Reuters/Washington

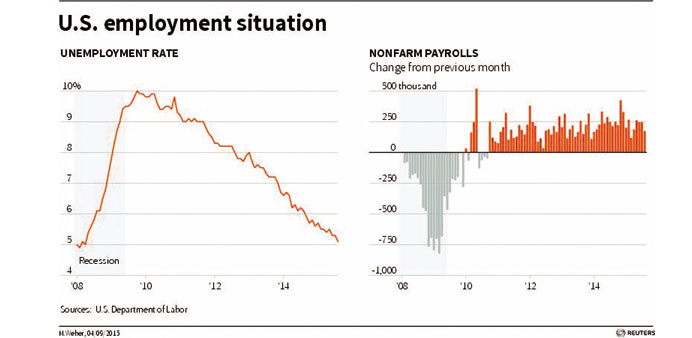

US job growth slowed in August, but the unemployment rate dropped to a near 7-1/2-year low and wages accelerated, keeping alive prospects of a Federal Reserve interest rate hike later this month.

Nonfarm payrolls increased 173,000 last month after an upwardly revised gain of 245,000 in July, the Labour Department said yesterday. August’s gain was the smallest in five months as the factory sector lost the most jobs since July 2013.

The jobs count, however, may have been tarnished by a statistical fluke that has often led to sharp upward revisions to payroll figures for August after initial weak readings.

Indicating the hiring slowdown was likely not reflective of the economy’s true health, the jobless rate fell two-tenths of a point to 5.1%, its lowest level since April 2008.

In addition, payrolls data for June and July were revised to show 44,000 more jobs created than previously reported, and average hourly earnings increased 8 cents, the biggest rise since January. The length of the average workweek also expanded.

“The payrolls data is certainly good enough to allow for a Fed rate hike in September,” said Alan Ruskin, global head of currency strategy at Deutsche Bank in New York. “The big question is still whether financial market volatility will scupper the plans.”

Investors seemed to agree. US stocks, which could be pressured by higher rates, opened lower, while yields on US government debt rose. The value of the dollar also moved higher against a broad basket of currencies.

While the mixed report did little to alter views that the US economy remains vibrant despite volatile global financial markets and slowing Chinese growth, it could further complicate the Fed’s decision at a policy meeting on September 16-17.

In the wake of a recent global equities sell-off, financial markets significantly scaled back bets on a September rate hike over the past month. But Fed Vice Chairman Stanley Fischer told CNBC last week it was too early to decide whether the stock market rout had made an increase less compelling.

“With this jobs report ... the Federal Reserve finds itself in a real uncertainty jam,” said Mohamed El-Erian, chief economic adviser at Allianz in Newport Beach, California.

Economists in a Reuters survey had forecast nonfarm payrolls increasing by 220,000 last month, but they had also warned that the model used to smooth the data for seasonal fluctuations is often thrown off at the start of a new school year.

They said the data could be further muddied because of a typically low response rate from employers to the government’s payroll surveys in August.

But the evidence of a tightening labour market added to a string of upbeat data, including figures on automobile sales and housing, that has suggested the economy was moving ahead with strong momentum after growing at a robust 3.7% annual rate in the second quarter.

The decline in the unemployment rate brought it into the range that most Fed officials think is consistent with a low but steady rate of inflation, and would likely bolster their expectation that a pick-up in wages will help lift inflation toward their 2% target.

A broad measure of joblessness that includes people who want to work but have given up searching and those working part-time because they cannot find full-time employment fell to 10.3%, the lowest level since June 2008.

In August, construction payrolls rose 3,000 on top of the 7,000 jobs added in July. Mining and logging employment fell by 10,000 jobs last month. Manufacturing payrolls slid 17,000, despite robust demand for autos.

The increase in hourly earnings left them 2.2% above their year-ago level, still well below the 3.5% growth rate economists consider healthy. Some analysts think earnings are being held back by falling wages in oil field services.

But a tighter labour market and decisions by several state and local governments to raise the minimum wage should eventually translate into faster earnings growth.

A number of retailers, including Walmart, Target and TJX Cos, have increased pay for hourly workers since the start of the year.

Canada unemployment up slightly at 7.0% in August

Canada’s unemployment rate rose slightly to 7.0% in August, as the economy added 12,000 jobs but more people sought work, the government’s statistical agency said yesterday.

Analysts had expected the jobless rate to remain unchanged at 6.8% after it had held steady for the six previous months.

The oil-exporting country entered recession in the first half of the year, hit hard by a global drop in oil prices, but analysts expect the economy to pick up in the second half of 2015.

According to Statistics Canada, the economy added 12,000 jobs in August — 54,000 full-time jobs were created, offsetting a loss of 42,000 part-time positions.

However, 52,000 more people started looking for work, sending the unemployment rate ticking up.

Self-employment was down slightly but the number of public administration jobs increased for a third consecutive month, offsetting previous declines, and universities continued to add faculty and other staff.

Employment gains were seen in the provinces of Saskatchewan, Newfoundland, Manitoba and New Brunswick.

Women aged 55 and older saw a bump while employment edged down for both sexes aged 25 to 54.