By Arno Maierbrugger/Gulf Times Correspondent/Bangkok

Triggered by rapidly growing demand for Islamic financial instruments, Shariah-compliant exchange-traded funds (Islamic ETFs, or iETFs) are beginning to add potential to the portfolios of Muslim and ethical investors.

In Southeast Asia, Malaysia last week came up with the first regional Islamic ETF that will include Shariah-compliant stocks from Malaysia, Singapore, Indonesia, Thailand and the Philippines. It is being launched by investment firm i-VCAP Management and will start trading on May 7, bringing Malaysia’s Islamic ETFs to three.

The region is joining the growing number of Islamic ETFs provided by large investment companies such as Blackrock (under the iShares brand), Deutsche Bank Asset & Wealth Management (under the DB X-trackers brand) and BNP Paribas (under the EasyETF brand).

The latest addition to the Islamic ETF family was an iETF launched by Seattle-based investment firm Falah Capital in October last year that tracks large US stocks such as Apple, Microsoft, IBM and Intel with Bahrain-based Shariyah Review Bureau acting as Shariah adviser.

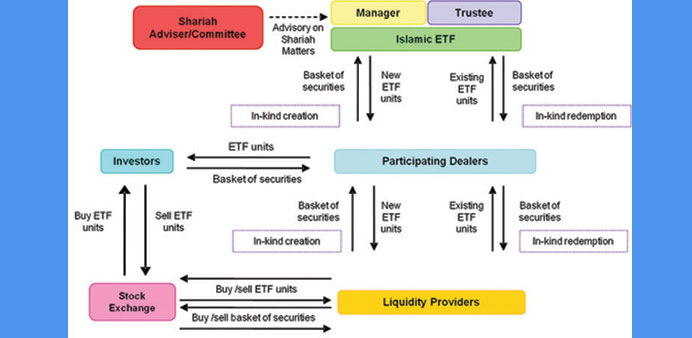

ETFs are funds which hold specific groups of stocks, bonds, commodities or other groups of assets and are traded at stock exchanges. Most of them are tracking an index. Their advantages are that they are low-cost alternatives to mutual funds, that they can be bought and sold like stocks, have a better intra-day price visibility, a high diversification rate and offer tax advantages in most countries where they are traded.

Their Shariah-compliant versions follow religious principles to avoid investing in companies involved in alcohol, gambling, weapons production, pork products and certain types of entertainment such as casinos, gambling and pornography, which keeps iETFs tilting to sectors such as metals, technology and energy. The stock screening is typically overseen by Islamic scholars and results in a portfolio of securities that adheres to Shariah principles.Currently, there are just 27 Islamic ETFs worldwide today, whereby about 97% are invested in precious metals and the rest is tracking equity indexes. This means a big potential for new issuances and a huge growth potential, as currently none of the Islamic ETFs has assets of more than $100mn compared to a current total global ETF market worth $2.3tn and forecasts for worldwide Islamic banking assets of $3.4tn by 2018.

Despite Islamic ETFs exist since a decade, many Islamic or ethical investors may not know of them or may be cautious towards their methodology. Thus they since played a minor role in the global ETF market, accounting for less than 1% in value. But especially for Muslims living in Western markets underserved by Islamic finance, Shariah-compliant ETFs are an excellent alternative to conventional finance.

The first-ever Shariah-compliant ETF was the Dow Jones Islamic Market (DJIM) Turkey ETF listed in 2006 on the Istanbul Stock Exchange that tracks the performance of the DJIM Turkey Index. It showed, however, a year-to-date performance of just 1.08% and a five-year performance of just 7.22%. Currently, the best Islamic ETF in terms of year-to-date performance is the iShares MSCI Emerging Markets Islamic UCITS ETF, which aims to track the performance of the MSCI Emerging Markets Islamic Index with top holdings such as Taiwan Semiconductor, CNOOC, PetroChina, MTN, Gazprom and Reliance Industries and delivered a performance of 13.2% since January 1, 2015.