Bloomberg

Frankfurt

Mario Draghi’s promise that the European Central Bank is willing to step up its stimulus if needed is resonating with economists, who see the euro-area recovery as too shallow to be sustained.

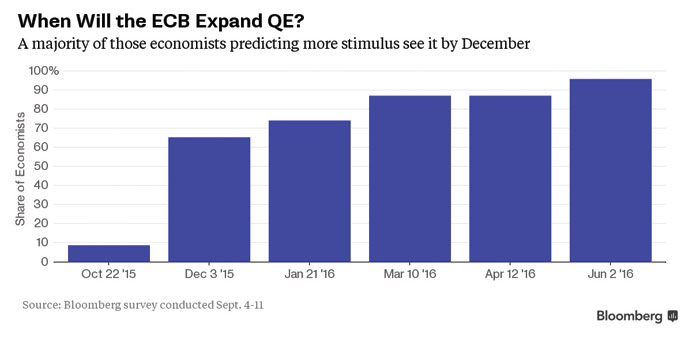

More than two-thirds of respondents in a Bloomberg survey predict the ECB’s president will expand or extend the €1.14tn ($1.3tn) quantitative-easing program, and almost all of those say he’ll do so within nine months.

While an increasing number of respondents see the economy improving for now, they’re also fretting that the upturn won’t last long.

The ECB’s Governing Council has already shown concern that a slowdown in global trade will erode exports, a pillar of the regional recovery, before domestic demand is strong enough to compensate. The central bank this month cut its growth and inflation forecasts and Draghi told reporters that QE is flexible in size, duration and composition. In contrast, the Federal Reserve may raise its interest rates as soon as this week.

“QE risks becoming a semi-permanent feature,” said Gianluca Sanna, a portfolio manager at Banca Monte dei Paschi di Siena in Milan. “While it’s certainly true that the eurozone is indeed going through a phase of decent, maybe even above-potential, output growth, chances are that there is nothing self-sustaining in what we are seeing right now and the eurozone ends up again in a low-growth environment with inflation dangerously close to zero.”

In the survey, 68% of the 41 economists polled said the ECB will step up its QE programme. Of those who provided a timeline, 65% predict an announcement by December and 87% see a commitment to more stimulus by March.

Nearly four-fifths of the respondents who expect a bigger QE program see the ECB extending its duration beyond the initial end-date of September 2016. About 43% said the monthly purchase amount will be lifted above the current €60bn, and 29% said the central bank will broaden the range of assets it buys.

The Frankfurt-based central bank has other options, though with less control over their scale. The fifth round of its targeted long-term loans to banks — aimed at rekindling lending to companies and households — will take place next week. Economists predict banks will opt to take up €70bn, compared with the €73.8bn they borrowed in June. The loans fall due in September 2018 and are charged at the benchmark interest rate of 0.05%.

Economic growth is returning, if unevenly. Figures published yesterday showed industrial production rose 0.6% in July, twice as much as economists predicted, as output jumped in Germany, Spain and Italy, while declining for a second month in France.

The 19-nation economy expanded 0.4% in the second quarter after 0.5% in the first. ECB data show credit standards eased and loan demand climbed in the second quarter. That bodes well for investment, which rose about 1% in the first half of the year.

“The recent data reinforce the image of a continued, gradual recovery,” ECB Governing Council member Jens Weidmann told reporters in Luxembourg on Saturday.

“With respect to the direction of European monetary policy, these provide more arguments for a stable-hand policy, even though the uncertainty with regard to the economic outlook is definitely still high.”

The share of economists saying the region’s short-term outlook will improve rose to 32%, compared with 28% last month. Only 5% said prospects will deteriorate.

Yet the concern is the fragility of the revival, as China’s slowdown drags on emerging nations and potentially on global growth. A rout in financial markets started last month when the country devalued its currency to shore up its economy. Oil prices dropped to a six-year low, threatening to tip the eurozone inflation rate negative again.

“The domestic situation of many eurozone economies has improved, particularly in Spain and Ireland, but headwinds from abroad, namely China, Brazil and some other emerging markets, have increased,” said Fabian Fritzsche of Collineo Asset Management GmbH in Dortmund, Germany. “However, I think the positive effect of the lower crude-oil price will exceed the negative effect of lower export growth to the emerging markets at least in the short term.”

The ECB now forecasts the euro area will expand 1.4% in 2015, 1.7% in 2016 and 1.8% in 2017. Officials cut their 2017 inflation forecast to 1.7%, a signal that more stimulus may be needed to ensure they reach their goal of medium-term price growth just below 2%.

“All options are open to the ECB as regards stepping up its QE program,” said Alan McQuaid, chief economist at Merrion Capital Group Ltd in Dublin. “Initially I see them broadening the range of assets purchased, then upping the monthly amount and then finally extending the program beyond September next year.”