Three members of Africa’s “youth club” - Rwanda, Zambia and Zimbabwe - offer some of the fastest-growing working populations in the world, if only investors can capitalise on that.

If the countries’ demographic trends can be coupled with good education to create skilled jobs and an avoidance of political unrest, this should lead to economic growth quickly enough to attract portfolio investors, some analysts say.

None of the three makes it to the flagship frontiers stock index, which tracks exchanges a tier below the larger, more established emerging markets. But according to UN projections, their working-age populations will increase by up to 20% by 2020.

This is attracting investors’ attention, even though the precise effect of expanding populations of young workers on economic growth remains contested. “I have never paid attention to demographics because I didn’t think it could be relevant on any investor timeframe - I was wrong,” said Charles Robertson, chief economist at Renaissance Capital.

Renaissance recently published a study of frontier markets showing Rwanda - which hosts the African Development Bank annual meeting this week - along with Zambia and Zimbabwe as the top three countries for demographics.

Each 1 percentage point annual rise in the working-age population should equate to a 1 point improvement in the annual growth rate, Robertson said. In the case of Rwanda, demographics would account for an extra 4 percentage points a year on growth.

But unsophisticated financial markets and, in some cases, erratic government policies may keep these countries out of the mainstream for some time to come.

Around $22bn in funds is under management in frontier markets, according to Rencap estimates, mostly through the MSCI frontiers index, one of the best-performing markets this year. Following the upgrading of two big Gulf markets - Qatar and United Arab Emirates - to emerging market status this month, Africa will make up around 30% of the frontiers index. But even to make it to frontier stock market status requires levels of size, liquidity and market access which the youth club three don’t have. Of the three, Zimbabwe has the largest and most-established stock market, which became a favourite with frontier investors last year, hitting record highs. But even here, daily turnover of a few million dollars compares with around $25mn in frontier market Nigeria, for example.

Stock favourites include brewery company Delta Corp, and mobile phone operator Econet Wireless.

Zimbabwe averaged nearly double-digit annual growth between 2009 and 2012 as it recovered under a power-sharing government from economic collapse. But rates have fallen sharply due to shortages of electricity and capital, while less than 20% of the working population is in formal employment.

Investors have also become more uncomfortable since elections last year cemented President Robert Mugabe’s Zanu-PF party in power. “We still have some exposure to Zimbabwe but we are less bullish on Zimbabwe than we have been,” said Andrew Lister, fund manager at Advance Emerging Capital.

Zimbabwe, shunned by Western governments and funding institutions, has not been able to follow many other African nations in issuing international bonds. For Danat Abdrakhmanov, institutional portfolio manager at Eaton Vance, a growing population is not enough for investment. “In terms of the way we look at countries - we want to see rule of law, less regulation, less government, smarter regulation - when you are talking about countries like Zimbabwe, things can only improve,” he said.

Valuations are also not as cheap as they once were, with price-earnings ratios at 11 for the MSCI Zimbabwe index, according to Datastream, compared with a little over 12 for the MSCI emerging markets index.

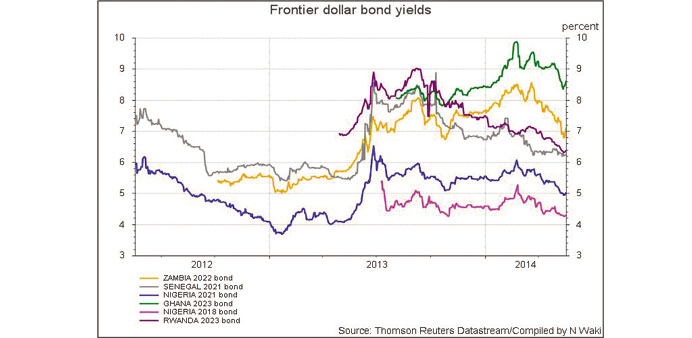

Zambia was one of the forerunners among African countries to issue international debt, launching a $750mn bond in 2012. The bond has not been a great success, with weakness in the price of copper - Zambia’s main export - leading Zambia to underperform other African debt.

Zambia succeeded in issuing a second bond this year, though at a higher yield. Zambian-focused mining companies listed outside the country, such as First Quantum Minerals and Gemfields, have attracted investors. But illiquid local stock markets, a sliding currency and a worryingly large budget deficit have kept many international investors away.