Reuters/Mumbai

Indian shares fell yesterday, retreating further from record highs hit at the start of the week, on worries US interest rates would rise sooner than expected and dent the appeal of higher-yielding emerging markets.

Recent outperforming blue chips such as ICICI Bank and ITC were among the leading losers after strong gains this month had sent the BSE and the NSE indexes to record highs on Tuesday.

Although India has largely been immune to global risk factors this month due to continued strong buying, earlier-than-expected US rate hikes could reduce the appeal of emerging markets for funds overseas.

Short-term US bond yields jumped by the most in almost three years on Wednesday after Federal Reserve Chair Janet Yellen said the central bank might end its bond-buying programme this fall, and could start to raise interest rates around six months later.

“The Fed has given indications that the rates could increase, and this will see FIIs (foreign institutional investors) cutting positions across emerging markets,” said Suresh Parmar, head of institutional equities at KJMC Capital Markets.

“And especially in India, where they have been pumping money in almost every session (in a month). We advise our clients to be cautious and selective,” he added. “Our markets are likely to trade range-bound in the medium term till elections.”

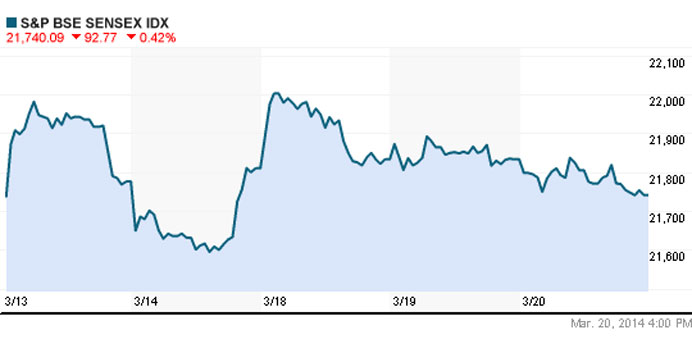

The benchmark BSE index fell 0.42% to 21,740.09, off its record high of 22,040.72 hit on Tuesday.

The broader NSE index closed 0.63% lower at 6,483.10, away from its record high of 6,574.95 touched on Tuesday.

Recent outperformers fell on profit-taking. Overseas funds have been integral to the rally this month, and any signs they may reverse their course could hit shares.

FIIs bought Indian shares worth 10.7bn rupees ($175.40mn) on Wednesday, marking their 22nd buying session in the previous 23.

Banking stocks fell, with ICICI Bank ending 0.76% lower but still up 15% this month. State Bank of India ended down 1.81% after gaining 9.4% during the same period.

Investors also cashed in on recent outperformers such as infrastructure and capital goods stocks. BHEL closed 2.79% lower, while Larsen & Toubro ended down 2.16%. Other blue chips also fell, including ITC which ended down 1.08%.

However, losses were limited as investors also picked up beaten down shares. Technology stocks gained sharply with the BSE IT index up 1.69% on value-buying after a recent slump. Tata Consultancy Services gained 3.37%, while Infosys closed 0.96% higher.

Among other gainers, Hindustan Unilever gained 1.95%, while Reliance Industries closed 0.33% higher, also on value-buying. Healthcare stocks also gained with Cipla up 1.16%.

Meanwhile the rupee saw its steepest fall in nearly two months yesterday as emerging market assets wilted on worries the US Federal Reserve would raise interest rates sooner than expected, although the currency recovered some losses on dollar sales by exporters.

Comments by Fed Chair Janet Yellen on Wednesday indicating the central bank could end its massive bond-buying programme this fall, and could start raising interest rates around six months later, had stunned investors.

The rupee has surged 12% since its record low in late August to a seven-month high this month on the back of strong foreign flows that have helped sharply narrow the country’s current account deficit, so any reversal of foreign flows could dent the outlook for the currency. Equities in particular have rallied on the back of expectations that the Bharatiya Janata Party led by prime ministerial candidate Narendra Modi would win elections set to conclude by May, given perceptions of the opposition party as being more business friendly.

“A lot of the rally due to hopes of Modi coming to power is priced in. I am bullish on the global dollar and think the rupee will show weakness on that going ahead,” said Abhishek Goenka, chief executive at India Forex Advisors, referring to US yields rising going ahead.

Dealers said exporters who had stayed on the sidelines cashed in to sell dollars around 61.40 levels, the day’s low for the rupee.

The partially convertible rupee closed at 61.34/35 per dollar, weaker than Wednesday’s close of 60.95/96. It fell 0.6% in the session, its biggest single-day loss since January 27.