Reuters

Washington

A faction of Republican conservatives who successfully slid the knife into the US Export-Import (Ex-Im) Bank are eyeing a new target for their drive against what they call “crony capitalism”: an obscure agency that helps US firms invest in the developing world.

Their focus on the Overseas Private Investment Corp (Opic) is the latest phase of a new strategy by conservatives in Congress to pick off agencies one at a time in their quest to shrink government and promote free markets.

Like Ex-Im, whose charter expired on June 30 after Republicans blocked its renewal, the most vulnerable agencies and programs are those that die unless reauthorized and that can be labelled by conservatives as offering handouts to politically well-connected corporate interests.

Opic was created in 1969 during the administration of Richard Nixon as a “soft power” tool to extend US influence in the developing world by funnelling private sector money to core infrastructure projects.

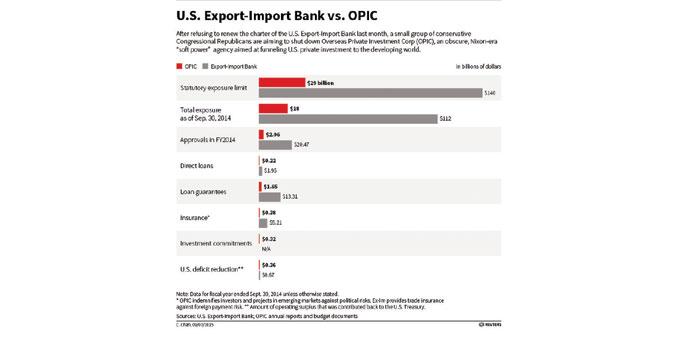

Similarly to Ex-Im, it borrows from the US Treasury at low rates and offers loans and loan guarantees for foreign projects. It also insures investors against political risks in unstable regions such as Africa and the Middle East and makes direct investments in private equity funds in these areas.

Even though it operates on a smaller scale and avoids wealthy countries, Opic has drawn similar complaints as Ex-Im — that it provides “corporate welfare” and is a “slush fund.”

And unless Congress acts, its authority will run out by September 30. The timing for Opic’s renewal coincides with a much larger fight over federal funding that could lead to another government shutdown as the new fiscal year starts on October 1.

“Where do we go next now? My guess is it’s Opic,” said Mick Mulvaney, a conservative Republican from South Carolina who had opposed efforts to renew Ex-Im’s charter.

Opic may be the first of many new targets for conservatives who tasted at least temporary success in blocking Ex-Im’s renewal. Sugar subsidies, which they say keep prices artificially high, are high on many of their lists, as is federal support for ethanol fuel production.

The Small Business Administration, whose mission is to support small Main Street firms, is a target for some conservatives. The agency’s main loan guarantee program is expected to run out of funds before Sept. 30 due to strong demand and some Democrats are seeking more.

“We should be looking at special-interest help and certainly Opic isn’t outside of that,” said Republican Representative Dana Rohrabacher, an Ex-Im Bank opponent. “It’s a subsidy to major Corps.”

Opic made just under $3bn in new financing, insurance and investment commitments last year, compared to $20.5bn for Ex-Im.

Ex-Im helps companies sell US-produced goods and services largely worldwide. It drew the ire of conservatives because of its government backstop benefits to a handful of prosperous industrial giants, including Boeing Co, General Electric Co and Caterpillar.

Opic targets poor emerging market countries for critical infrastructure and does not necessarily require US procurement if the project significantly involves American investors.

Among Opic approvals this year are a $250mn direct loan for 2,500 cellular towers to be built across Myanmar by a consortium led by US-based investment firms Texas Pacific Group and Tillman Global Holdings.

Ghana-based Amandi Energy secured a $250mn Opic loan guarantee for a 250 megawatt power plant that will use US-made General Electric gas turbines.

Representative Eliot Engel, the top Democrat on the House Foreign Affairs Committee, which has jurisdiction over Opic, is bracing for an onslaught against the agency.

“Of course I’m concerned,” Engel said. “Opic and Ex-Im have always been Republican priorities, and now they’ve done a flip. It’s the private sector supporting US foreign policy with its own funds, which is everything that conservatives should want.”

Republican Ed Royce, who chairs the panel and is a past critic of Opic, declined to comment on the agency’s future.

Before attacking Opic, conservative Republicans say they need to complete their victory over Ex-Im. Democrats and moderate Republicans aim to attach legislation to revive the trade bank to a transportation funding bill this month, after many export companies warned of job losses due to the bank’s demise.

All but one of the declared and expected Republican presidential candidates have said they favour closing Ex-Im, an 81-year-old institution that Congress once routinely reauthorized by voice vote.

Outside conservative groups that helped elevate the Ex-Im issue to national prominence, including Club for Growth and Heritage Action, are already positioning Opic as a target and drawing parallels to the trade bank.

“The similarities between Opic and Ex-Im are chilling. Two government agencies that focus on artificially propping up US companies,” said Veronique de Rugy, a senior research fellow at George Mason University’s Mercatus research centre who frequently testifies before Congress against Ex-Im and other business subsidy programmes.

Building a coalition against Opic could be more difficult than against Ex-Im, however, because of its smaller size and focus on needy countries.

“It’s a cousin to the Ex-Im Bank, but the people who benefit from Opic typically do not have the same kind of balance sheets that would benefit from Ex-Im,” said Representative Mark Meadows, a founding member of the conservative Freedom Caucus, who said he would vote to renew Opic.