Doha

Supply cutbacks are expected to push up oil prices from 2016, QNB has said in a report.

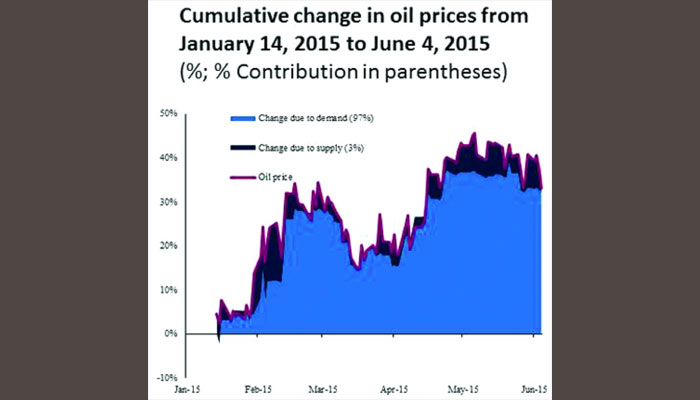

Oil prices have rebounded by 33.1% since their trough in January to $62 per barrel.

To answer many questions related to the oil price recovery QNB has adopted a methodology, which allowed it to quantitatively disentangle demand from supply factors.

The QNB methodology showed that demand was single-handedly behind the recent recovery, but that supply was responsible for the majority of the 60% collapse in oil prices in the second half of 2014. “Our conclusions about the relative roles of demand and supply are supported by independent data from the International Energy Agency (IEA). This suggests that the recovery in oil prices still has legs as the adjustment through lower supply is yet to happen. As a result, we expect average oil prices to rise in 2016 to $64.1 (for a barrel) from an expected $56.2 in 2015,” QNB said.

A simple way to distinguish between the demand and supply factors is to look at their impact on both oil and stock prices. Higher global demand, due to stronger growth for example, will push up oil prices. It should also boost the earnings of companies, leading to higher stock prices.

On the other hand, higher oil supply will reduce oil prices, but, it should also lead to lower energy costs, higher corporate profits and consequently rising stock prices. Therefore, the co-movement between oil and stock prices provides a basis for identifying demand and supply shocks.

If oil and stock prices move in the same direction, QNB interprets this as being caused by a demand shock. Conversely, if they move in opposite directions, the bank interprets this as being driven by an oil supply shock.

“Our methodology is a modified version of the one recently used by the IMF,” QNB said. “We apply this method to daily data on oil prices (Brent crude oil) and stock prices (S&P500 index excluding the energy sector). Each day we attribute the change in oil prices, either to changes in expectations of global demand (if oil prices and stock prices move in the same direction), or to changes in expectations about oil supply (if oil prices and stock prices move in different directions). “We then add up the change in the oil price that is attributable to global demand and the change that is attributable to oil supply over a period of time. We reach two conclusions. First, oil supply contributed 54% to the fall in oil prices in the period from June 19, 2014 to January 13, 2015. Second, the recovery in oil prices since January 14, 2015 is exclusively attributable to global demand (97%).”

The method yields sensible results, QNB said. For example, it correctly attributes the fall in oil prices around Opec’s meeting on November 27, 2014 to supply. Opec surprised markets by not reducing its production ceiling, oil prices tumbled and stock prices rose.

The conclusions are also consistent with independent data from the IEA. From June 2014 to December 2015, the IEA continuously revised up its forecast for non-Opec production in 2015, while revising down its forecast for global demand. This supports QNB’s first conclusion that both demand and supply factors were responsible for the oil price fall in this period.

Furthermore, the IEA’s forecast for non-Opec production in 2015 was unchanged in June 2015 relative to December 2014. Meanwhile, the IEA has continuously revised up its forecast for global demand since the end of last year. This is in line with QNB’s second conclusion that the oil price recovery was solely demand-driven.

“In summary, our new methodology allows us to disentangle demand factors from supply shocks, and its conclusions are consistent with other data in the oil market. Our method shows that the recent recovery in oil prices was driven by a strengthening in demand. This could be due to the improvement in growth prospects in advanced economies, especially in the Euro area and Japan.

“Our forecast for oil prices to continue to recover is based on the assumption that high cost oil producers, particularly shale producers in the US, will be forced to cut production in response to lower oil prices. Based on our methodology, this has not materialised yet. Therefore, we still expect supply cutbacks to push up oil prices from 2016,” QNB said.