By Santhosh V Perumal/Business Reporter

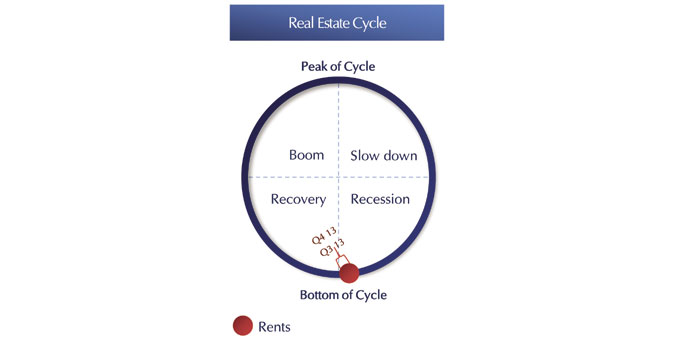

Qatar’s office market has bottomed out the recession cycle with not much rent decline expected in the coming quarters, according to Al Asmakh Real Estate Development Company (Aredc).

“Due to government initiatives to encourage businesses, on-going and proposed optimistic changes as well as lucrative opportunities for corporations, the long-term scenario in the office segment looks confident within Qatar,” a report from Aredc valuation and research department said in its latest report.

Doha remains the first choice for the corporate segment within Qatar with around 58% of business having their offices within the capital, while another 28% are housed within Al Rayyan municipality.

Nearly 91% of businesses are owned by private entities, whereas government and government managed establishments have a share of 7.5%.

Qatar has nearly 16,000 commercial buildings which includes towers, low-rise buildings and commercial villas. Almost 45% of total commercial buildings are located within Doha municipality, whereas, 32% are in Al Rayyan municipality, the report said, adding the lowest number of establishments are in Al Daayen.

Finding that the highest occupancy within commercial buildings can be seen in and around the areas of Doha city centre, Grand Hamad Street, and areas connected to C-Ring Road, the report said the average office size within commercial buildings on C-Ring Road is about 300 sq m. About 55,672 sq m area is presently under construction and may be delivered within 9-12 months from now.

D-Ring Road is competing as a substitute to C-Ring Road for commercial activities; around 60,500 sq m net leasable area is at various stage of completion.

The overall occupancy within commercial towers in West Bay is nearly 65%-70%. Major occupiers within West Bay are government and government-managed companies. During the fourth quarter of 2013, government took an additional tower of around 30,000 sq m gross leasable area. Offices at Barwa Commercial Avenue, the latest entrant in the office and retail segment, may fetch a monthly rent of QR120–QR140 per sq m.

The average monthly rents of office space in West Bay is nearly QR220 per sq m; C and D Ring Roads command QR120–QR150 per sq m; while offices in Al Sadd can be leased at an average monthly rent of QR135 per sq m.

The rents appreciation within West Bay offices is 69% against that in 2006, C-Ring Road around 36%, Al Sadd (42%) and Salwa Road (41%).

Owing to higher occupancy rate and decent monthly rents, average gross annual yield in office segment in Al Sadd is around 7.5% which is comparatively higher than any other commercial area within Doha.

Similarly, average gross annual yield on C-Ring Road can be derived at 7%, West Bay at 6.5%, and Salwa Road at 6%.