Reuters/London

Global mining company Anglo American said yesterday it will shed thousands of jobs in the next couple of years and might put up more assets for sale as it battles an accelerating slump in metals prices that has dragged its shares down to a 13-year low. The company posted a steep fall in first-half profit after a rout in prices of metals from platinum to iron ore, and said the next six months could be even worse.

“Quite frankly we didn’t expect the commodity price rout to be so dramatic and in all likelihood the next six months are going to be even tougher,” CEO Mark Cutifani said during a presentations with analysts. “We have pulled costs out of the business but we need to do more because prices continue to deteriorate.”

Anglo, the fifth-biggest diversified global mining group by stock market capitalisation, said it would cut about 6,000 of its almost 13,000 office-based and other non-production roles globally, 2,000 of which will be transferred through the sale of some assets. If market conditions soured further the company would consider putting up for sale more of its underperforming assets than currently planned, Cutifani said.

In the longer term, Anglo, which employs 151,000 staff worldwide, aims to reduce its workforce by about a third, it said.

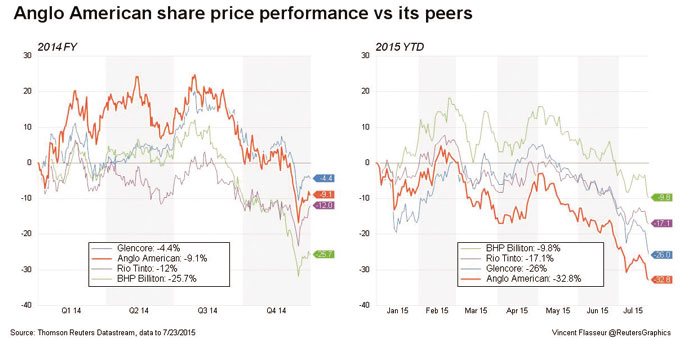

The London-listed company, in the middle of a turnaround effort launched by Cutifani in 2013, has suffered more than peers from the drop in metals prices, mostly due to higher-cost iron ore operations than its larger competitors and a platinum division afflicted by rising costs and falling prices.

It has seen its share price shed about a third this year as investors worry about the slow pace of Cutifani’s revamp, focused on improving the productivity of its mines and divesting non-core assets.

Anglo is not the only one to feel the pinch. Platinum producer Lonmin outlined yesterday plans to cut thousands of job and to close loss-making mines. Larger rivals Rio Tinto and Glencore have also cut hundreds of jobs this year.

Investors reacted positively to Anglo’s decision to maintain its dividend and to its plans to accelerate its cost-cutting programme, pushing its shares up 2% by 1135 GMT, outperforming a 0.6% fall in the mining sector.

In a letter sent yesterday to employees and seen by Reuters, the company said 1,000 jobs would be cut by the end of this year; 1,500 by the end of 2016 and a further 3,000 later on.

“This is a significant change and I know it will be unsettling for many, but it is the minimum that we need to do to compete with our major competitors and ensure the sustainability of our business,” Cutifani said in the letter.