Reuters/London

Health-conscious consumers beware: a supply squeeze has pushed global prices of olive oil to their highest in nearly a decade and the cost of dressing a salad could rise further due to prospects for another small crop in top producer Spain.

Commodity prices for virgin olive oil reached €4,099.52 ($4,615) per tonne last week, up more than 60% from a year earlier, according to Spanish industry group La Fundación para la Promoción y el Desarrollo del Olivar.

Global retail prices have risen about 10% in the last 12 months, Euromonitor research shows.

“The main reason is a key supply issue, which happened simultaneously in the two most important countries – Spain and Italy,” said Vito Martielli, analyst at Rabobank.

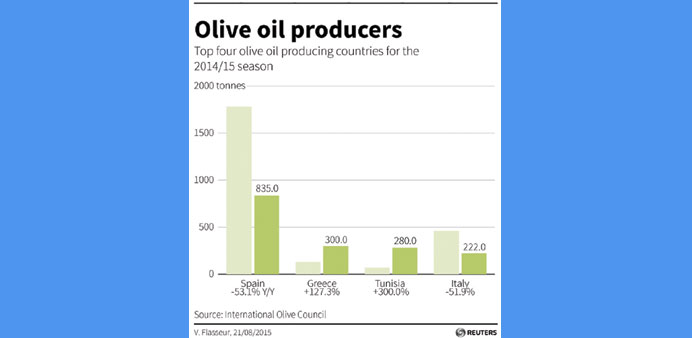

Crop-damaging droughts last summer shrank the Spanish harvest to 835,000 tonnes, less than half the prior season’s bumper crop of 1.78mn tonnes.

In Italy, traditionally the world’s No 2 producer, insect-borne bacteria destroyed swaths of olive groves in the southeast and cut production by more than 50% to 222,000 tonnes.

Global production for 2014/15 dropped by 29%, figures from the International Olive Council (IOC) show, helping to push olive oil’s commodity price to its highest since February 2006.

The supply crunch was partially eased by unusually large harvests in Greece and Tunisia, as well as ample Spanish stocks from the previous crop.

But those supplies have now been heavily depleted. Global stocks are expected to dwindle to about 274,000 tonnes by the end of the current 2014/15 season, from 767,500 tonnes a year earlier, the IOC estimates.

Another heatwave this summer has further pressured European olive crops and fuelled concerns about a second poor harvest in Spain, which produces about 45% of the world’s olive oil.

Forecasts call for a harvest of about 1.1 to 1.2mn tonnes, slightly below the five-year average of 1.25mn. Analysts say yields could be even smaller if Spain gets insufficient rain before harvesting starts in late October. “The summer has been hot and this hot temperature is not helping the trees, which are under stress,” Martielli said.

Retail prices for olive oil may climb a further 15 to 20% in the coming months, according to David Turner, global food and drink analyst at Mintel. But this could trigger a consumer pullback and a price correction.

“The market will struggle if prices keep rising,” Turner said. “I think consumers will then start switching down the value chain. Olive oil is still the healthiest oil and it’s still the gold standard, but it’s not the only oil in town.”