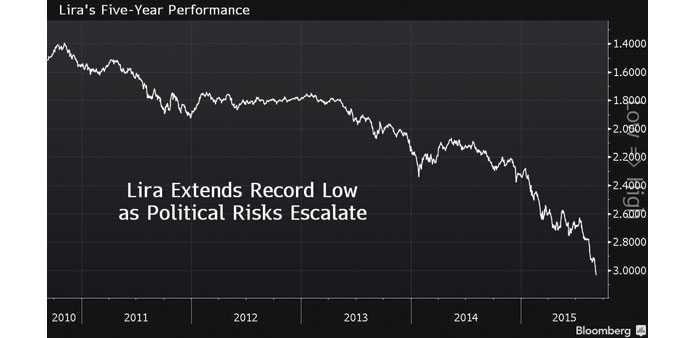

Turkish currency third-worst performer among peers this year; trading patterns in equities sending bearish signals

Bloomberg

Istanbul

The lira weakened to an all-time low and stocks slid with bonds as President Recep Tayyip Erdogan vowed to escalate the government’s campaign against Kurdish separatists after a roadside bomb killed Turkish soldiers, deepening concern over the nation’s security.

The currency lost as much as much a 1.3% to 3.0465 per dollar before trading 0.8% lower at 2.49pm in Istanbul and the Borsa Istanbul 100 Index dropped a second day to the lowest in two weeks.

Militants from the Kurdistan Workers’ Party, or PKK, killed and wounded soldiers in an attack on two armoured vehicles near the southeastern town of Daglica in Hakkari province on Sunday, the army said in a statement yesterday.

The lira has tumbled 23% this year as the nation heads for its second elections in six months and a cease-fire with autonomy-seeking Kurdish militants broke down. The prospect of the US Federal Reserve raising interest rates is compounding pressure on the lira as it depresses demand for riskier assets. The currency is the third-worst performer in emerging markets this year, data compiled by Bloomberg show.

“One thing that all market participants agree on is continued volatility in the Turkish markets on global turmoil and political and geopolitical risk in Turkey,” Gulsen Ayaz, a director of institutional equity sales at Deniz Yatirim in Istanbul, said by e-mail. “Yesterday’s (Sunday) attack by the PKK has once again heightened the latter and the markets are pricing this.”

The roadside bomb left 31 Turkish soldiers dead, the Firat news agency said, citing HPG, the PKK’s armed wing.

Turkish warplanes struck about a dozen PKK hideouts in Hakkari after the incident, state-run TRT television reported. More than 1,180 people have been killed in fighting since early July, according to unconfirmed official figures.

The yield on two-year government debt jumped 10 basis points to 11.28%, extending its increase this year to more than 320 basis points, the most among emerging markets.

Turkey’s benchmark index of equities decreased 1.2% to 72,081.50 led by Akbank TAS, the country’s second-largest bank by market capitalisation. The lender lost 1.2% to the lowest since August 25.

Trading patterns on the Borsa Istanbul Index are sending bearish signals. The Moving Average Convergence-Divergence line, or MACD, fell below the signal line for the second time in a month, a negative indicator for some traders. Foreign investors have sold a net $5.7bn worth of Turkish stocks and government bonds this year, according to central bank data.

“The index has been breaking many support levels without any mercy so far, which proves valuations alone can’t and don’t warrant inflows back into the markets,” Ayaz said. “Continuation of the sour sentiment in global markets as well as domestic issues in Turkey may well drag us down further.”

The odds the Fed will raise rates at the September 16-17 meeting held at 30% as of Friday after US unemployment fell to the lowest level since April 2008.