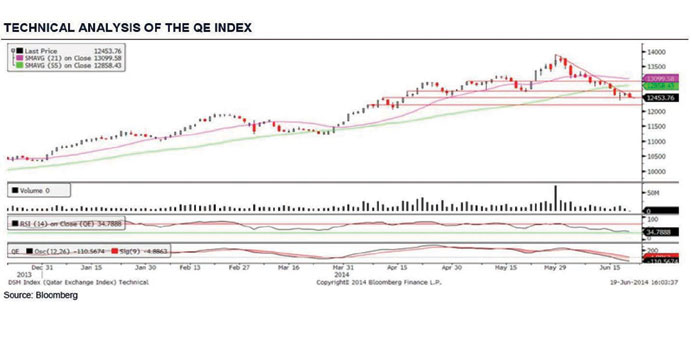

Technical analysis of the QSE index

The QSE Index breached its higher highs and higher lows pattern on the charts, as it fell in four of the five trading sessions. The index opened on a positive note on Thursday, but later fell in the day to close at 12,453.76, down 1.09%. The index lost more than 4% during the week, moving below the psychological level of 12,500. However, the index managed to hold on to its support level of 12,450. If this level is broken, the index may move toward its next strong support of 12,250. The index closed at its lowest point of the day on Thursday, which suggests that it remains weak, and may fall further from the current level. The RSI and the MACD continued to trend lower, supporting this negative market view. On the upside the 12,600 level is a strong resistance level for the index. A close above the 21-day moving average (currently at 13,099.58) would indicate a reversal of the short-term downtrend.

Definitions of key terms used in technical analysis

RSI (Relative Strength Index) indicator – RSI is a momentum oscillator that measures the speed and change of price movements. The RSI oscillates between 0 to 100. The index is deemed to be overbought once the RSI approaches the 70 level, indicating that a correction is likely. On the other hand, if the RSI approaches 30, it is an indication that the index may be getting oversold and therefore likely to bounce back.

MACD (Moving Average Convergence Divergence) indicator – The indicator consists of the MACD line and a signal line. The divergence or the convergence of the MACD line with the signal line indicates the strength in the momentum during the uptrend or downtrend, as the case may be. When the MACD crosses the signal line from below and trades above it, it gives a positive indication. The reverse is the situation for a bearish trend.

Candlestick chart – A candlestick chart is a price chart that displays the high, low, open, and close for a security. The ‘body’ of the chart is portion between the open and close price, while the high and low intraday movements form the ‘shadow’. The candlestick may represent any time frame. We use a one-day candlestick chart (every candlestick represents one trading day) in our analysis.

Doji candlestick pattern – A Doji candlestick is formed when a security’s open and close are practically equal. The pattern indicates indecisiveness, and based on preceding price actions and future confirmation, may indicate a bullish or bearish trend reversal.