Medium crude discount to US widened first time in 8 months; Arab Light crude premium to Asia cut 30 cents a barrel

Bloomberg

Dubai

Saudi Arabia, the world’s largest crude exporter, cut pricing for all October oil sales to the US, widening the discount on its Medium grade for the first time in eight months, with refining demand plunging after the end of the summer driving season.

State-owned Saudi Arabian Oil Co cut its official selling price for October Arab Medium sales to US buyers by 50 cents a barrel, to 55 cents less than the regional benchmark, the company said in an e-mailed statement on Thursday. Light crude will sell at a premium of 95 cents a barrel to the regional benchmark, 60 cents below the differential in September.

Crude demand at US plants fell below 2014 levels last week for the first time since March. Oil inventories rose by the most in four months as wells are still producing near the highest level in 40 years. The profit margin for making gasoline and diesel along the Gulf Coast, home to more than half of US refining capacity, slid below $10 a barrel for the first time since April as fuel demand wanes.

“Refining margins are coming down,” Olivier Jakob, managing director at consultants Petromatrix GmbH in Zug, Switzerland, said by telephone. “They’ve gone from very strong to just strong.”

Global crude prices slumped last month as signs of weaker Chinese growth increased concern of slowing oil demand. Oil prices fell almost 50% last year as Saudi Arabia and other Opec members chose to protect market share over cutting output to boost prices. That contributed to a global oversupply that will average 1.4mn bpd in the second half of this year, the International Energy Agency said on August 12.

Saudi Aramco, as the state-owned company is known, also cut all pricing to Northwest Europe and reduced the premium on its main Light grade to Asia by 30 cents a barrel.

The company cut its official selling price for October sales to Asia of Arab Light crude to 10 cents a barrel more than the regional benchmark, according to the statement. The discount for Medium grade crude for buyers in Asia widened 50 cents to $1.30 a barrel less than the benchmark.

Saudi Aramco was expected to reduce the premium for Arab Light by 20 cents a barrel sales to Asia, according to the median estimate in a Bloomberg survey of seven refiners and traders this week. Cuts were expected because “refining margins in Asia were not very good,” Jakob said.

The Organisation of Petroleum Exporting Countries led by Saudi Arabia decided on June 5 to keep its production target unchanged to force higher-cost producers such as US shale companies to cut back. The producer group has exceeded its target of 30mn bpd since May 2014.

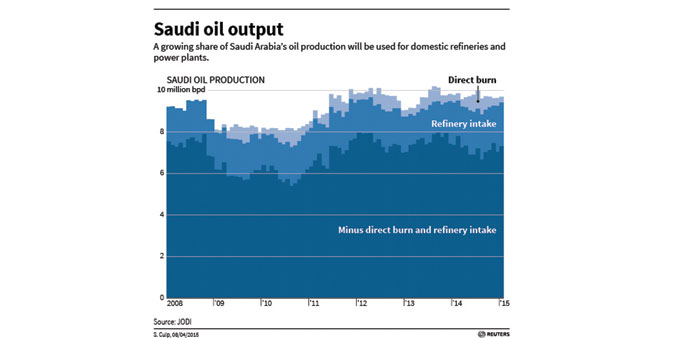

Saudi Arabia reduced production in August to 10.5mn bpd, the first decline this year, according to data compiled by Bloomberg.

Middle Eastern producers are competing increasingly with cargoes from Latin America, North Africa and Russia for buyers in Asia. Producers in the Arabian Gulf region sell mostly under long-term contracts to refiners. Most of the Gulf’s state oil companies price their crude at a premium or discount to a benchmark. For Asia, the benchmark is the average of Oman and Dubai oil grades.