Reuters/Bangkok

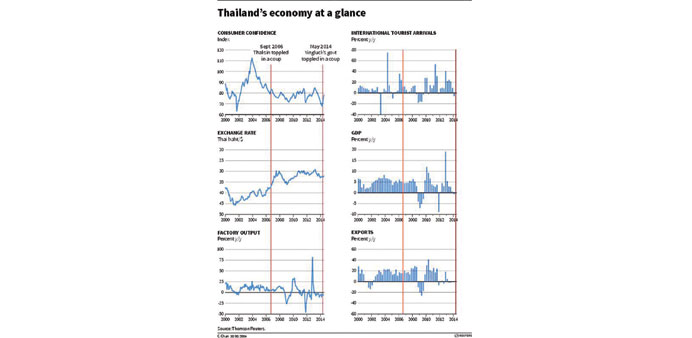

Thailand avoided recession in the second quarter, though doubts remain about how robustly it can recover after the army stepped in to end political unrest and seek to lift a stumbling economy.

Southeast Asia’s second largest economy grew 0.9% in April-June on a seasonally-adjusted basis from the previous quarter as private and government spending and exports improved, the state planning agency said yesterday.

The central bank believes there can be a strong V-shaped rebound from the country’s recent rough patch – predicting robust growth of 5.5% next year – but questions remain about the pace and depth of a recovery.

Thailand’s high household debt levels and headwinds facing exports are “likely to constrain the bounce in growth”, said Benjamin Shatil, economist with JP Morgan in Singapore.

“We look for a modest recovery, rather than a sharp V-shaped recovery through next year,” he said.

The National Economic and Social Development Board (NESDB), which compiles gross domestic product (GDP) data, yesterday trimmed its full-year growth forecast to 1.5%-2% from a 1.5-2.5% range.

It also revised the shrinkage in the first quarter from the previous three months to 1.9%, from 2.1%.

After the data came out, the baht strengthened to 31.79 to the dollar, the strongest since July 29, from 31.83, and then eased. Thai stocks, which are up 19% this year, were flat for the day.

Second quarter GDP data was keenly awaited, to see if Thailand steered away from a recession and how the economy is faring after the May 22 coup.

The NESDB said growth in the second quarter came from government expenditure, private consumption and exports. Private investment declined in the period.

It said that Thailand in the second quarter grew 0.4% from a year earlier, and in the first half contracted 0.1% from the year-earlier period.

The first quarter shrinkage reflected the economic damage from a political crisis that hit consumption, confidence and tourism.

The NESDB said the second half will show growth “supported by the improved confidence and the return of government administration and budget disbursement to normal process”.

However, some pillars of the Thai economy remain shaky. Consumption remains subdued, auto sales are tumbling and exports are tepid.

A slump in the key tourist industry, which accounts for about 10% of GDP, has eased. In July, the number of tourists fell 10.9% from a year ago, compared with June’s 24.4% plunge.

Five-star hotelier Erawan group, which earlier forecast a 2%-4% rise in revenue this year, said on Thursday it expects a 9% fall. An improving second half “can’t offset a weak first half,” chief financial officer Kanyarat Krisnathevin said.

Gundy Cahyadi, an economist with DBS Bank in Singapore, said “the outlook is still far from being robust.”

“GDP growth momentum is likely to pick up in late 2014 but a return to near-term potential will still take some time, even if the government is going to be clearly pro-growth,” he added.

The junta has made delayed payments to rice farmers, approved infrastructure projects and accelerated approvals for private investment applications halted by political unrest.

Exports are equal to more than 60% of the economy, so sustained growth gains depend on raising shipments. Weak exports have hit factory output. In April-June, exports rose just 0.6% from a year earlier and factory output fell 5%, and the average capacity utilisation was 59.5%, the lowest in the past 10 quarters.

The central bank has forecast economic growth of 1.5% this year.

Santitarn Sathirathai, economist with Credit Suisse in Singapore, said that to grow like that, Thailand will need to expand at nearly 9% in the second half “and that’s quite a demanding number especially when you don’t have that many of the strong, positive catalysts this year.”

Government spending, halted during the paralysing political crisis, “will eventually come through and help but it will probably take time,” he said.

The Bank of Thailand’s monetary policy committee has kept the policy rate at 2% since March, and many economists expect it will remain at that level as the central bank waits for steps by the government to get economic growth going. The next meeting to review policy is on September 17.