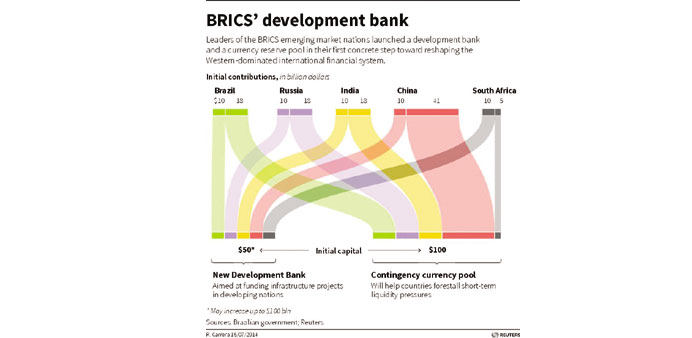

The old structures of international development financing are increasingly getting disrupted. Not only that the five emerging countries of the Brics grouping (Brazil, Russia, India, China and South Africa) just recently announced their own Brics Development Bank as a counterpart to the World Bank and the International Monetary Fund, now Asian nations are working on establishing their own financial body to fund infrastructure projects on the continent, the Asian Infrastructure Investment Bank (AIIB), which would build upon members from Southeast and East Asia, Central Asia and the Middle East.

Interestingly, both of these banks enjoy heavy support and funding from China, with the Brics bank being even situated there (in Shanghai). The location of the AIIB is not known yet.

The AIIB, proposed last October by Chinese President Xi Jinping during the Asia-Pacific Economic Cooperation Summit in Bali, has remained a deeply debated issue. The proposed foundation of the AIIB was met with criticism from established development banks such as the World Bank and the Asian Development Bank (ADB), saying that China wants to increase its influence over development loans and projects, but supporters said banks such as AIIB are necessary as the World Bank and ADB “have not been playing their roles” adequately and were dominated by US and Japanese interests.

The AIIB is planned to be established this year with a working capital of $50bn, half of which China would be contributing at the beginning. Initially, the members will come from Asia, but applications for membership from non-Asian countries will be opened in the future. Countries such as India and Thailand have already been asked to participate and responded on a positive note. As of June 10, the number of potentially participating countries was 22, up from 15 in March, including many Asean countries. Around 20 nations, including those in the Middle East and Central Asia, have also been eager to engage in the Beijing-led project.

After the $50bn working capital is reached – paid in from member countries according to their financial capability – China proposed doubling the capital of the bank to $100bn. Thailand, which has huge infrastructure projects in the pipeline for the next decade, said it might be able to contribute $5bn to the AIIB. India is also expected to contribute a sizeable amount.

The area of action for an AIIB is huge. The ADB itself has estimated that the whole of Asia needs about $8tn in funds to improve national infrastructure between 2010 and 2020 to sustain its growth trajectory, adding that the ADB can provide about $13bn in new lending every year. This has led observers to believe that a China-dominated AIIB would rather cooperate than compete with the ADB and other sources of funds to provide such huge amounts of loans.

However, one country that is not so happy with the new bank is Japan, with the government in Tokyo saying that it was “not convinced” of the necessity of the AIIB. Japan and the US are the largest shareholders in the ADB, which has provided financial support to emerging countries in Asia for around 50 years and is eager to maintain the status quo rather than let China challenge the dominance of Japan and the US in the Asian infrastructure finance sector. In the end, the new AIIB is a sensitive geopolitical mission that holds a certain degree of conflict potential.