Reuters/London

Hopes of a cash-for-reforms deal for Greece boosted Eastern European stocks and currencies yesterday, while a Chinese market recovery helped to lift the main emerging market equity index further off recent two-year lows.

Greek Prime Minister Alexis Tsipras has offered last-minute concessions to try to save his country from bankruptcy, and parliament in Athens is expected to vote on them. Creditors have yet to comment on the plan, but markers have rallied.

With Western European stocks and peripheral bonds moving up, bourses in Prague, Warsaw and Budapest rose around 1%. Bucharest stocks rose 0.7%

Also, a 5-6% rise in Chinese stocks filtered through to emerging market assets and commodities, lifting MSCI’s main emerging equity index 1%.

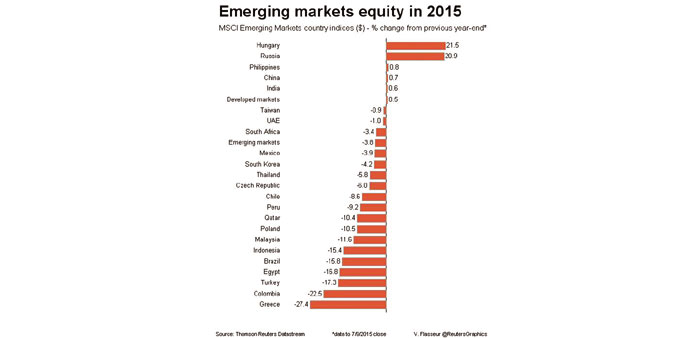

Government stablisation measures helped Chinese stocks close the week higher, but the emerging market index is set for its worst weekly loss since December 2014 and is down 2% on the year so far.

“It looks like we are heading for another kick-the-can-down-the-road with Greece, so we are seeing a decent comeback with a euro rebound, which is supporting the likes of zloty and forint,” said Luis Costa, head of CEEMEA debt and FX strategy at Citi.

“In China, no one should be surprised they piled on the stabilsation measures, so all in all, it’s a bit artificially driven, but it is supportive of risk.”

The Hungarian forint outperformed neighbouring currencies, jumping 1% versus the euro. The zloty rose 0.6% and the leu firmed 0.3% .

Polish yields rose 2-5 basis points after slipping under 3% on Thursday for the first time in seven weeks. Hungarian yields dropped another 1-3 bps after a strong debt auction and on expectations Moody’s would upgrade its ratings outlook.

Yields on Romania’s 2020 leu bonds fell 6 basis points, extending Thursday’s fall.

Chinese credit default swaps eased 5 bps to 93 bps after rising as high as 105 bps earlier in the week.

Eastern European CDS failed to move significantly, with Polish 5-year CDS, used as a proxy for regional risk, close to 17-month highs at 77 bps. Markets are also worried about political risk as elections approach.

Polish stocks have underperformed this year, hurt by the banks index, which is near two-year lows because banks look to suffer from plans to convert Swiss franc mortgages into zloty.

The rouble and rand rose around 0.8% to the dollar as the Chinese stabilisation halted the slide in oil and metals prices

EM bond funds saw small investment inflows of $167mn but EM equities lost $1.5bn, bringing year-to-date outflows to $7.8bn, JPMorgan said.