Q1 earnings seen up 19.6% ex-energy, says StarMine; biggest increase since Q2 2011, outperforms US; analyst upgrades outweigh downgrades for first time in four years

Reuters

London

European companies are heading for their best earnings season in four years, sharply outperforming their US counterparts on the back of a weak euro and improving economic conditions.

Earnings for companies in the STOXX Europe 600 are expected to have grown 19.6% in the first quarter of the year after stripping out the energy sector, where profits are forecast to have fallen by nearly a half due to a slump in oil prices, StarMine data showed.

If these expectations are borne out, this would represent the biggest earnings increase since the second quarter of 2011 and a sharp outperformance over the US, where profits ex-energy are seen rising 5.4%.

Investors see a pick-up in profits as crucial for underpinning confidence in Europe’s nascent economic recovery, validating the European Central Bank’s stimulus plan and easing concerns about elevated equity valuations.

Companies in the STOXX Europe 600 index currently trade at 18 times the profits they reported in the last 12 months, the highest level in 11 years, Datastream showed. The ratio would come down, however, if earnings rose faster than prices.

“The market is not overvalued if earnings...improve, and it looks like they will,” said Dennis Jose, European equity strategist at Barclays.

Early sales reports struck an upbeat tone, with Nestle, Unilever and Danone all reporting better than expected first-quarter sales in the past week.

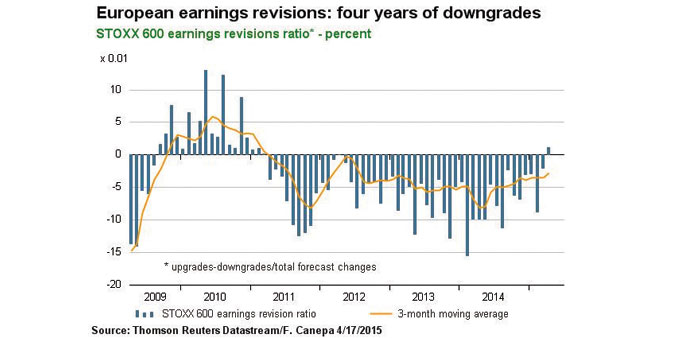

Analyst expectations for earnings further into the future have also started to improve.

Upgrades to analysts’ earnings forecasts for the next 12 months outnumbered downgrades for the first time in four years in March, Datastream data showed.

Companies which rely heavily on economic growth for their profits, such as household goods firms, software and media groups, have driven the upgrades, according to a UBS analysis.

This mirrors an improvement in European economic activity indicators and a weakening in the euro following the launch of the ECB’s sovereign bond purchase programme in January.

“The (combination of better earnings and data) gives us a bit more confidence,” Nick Nelson, a strategist at UBS said. “I think you can see a multi-year earnings recovery.”

The earnings uptick in Europe comes when US companies face their worst earnings season in six years, suffering the effects of a cold winter and a strengthening of the dollar.

Including the energy sector, companies in the STOXX Europe 600 index are seen reporting a 5.3% profit increase in the first quarter, compared to a 2% fall for the constituents of the US S&P 500 index.

This divergence has already started to play out in share prices. The STOXX Europe 600 is up 18.8% year-to-date, compared to a 1.1% rise for the S&P 500.

The S&P outperformed its European counterpart in each of the previous four years. Given that the European earnings recovery is only just starting, many see scope for the region’s shares to extend the advantage they have enjoyed so far in 2015.

“I expect Europe to continue outperforming in Q2 and most likely in Q3 as well,” said Stewart Richardson, a director at macro hedge fund RMG Wealth Management.

Richardson cautioned the biggest caveat to this scenario was a disorderly Greek exit from the euro zone if Athens cannot get further bailout aid, which would raise questions about other countries’ euro membership.

A further weakening in the US economy, Europe’s largest trading partner, was also seen as a major risk.

“If the US was to fall back towards recession, this earnings recovery in Europe would end quite quickly,” UBS’s Nelson said.