By Pratap John

Chief Business Reporter

Qatar may see strong credit growth above 10% this year and in 2016 despite tight banking sector liquidity in view of the declining oil price, a new report has shown.

According to Samba Financial Group, lending opportunities will continue in the contracting and services sectors, which have averaged credit growth of 27% and 17% respectively over the first half of 2015. Loans for consumption are also expanding at a rapid pace, 31% year-on-year (y-o-y) in June.

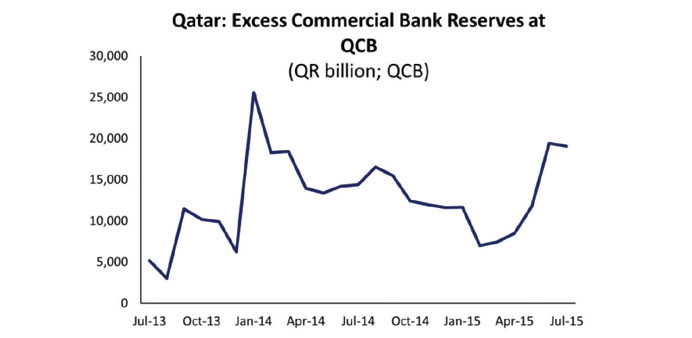

Banking sector liquidity appears to be tightening as robust double-digit credit growth has not been matched by deposit growth, which is being curtailed by falling public sector deposits. This is worth monitoring, but Samba believes that the authorities have ample resources to address any liquidity and funding issues, although public sector projects may take priority over private sector lending.

Government issuance of domestic debt does raise some questions over the impact on bank liquidity. Already the loan to deposit ratio was up at 112% in July, its highest level since January 2014.

This primarily reflects a fall in public sector deposits, while credit growth remained robust (15% y-o-y). Public sector deposits fell by 12% y-o-y in July, the eighth consecutive month of decline. Public sector deposits constitute around 40% of total deposits at commercial banks, which is elevated compared to other regional peers. However, private sector deposits and non-resident deposits both grew robustly and dragged total deposits up by 8% y-o-y, though they were down on the previous month.

As the large hydrocarbon receipts to the state and other quasi-government entities begin to ease, this may start feeding through to lower overall deposits in the banking system. The International Monetary Fund addressed this issue (in the Article IV) and concluded that policymakers could avoid any emerging liquidity constraints by reallocating deposits of government-owned companies and the Qatar Investment Authority from abroad, and adjusting the size of T-bill and T-bond auctions.

Both the IMF and the authorities expressed confidence that sizeable capital, liquidity and policy buffers would provide ample protection in case the risks materialise, Samba noted.

Samba also said there has been an evident upward trend in the interbank rate since the beginning of the year (though this is relatively subdued compared to other Gulf Co-operation Council economies). All things being equal, without the authorities exercising one of the available options outlined earlier, Samba would expect this to continue as liquidity tightens.