Qatar’s economic growth will accelerate to 7.8% in 2016 from 6.8% this year as hydrocarbon production grows moderately while the non-hydrocarbon sector expands at a double-digit pace on higher investment spending and a growing population, QNB has said in a report.

In its latest issue of Qatar Economic Insight, QNB said Qatar’s economy has started a new diversification phase as large investment spending in the non-hydrocarbon sector accelerated growth to 6.5% in 2013 (6.1% in 2012) while growth in the hydrocarbon sector slowed.

The share of the non-hydrocarbon sector in GDP is projected to grow from 49% in 2014 to 57.2% by 2016.

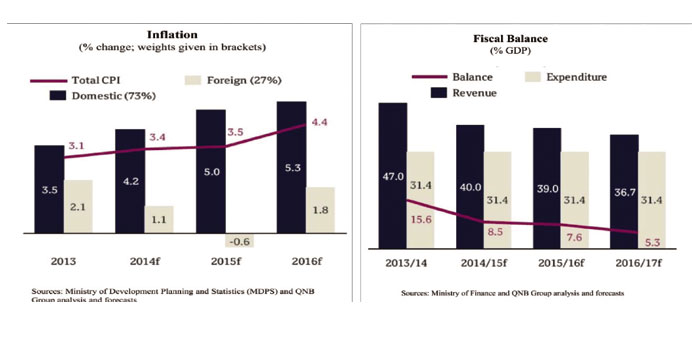

Inflation has slowed since mid-2013 (CPI inflation averaged 2.8% in H1, 2014) as rising rents were offset by lower global food prices.

Nevertheless, overall inflation is projected to increase moderately to 3.4% in 2014 and 3.5% in 2015 as rising rents outweigh lower food prices.

There are risks, however, of higher inflation if the economy hits significant supply bottlenecks.

The government has ramped up budgeted capital spending, driving overall investment and economic growth, while the fiscal surplus increased to 15.6% of GDP in the fiscal year that ended in March.

Lower hydrocarbon revenue and rising capital spending could narrow the fiscal surplus from 8.5% of GDP in 2014/15 to 5.3% in 2016/17.

The government has recently earmarked $182bn for project implementation over the next five years, of which $27.4bn is in 2014/15.

Banking asset growth slowed to 9.4% in the 12 months to end-June 2014 on lower public sector borrowing; non-performing loans (NPLs) were low at 1.9% of gross loans at end-2013 and banks remained well capitalised, with the average capital adequacy ratio well above the QCB requirement under Basel III.

Bank lending is expected to rise by an average 10.7% in 2014-16, increasingly driven by the expanding population and steady deposit growth averaging 12.5%.

Low provisioning requirements and efficient cost bases will support continued strong bank profitability.