Strong public investment spending is expected to give a push to Qatar’s real GDP growth to 6.7% this year and 6.9% in 2015, Samba has said in a report.

By Pratap John/Chief Business Reporter

Strong public investment spending is expected to give a push to Qatar’s real GDP (gross domestic product) growth to 6.7% this year and 6.9% in 2015, a new report has shown.

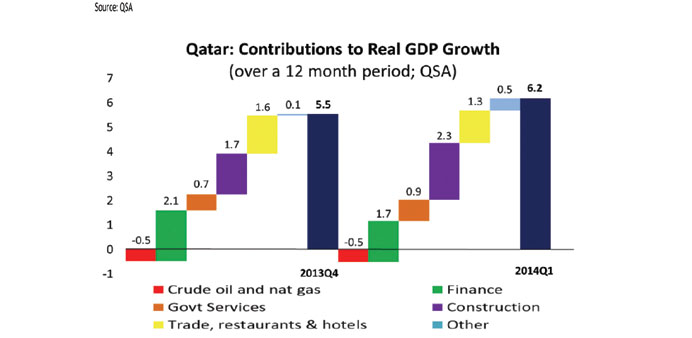

Qatar’s economy continued its strong growth in the first quarter of 2014, expanding by 6.2% on a 12-month basis, up from 5.5% in Q4, 2013, Samba Financial Group has said in a report.

The growth was driven exclusively by the non-hydrocarbon sector, which is testament to the plans set out in the National Development Strategy. Finance, construction, trade, restaurants, hotels and government services each contributed between 0.9 – 2.3 percentage points to GDP growth.

These sectors have benefited from large government spending projects aimed at improving the country’s infrastructure whilst proving a catalyst for the diversification of the economy. This spending is forecast at $210bn up to 2021, $160bn of which will be financed through the budget, Samba said.

The hydrocarbon sector detracted 0.5 percentage points from the total growth figure, mainly due to receding oil production and the moratorium on natural gas production. Oil production has fallen due to the maturing of oil fields such as Dukhan, Maydan Mahzam and Bul Hanine, which were all first exploited more than thirty years ago, the report said.

Recent reports have suggested that there will be an $11bn redevelopment of the Bul Hanine field. HE the Minister of Energy said that the redevelopment would double the production rate (currently around 45,000 bpd) and prolong the lifespan of the ageing field. The new Barzan gas-to-liquids plant may also provide impetus for some hydrocarbon growth, but not until 2015. The moratorium on natural gas production is set to be reviewed in 2015.

There has been no news of any imminent development plans as the government may well extend the suspension as they turn their focus to the infrastructure required for the World Cup in 2022, the report said.

“We expect hydrocarbon growth to be broadly flat - between 0 and 1% to the end of 2015, with overall GDP growth to hold at around 6.7% in 2014 and 6.9%% in 2015 as infrastructure spending is ramped up and population growth underpins aggregate demand,” Samba said.

According to Samba, Qatar’s projects market was dominated by transport and real estate, with a quarter of all infrastructure spending being dedicated to the rail projects in coming years. This includes the integrated rail project which comprises of the Doha Metro, Lusail Light Rail Transit and the overland railway. This will help to ease the congestion on Doha’s roads, where at peak times; trucks are banned from the capital Doha.

Work started on the Doha Metro last year, with plans for some 37 stations and 100km of track completed by 2019, with the other 55 stations online by 2026. Other transport projects include the $12.7bn worth of road infrastructure and the Sharq crossing ($12bn), which will link Doha’s new airport with the city’s cultural district and the business area of West Bay.

The authorities have recently suggested that there will be a revision of the spending plan for the years leading up to the World Cup, as a certain number of projects will be prioritised in order to meet looming deadlines.

Qatar has also recently announced that it will be cutting the number of World Cup stadia to eight, the minimum required by FIFA, from a more ambitious target of 12, as set out in the bid. To date, authorities have kept prices stable and growth robust amidst significant project spending, but with the scheduled pipeline of projects burgeoning, it presents a significant feat for the emerging economy, especially when the total spending equates to 110% of last year’s GDP, Samba said.