digicel said last month it planned to use about $1.3bn euros of the proceeds from the sale to repay some of its $6.5bn debt, with the rest earmarked to finance expansion through acquisitions and capital spending.

“It is a disappointment for creditors as the flotation would have improved Digicel’s strategic flexibility as much as its liquidity, ” Stanley Martinez, a credit analyst at Legal & General Investment Management Ltd in Chicago, said. The “debt reduction indicated in the prospectus would have represented a step change and made their credit quality more comparable with peers such as Cable & Wireless.”

Volatility in US stock markets killed those plans, at least for now, according to O’Brien. Equity markets have whipsawed since concerns about the Chinese economy helped spur a sell-off in August. Shares in Cable & Wireless Communications, Digicel’s main competitor in many of its markets, have fallen more than 15% since Digicel announced its intention to go public.

“Given our growth outlook, an IPO for Digicel was optional and predicated on achieving fair value for the company,” O’Brien said in the statement announcing the cancellation of the share sale. “Recent volatility in equity markets has seen a number of IPOs listing at a discount to their signaled price range and this was a less attractive route for us.”O’Brien hired banks including JPMorgan Chase & Co and UBS for the share sale. This would have been the latest milestone for the mogul, who founded Digicel in 2001 and turned it into a mobile-phone empire with almost 14mn customers spread from El Salvador to Vanuatu, partly on the back of issuing high-risk, high-yield debt.

According to company filings, earlier this year, Digicel was close to the limit of how much it can borrow under the terms of its bonds, after dividend payments to O’Brien and a slump in the Jamaican dollar hurt the company’s earnings.

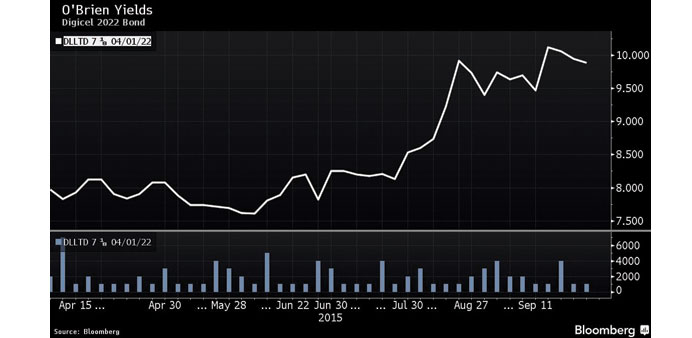

Though a slew of exceptions are laid out in Digicel’s listing documents, broadly, the company is prevented issuing more debt if total debt climbs above six times its earnings before interest, tax, depreciation and amortisation, according to company documents and interviews with analysts. The ratio was 5.4 times at the end of March. Yields on Digicel’s 2022 bonds have risen to 9.88% from 6.37% a year ago.

“Bond investors had reservations that an IPO would be successful, especially in current market conditions,” said Michael Chakardjian, an analyst at CreditSights in London. “Obviously an IPO would have been a positive event for bondholders.”

While O’Brien said that the company’s growth plans remain unchanged, not all analysts are so sure. It may be a year before he can revisit the sale, according to David Holohan, an analyst with Merrion Capital in Dublin.

“Without the IPO proceeds and having public stock as a currency, management’s ambitions will need to be pared back because the balance sheet will struggle to sustain more debt,” said Holohan. “The company is in a bind because one of the main selling points during the roadshow was the prospect of further M&A and new products moving the focus away from telephony.”