Bloomberg

Houston

Hedge funds slashed their bets on falling oil prices, leaving them the most bullish on US crude futures in two months.

Money managers’ net-long position in West Texas Intermediate rose by 14,821 contracts to 147,678 futures and options in the week ended Sept. 15, according to data from the Commodity Futures Trading Commission. That’s the highest level since July 7. In contrast, traders curbed their bullish positions in European benchmark Brent by the most in a month.

The Organisation of Petroleum Exporting Countries assumes crude prices will rise to $80 by 2020 as output falls elsewhere. US production could sink by the most in 27 years in 2016 as the price rout extends a slump in drilling. Speculators closed out short positions two days before the Federal Reserve decided not to raise key US interest rates.

“The market’s not as oversupplied as we think it is,” David Pursell, a managing director at investment bank Tudor Pickering Holt & Co in Houston, said in a phone interview. “The news out of Opec is more bullish, US production is falling and demand is great right now.”

The US benchmark oil contract fell 2.9% in the report week to $44.59 a barrel on the New York Mercantile Exchange. Prices were up 2.6% at $45.85 in London.

Opec assumes crude prices will rise by about $5 a year through 2020. Production from nations outside the group will be 58.2mn bpd in 2017, 1mn lower than previously forecast, according to an internal report.

The impact of low prices is “most apparent on tight oil, which is more price reactive than other liquids sources,” according to the report.

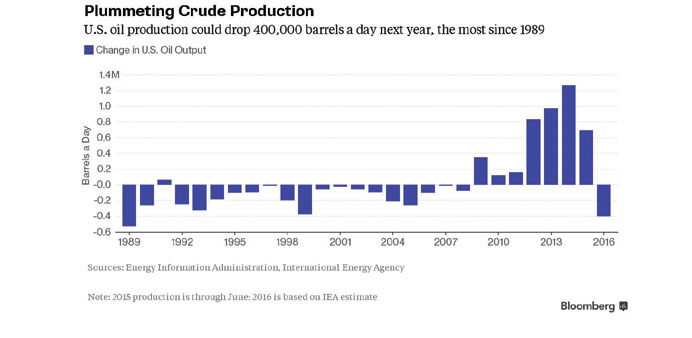

US output could sink by 400,000 bpd next year after a prolonged period of low prices forced producers to idle more than half the rigs seeking oil, the International Energy Agency said in a monthly report.

That would be the largest one- year decline since 1989, according to US government data.

“There is quite a discernible shift in sentiment because production declines are quite high,” Amrita Sen, chief oil market analyst for Energy Aspects in London, said by phone. “There’s a realisation that US production is rolling over.”

Money managers reduced short positions, or bets that prices will fall, by 14,569 contracts, CFTC data showed. Long positions, or bets on rising prices, increased by 252.

In London, money managers reduced their net-long position in Brent crude by 6,612 contracts to 161,846 in the period to September 15, data from the ICE Futures Europe exchange showed yesterday.

In other markets, net bullish bets on Nymex gasoline rose 3.5% to 16,562, CFTC data show. Futures fell 4.9% to $1.3329 a gallon. Net bearish wagers on US ultra low sulfur diesel expanded by 12% to 28,057 contracts. Diesel futures dropped 5.9% to $1.50 a gallon.

The Fed decided not to increase rates for the first time in almost a decade as Fed Chair Janet Yellen said slower growth in China, the second biggest oil-consuming country after the US, contributed to volatility across markets and that overall financial conditions have tightened.