India’s NSE index edged lower yesterday to post a fourth consecutive losing session after earlier falling to a 2-1/2 week low, as blue chips such as Larsen & Toubro and ICICI Bank slumped in a bout of profit-taking.

Earnings disappointment by key companies such as Bharti Airtel and Sesa Sterlite also weighed on sentiment, denting some of the hopes about an economic recovery that had boosted shares.

Investors are also concerned after foreign investors sold nearly Rs16bn ($264.80mn) worth of index futures over the last three sessions, according to exchange and regulatory data.

Heavy overseas buying in cash shares had helped spur the rally, along with hopes for a revival in domestic economy and that the Bharatiya Janata Party led by Narendra Modi will form the next government.

But some of that momentum is waning, with the NSE index ending down 0.1% for the month, after surging 10.1% over February and March.

“Market has moved quite higher in the last few months, so some people are certainly booking profits. Till elections we won’t see too much of a directional move on either side,” said Aneesh Srivastava, chief investment officer at IDBI Federal Life Insurance.

The broader NSE index fell 0.28%, or 18.85 points, to end at 6,696.40 points, after earlier hitting its lowest level since April 7.

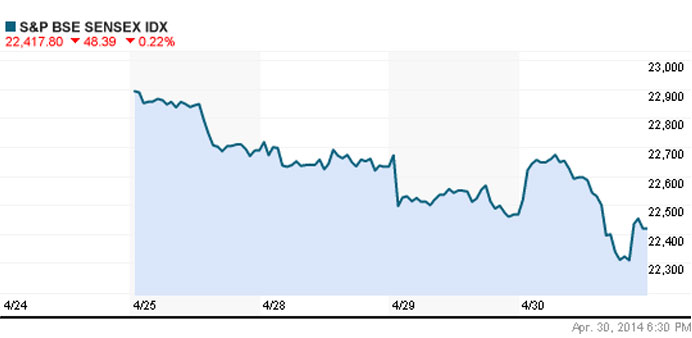

The benchmark BSE index lost 0.22%, or 48.39 points, to close at 22,417.80, after touching its lowest since April 16. The index, however, managed to end 0.14% higher for April, its third straight monthly gain.

Indian equity, foreign exchange and debt markets are closed today for a local holiday.

Profit-taking weighed on blue chips, with L&T falling 2.1% and ICICI Bank losing 1.5%.

Tata Power fell 3.5%, while Bajaj Auto ended 1.4% lower.

Bharti Airtel fell 2.1% after earlier rising as much as 2.6% as some investors were disappointed by the company’s January-March earnings.

Investors noted lower tax rate and a 1.7% sequential fall in Africa revenue as key drag on Bharti’s quarterly earnings.

Rupee strengthens

The rupee rose for a second consecutive session yesterday, boosted by large dollar sales by exporters, but gains were capped by caution ahead of the US Federal Reserve’s policy meeting this week and as shares fell to 2-1/2 week lows.

The partially convertible rupee closed at 60.31/32 per dollar compared with 60.42/43 on Tuesday.

Markets will be shut today on account of Labour Day.

Earlier in the session, a large state-owned bank was said to have sold dollars aggressively on behalf of a foreign client, which briefly lifted the rupee to a more than one-week high of 60.2650, a level last seen on April 21. In the offshore non-deliverable forwards, the one-month contract was at 60.68.