Reuters/Beijing/Singapore

China’s independent buyers of liquefied natural gas (LNG) are taking their first cargoes of the fuel as Beijing permits third-party use of idle capacity at import terminals and approves the new players’ long-term plans to build their own facilities.

Privately run city gas distributor ENN Group and onshore LNG investor Guanghui Energy Co were among the first to start importing spot cargoes, renting space at PetroChina’s underutilised receiving terminals at Rudong and Dalian and each bringing in at least one cargo since late 2014, according to company officials.

Other new importers include trader JOVO Group and independent oil and gas company Pacific Oil and Gas as China works to meet clean energy targets calling for natural gas’ share in its energy mix to double. Beijing is freeing up the nation’s LNG trade as part of broad reforms that allow private companies to invest in oil and gas exploration as well as pipelines and tank farms, and to engage in importing and exporting. The aim is to help secure supplies while boosting competition and efficiency in an energy sector long dominated by state firms.

“There will be sizeable room for independents to grow, either by building their own receiving terminals or taking stakes in large existing terminals,” said Li Qingping, advisor to city gas distributor Shenzhen Gas in southern China.

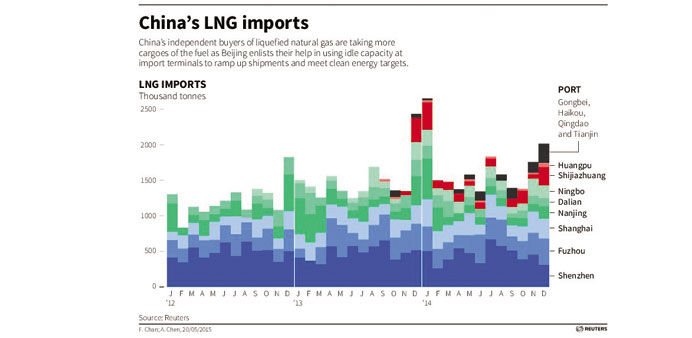

The new non-state buyers have taken about six spot cargoes so far this year, said traders involved in LNG trades into China. That compares with around 45 total cargoes of LNG imported in the first four months of the year, based on official customs data and the typical size of LNG tanker shipments.

Independents could account for as much as 30% of China’s LNG import market by around 2030, said industry experts, benefiting suppliers from Australia to North America in a market where spot prices tumbled over the past year as slowing Asian economies met expanding supplies. Import terminals built by state-run energy companies over the past decade are being used at just over 50% of capacity, in part because of receiving room built ahead of supplies to be delivered out of Australia when new LNG projects come online there this year and next.

In the first four months of the year, LNG imports are running 4.5% behind last year due to high contract prices and overstocking ahead of last winter, while pipeline flows have surged 32% over the same period.

Last year in April, Beijing said parties such as ENN Group – parent of Hong Kong-listed ENN Energy Holdings - and Shenzhen Gas could lease and use that idle infrastructure, and independent energy companies and small buyers are taking advantage of Asia’s low spot prices to bring in LNG at a lower cost than some of the supplies contracted by state importers such as PetroChina.

Companies are also building and planning their own receiving and storage facilities so they can have more control over their future purchase prices and volumes.

ENN won Beijing’s nod this February to build a 3mn tonne-per-year receiving facility off the east coastal city of Zhoushan, and Guanghui is building a receiving terminal in eastern Jiangsu province, company officials said.

Huadian Group, a state utility, is also venturing into the LNG sector, taking a 5% stake in an $11bn Canadian gas export project and planning to build a receiving terminal on China’s southeast coast. “China is set to see more active spot trade with the government policy support including market access and gradual price deregulation, and firms like ENN approved to build receiving terminals,” Ma Shenyuan, vice president of ENN Group, told an LNG seminar in April.

Top global energy consumer China aims to more than double the share natural gas has in its energy mix to 13-15% by 2030 from about 6.5% now, seeing the fuel as more effective than renewables in cutting emissions and tackling air pollution.

China is raising gas imports from Central Asia and Russia via pipelines and from producers such as Qatar and Papua New Guinea as LNG. Some experts are forecasting LNG shipments to triple by 2025 from last year’s 20mn tonnes.

The country’s current 12 terminals – with a total capacity of about 38mn tonnes per year – were used at just 52% of their capacity in the first four months of 2015, leaving plenty of room for new players to enter the market. While welcoming the new buyers, suppliers remain cautious, especially when negotiating longer-term supplies with the independent companies.

“They don’t really have a strong balance sheet, or lack a pipeline network,” said a marketing executive with a North American exporter.

Recently a small Chinese buyer had to turn away an LNG delivery from Spain’s Gas Natural Fenosa because it lacked the credit rating to swing the deal, according to industry sources and ship tracking services on the Thomson Reuters

terminal.