Reuters/Hong Kong

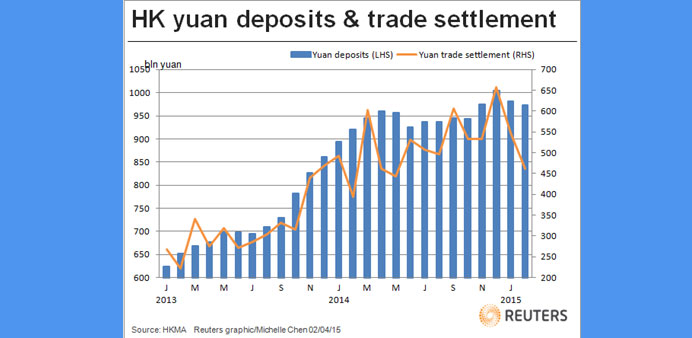

Yuan deposits in Hong Kong contracted for the second straight month in February, a sign that more measures to encourage yuan fund flows from the onshore market may be needed to grow the world’s biggest offshore yuan pool.

The city’s yuan deposits fell 0.9% to 973bn yuan ($157bn) in February from a month earlier, when they declined 2.2%, the Hong Kong Monetary Authority (HKMA) said on Tuesday.

Last year, yuan deposits in the former British colony increased, but the rise was only 16.6%, compared to 46.2% in 2013 and 86.9% in 2012.

An HKMA spokeswoman told Reuters that the February decline “was mostly from corporate deposits as companies sold more renminbi than buying it”. She said individual customer deposits were relatively stable.

Yuan deposits grew quickly in Hong Kong after China in 2009 allowed cross-border trade to be settled in its currency. However, as a series of pilot programmes kicked off to broaden the channels through which investors could enter China, the pace of expansion for the offshore yuan pool slowed.

China needs to encourage fresh yuan outflows to offshore markets, as the movement of yuan back onshore has accelerated under schemes like Renminbi Qualified Foreign Institutional Investors (RQFII) and the Shanghai-Hong Kong stock connect, market players say.

“Although policymakers have not shown a preference for flows in one particular direction, the reality is that actual outflows have been much smaller,” HSBC analysts said in a report.

This is because overseas investment has not proved very profitable in the past, amid steady yuan appreciation, a large domestic versus global growth differential, and low interest rates in major G10 markets, they added. However, the situation is changing as the yuan began to depreciate last year and Beijing is about to roll out more initiatives such as the “one belt one road” that may encourage the yuan to be used more outside of China.

“As China will shoulder the responsibility for most of the financing (for the initiative), it is likely that at least some of the loans and vendor financing will be provided in yuan,” said Qu Hongbin, HSBC’s China economist.

Meanwhile, Chinese regulators on March 27 said restrictions on domestic mutual funds investing in Hong Kong shares would be eased under the stock connect scheme.

That boosted southbound trading volumes. On Monday, southbound trading reached a record HK$5.593bn ($721.41mn).

Since the connect scheme started on Nov. 17, about 41% of the northbound quota has been used, but only 15% for the southbound, effectively draining a net 86bn yuan ($13.88bn) from Hong Kong’s yuan pool.