Bloomberg

New York

Being bullish on the US bond market just got a lot easier.

Not only did the Federal Reserve hold the line on interest rates last week, central bank officials yet again cut their forecasts for how high borrowing costs need to rise over coming years. For the first time, they also explicitly cited the rising risks of international turmoil such as China’s slowdown in their decision to keep the benchmark rate near zero.

With traders betting inflation will remain below the Fed’s 2% target for at least a decade, some of the biggest investors are convinced bonds will stay in demand for years to come. And once the central bank does lift rates - which the market doesn’t see until at least 2016- Prudential Financial and State Street Corp say policy makers will be exceedingly cautious to avoid upending the economic recovery.

“The US bond market looks fantastic,” said Erik Schiller, a Newark, New Jersey-based money manager at Prudential Financial’s fixed-income unit, which oversees $533bn. “Our main stance has been to not fear the Fed.”

Debt securities of all types rallied after the Fed’s decision on September 17. The surge pushed down yields on the two- year Treasury note, the most-sensitive to interest-rate moves, by the most since 2009.

Those on 10-year Treasuries, used to guide borrowing costs on everything from mortgages to corporate bonds and emerging- market securities, ended at 2.13% last week, lower than they were at the end of last year. The yield was at 2.16% in London.

Bond-market forecasts for a slow-moving Fed continue to be validated, confounding experts who less than a year ago predicted Treasury yields would be approach 3.25% by now.

Much of the bullishness stems from the Fed’s worries about the global economy, which has bolstered the view that borrowing costs will stay lower for longer.While a majority of traders and analysts expected the central bank to stand pat, firms such as BlackRock and JPMorgan Chase & Co said the big surprise came from its unusually dovish statement. In it, policy makers highlighted the growing risk that global economic and financial events could hold back US growth and put more “downward pressure” on inflation - even as they played up job gains and improvements in household spending.

The Fed is worried about events abroad “to a degree that we hadn’t seen before,” said Jeffrey Rosenberg, the chief investment strategist for fixed income at BlackRock, which oversees $4.4tn.

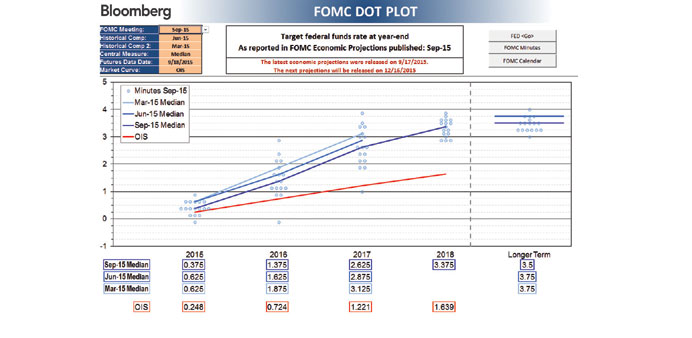

Fed officials cut their median forecast for where rates are headed for the third time this year. They now predict the rate will rise to 1.375% by the end of next year and 2.625% in 2017. They also foresee rates reaching 3.375% in 2018.

Traders are sceptical that rates will rise even that high. In the derivatives market, they’re pricing in the effective rate averaging about 0.75%, 1.22% and 1.67% - far lower than the Fed’s own projections.

A big reason is that inflation is virtually non-existent. Cheaper gasoline, uneven wage growth and a stronger dollar are all acting as a brake on price pressures.

Prices paid by American households fell 0.1% in August, the first drop since January, while annual inflation has been flat this year.

In the bond market, traders see inflation averaging just 1.57% per year through 2025, close to the weakest outlook since 2009, when the US was still mired in recession. It’s been almost a year since traders priced in inflation reaching the Fed’s target.

“We just don’t see an environment where inflation is moving up rapidly in the medium term,” said John Bellows, a money manager at Pasadena, California-based Western Asset Management Co, which oversees $453bn of fixed-income assets. “That will keep bond yields low.”

Bellows holds Treasuries and says he’s been buying long- term corporate bonds because they offer the biggest rewards relative to the risk of default. Investment-grade US company securities due in 15 years or more offered 2.37 percentage points more in yield than government debt last month, the most since 2012, according to index data compiled by Bank of America Corp.

Mike Materasso, who oversees $396bn as co-chairman of the fixed-income policy committee at Franklin Templeton Investments, warns that some money managers are becoming too complacent and continued economic growth means US government bonds are particularly vulnerable.

“There’s a decent chance the Fed is too pessimistic” on growth and inflation, said Materasso, who said he’s avoiding Treasuries.

Over the weekend, three Fed policy makers - San Francisco Fed President John Williams, St Louis Fed President James Bullard and Richmond Fed President Jeffrey Lacker- argued for lifting its rate before year-end, countering the market’s view that the Fed will wait until 2016.

State Street’s Michael Arone says that even with Treasury yields close to historical lows, they are far higher than those in other developed countries. That advantage will help attract buyers and contain any sell-off once the Fed starts raising rates.

Ten-year US notes yield more those in 17 of the 25 developed nations tracked by Bloomberg. They’re at least as high as those in Germany, France and Sweden. Those in Japan are near zero, while Switzerland has negative rates. What’s more, the Fed’s decision to stay on hold will put more pressure on central banks in Europe and Japan to ease further, which will only increase the advantage of higher-yielding US debt.

“There are real concrete reasons why investors should own fixed income,” said Arone, the Boston-based chief investment strategist at State Street Global Advisors, which oversees $2.4tn.