By John Kemp/London

US crude oil production is falling sharply, helping put a floor beneath US domestic crude prices and causing them to rise relative to the international marker Brent.

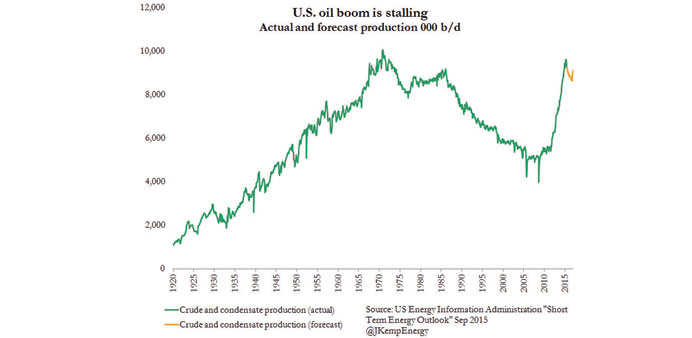

In the face of lower prices, the US oil boom has stalled and the industry is facing the sharpest setback in production for decades, excluding hurricane periods.

According to the US Energy Information Administration (EIA), US crude and condensate output peaked at 9.612mn barrels per day (bpd) in April and had declined by 316,000 bpd by June.

Production continued to rise in North Dakota (36,000 bpd) but in most other states and offshore areas output turned down.

The largest declines were reported in Texas (129,000 bpd), the Gulf of Mexico (90,000 bpd), West Coast offshore (28,000), Alaska (27,000 bpd) and California (18,000 bpd).

The EIA estimates national production dropped by another 325,000 bpd over the third quarter, which will take output this month below 9mn bpd for the first time since September 2014.

Production is forecast to continue dropping by a further 340,000 bpd over the next 12 months, bottoming out at just 8.63 and 8.64mn bpd in August and September 2016.

In total, EIA expects US output to decline by nearly 1mn bpd between April 2015 and August 2016 as a result of falling oil prices.

Some of the current and forecast reductions are coming from the formerly fast-growing shale plays of Texas, North Dakota, Colorado and Wyoming.

Combined production from the Bakken, Eagle Ford, Permian and Niobrara plays, the main sources of shale oil, is predicted to fall by 360,000 bpd in October compared with April (“Drilling Productivity Report”).

Conventional output is also declining as producers postpone drilling in high-cost and marginal areas and some stripper wells, producing just a handful of barrels per day each, are abandoned.

Actual and forecast declines in US production are starting to provide some support to the strip of US crude futures prices.

US crude futures have strengthened compared with Brent as the market adjusts to the idea the US market will be less glutted than previously believed.

The spread between WTI and Brent prices for nearby contracts has shrunk to its narrowest since January as WTI prices have firmed.

The most actively traded WTI contract is currently priced at just $3.14 per barrel under Brent, down from a gap of almost $13 in March.

The contango in WTI futures has narrowed consistently over the last month even as the contango in Brent continued to widen.

In contrast to Brent, WTI is firming across the entire strip. As a result, WTI for delivery in the month of December 2016 is now priced at less than $5 under Brent. The narrowing contango in WTI suggests most traders have dismissed concerns about rising US stockpiles or US tank farms running out of storage space.

The adjustment in US oil production is well underway but the reaction in futures markets has far been muted.

Partly that is because much of the actual data on production is available only with a lengthy delay (accurate national figures are available only up to June and show only a relatively marginal drop in output at that point).

Partly it is because the market has focused on production from North Dakota, which publishes the most high-frequency data, but where output has been more resilient than in other parts of the country.

And partly it is because many traders and hedge fund managers still dispute whether output is declining as much as the EIA estimates and are waiting for stronger evidence before changing their bearish stance.

Bearish traders and investors are focused more on the weekly data on crude stocks rather than monthly production figures.

Hedge funds and other money managers still have an unusually large concentration of short positions in the main NYMEX WTI futures and options contracts.

The next few months should provide much stronger evidence for declining US oil output which should dispel some of the bearish sentiment.

The major statistical agencies (EIA, IEA and Opec) are all now predicting US output will decline in the remainder of 2015 and 2016, as are major US shale producers like EOG Resources.

If production declines as expected, and demand continues to grow, it should gradually turn market sentiment and could put a floor beneath WTI and Brent prices.

Both Brent and WTI could yet hit new lows if China’s economy goes into recession or the predicted slowdown in US shale production fails to materialise.

But in the absence of a fresh shock, the oil market appears to be gradually adjusting to much lower prices, with a drop in non-Opec production and a pick-up in fuel consumption among the advanced economies.

John Kemp is a Reuters market analyst. The views expressed are his own.