Reuters

Boston

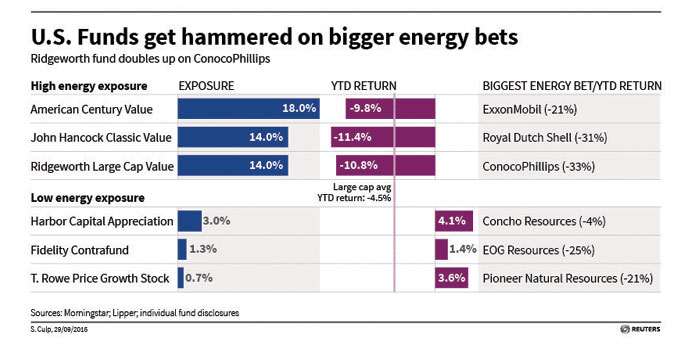

One-in-four US large-cap mutual funds have increased their stakes in energy companies this year and many have suffered heavier losses than their peers as a result of ill-timed bets.

The moves into shares of frackers, refiners and integrated oil conglomerates reflect a gamble that the sector will rebound after rising supply and slowing global growth triggered a nearly 60% slide in crude prices since the middle of 2014.

But so far, the gambit has not paid off.

“We are kind of holding our nose to buy them, but we see value there,” said Ernesto Ramos, who oversees about $15bn in large-cap equity assets at BMO Asset Management. “We’ve been selling the defensive part of the portfolio exposed negatively to higher interest rates, such as consumer staples and utilities, and making room for what we see as a slow but gradual recovery in world growth.”

BMO’s Large-Cap Value Fund boosted it energy exposure to 13% from 10% at the end of February after buying more shares of ExxonMobil Corp and refiner Valero Energy Corp, for example.

With oil prices down, ExxonMobil is seen as a defensive play because its refineries and chemicals manufacturing can benefit from lower input costs and offset lower profits from crude production.

Shares of Exxon and other oil majors, such as Chevron Corp and ConocoPhillips are hardly doing any better than the S&P 500 Energy Index, which is down 25% this year.

Exxon shares are off 21%, while Chevron and Conoco are down 32% and 34%, respectively, reflecting expectations that the global crude supply glut will persist, ultimately weighing on their returns.

A Reuters analysis of 265 actively managed large-cap funds with at least $500mn in assets and combined assets of about $1.8tn, revealed that 25% of them increased their energy sector bets this year.

That overall group of funds produced an average return of minus 7.17% so far this year, according to Lipper, a Thomson Reuters company. And three-quarters of the funds that increased their exposure to energy performed worse than the overall average.

Investors have not been pleased with the shift, pulling nearly $27bn from funds that increased exposure to energy, according to Lipper data. Those which did not, saw about the same amount of net investor withdrawals, but over a larger number of funds with nearly five times more in assets, Lipper data shows.

BMO’s Ramos said managers and investors have to remain patient with their energy picks.

“We think we will eventually be rewarded with these stocks,” he said.

The $2bn Ridgeworth Large Cap Value Equity Fund made among the biggest bets on the energy sector among its peers earlier this year, raising its exposure to 14% at the end of August from 6.7% at the end of February, according to Lipper.

The fund nearly doubled its stake in ConocoPhillips and bought more shares in EOG Resources, Hess Corp and Noble Energy, disclosures show.

All of those stocks are down at least 19% over the past three months, badly underperforming broad benchmarks.

The Ridgeworth fund’s year-to-date total return of minus 13% is worse than 88% of similar funds, according to Morningstar. Mills Riddick, manager of the fund, declined to comment for this story.

Other portfolio managers who bet big on some energy stocks, thinking they found bottom, or somewhere near it, have been sorely disappointed, too.

Take the $68bn Investment Company of America fund, which bought nearly 23mn shares of former shale oil boom star Chesapeake Energy Corp during the first half of the year.

That represented just 0.50% of the fund’s assets, but still hurt as Chesapeake shares dropped 43% during that time.

Chesapeake stock has fallen 70% since November, and 39% since June, to below $7 a share. The fund, run by Capital Group’s American Funds, declined to comment, saying as a matter of policy the company does not discuss individual holdings.