Doha

The Chinese economy faces serious implications because of the global economic forces, QNB has said in a report.

China is the world’s largest economy and the main driver of global growth. Since its opening up to the world in the early 2000s, the performance of China has had significant impact on economies and markets around the world. But China is also influenced by global economic currents, and the strong forces of lower oil prices, divergent global monetary policies and a stronger US dollar are setting new trends in China. Nowhere is this more visible than in the Q1, 2015 balance of payments data, where capital flight from China reached record levels.

China’s financial account, where capital and financial flows are recorded, registered a deficit of $159.1bn, by far the largest deficit since at least 1998. The large financial account deficit occurred despite the impressive performance of the Chinese stock market, which rallied by 15.9% in Q1 2015. The deficit was a reflection of accelerating capital outflows, as Chinese corporates paid off their foreign-currency debt.

These debts were accumulated as Chinese corporates took advantage of the low interest rate environment in the US to borrow in US dollars. And because they expected the yuan to appreciate, they left their liabilities unhedged. This process has begun to reverse ahead of the Federal Reserve’s normalisation of monetary policy in the US. Full data are yet to be made available, but China’s external debt in US dollars fell by $23bn in Q3 2014. The trend of paying back foreign-currency debt and the resulting capital outflows are expected to continue in 2015.

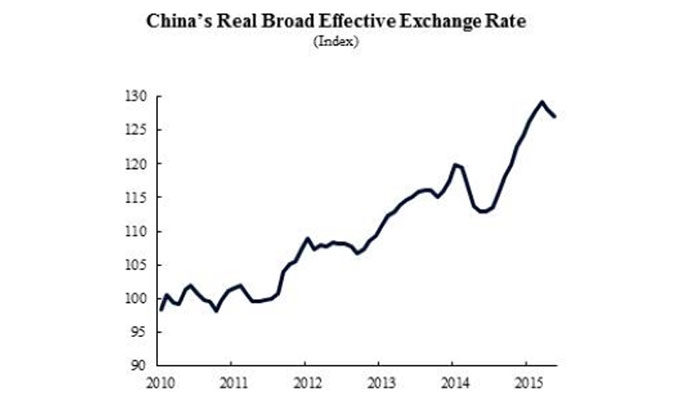

Partly offsetting capital flight, China’s current account registered a large surplus in Q1, 2015. The $78.9bn surplus—equivalent to 3.5% of GDP—was due to the drop in oil prices which reduced crude oil import bill despite a steady increase in the volumes of imported oil. The current account surplus occurred in spite of the appreciation of the Chinese yuan, which has seen its real effective exchange rate appreciate by 12.9% since June 2014. This has hurt Chinese exports, by making them less competitive relative to other countries.

“Going forward, we expect the current account surplus to reach 3.0% of GDP as the effect of lower commodity prices will continue to outweigh the impact of a less competitive exchange rate,” QNB said.

Because the financial account deficit was much larger than the current account surplus, China’s overall balance of payments recorded a deficit in Q1, and reserves fell by $80.2bn.

QNB said it did not expect the drawdown in reserves to continue or significant currency depreciation.

“Going forward, we expect capital outflows to be mitigated by the gradual liberalisation of the capital account. This should lead to stronger portfolio inflows by foreign investors seeking to benefit from the high-growth environment,” the report said.

An unintended consequence of capital outflows is tighter domestic monetary conditions in China. As corporates exchange domestic currency for US dollars with the People’s Bank of China (PBoC), it leads to lower currency in circulation and tighter monetary conditions. The PBoC’s repeated rounds of easing, most recently just before the publication of the balance of payments data, are therefore necessary to keep monetary conditions at least stable. As a result, further easing is expected going forward to achieve the authorities’ growth target of 7% in 2015.

“Overall, global economic forces are having serious implications for the Chinese economy. The current account is expected to remain in surplus due to lower commodity prices, despite the appreciation of the yuan. Capital outflows are expected to continue as Chinese corporates pay down their debt ahead of the US monetary normalisation. But they are expected to be mitigated by portfolio inflows as China takes further steps to liberalise its capital account. In this sense, the liberalisation of the capital account is not just necessary for the internationalisation of the renminbi, but also to keep its volatility under control,” QNB said.