By Santhosh V Perumal/Business Reporter

Qatar’s hotel industry appeared to show strains owing to decline in rooms’ yield due to lower occupancy and average room rates during 2013, according to Ernst and Young (EY).

In comparison, the hospitality industry in most of the neighbouring countries witnessed robust gains in rooms’ yield year-to-date in December, EY said in its Middle East Hotel Benchmark survey.

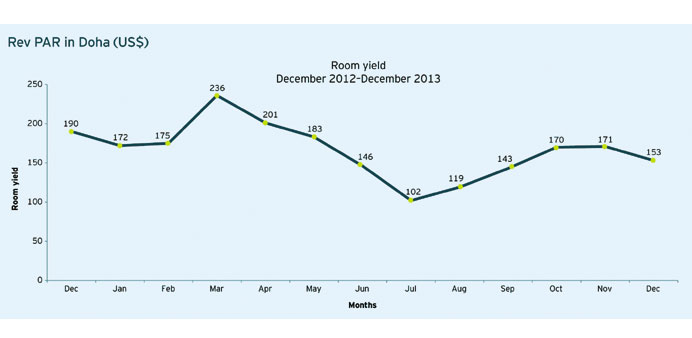

Doha’s hotels, whose occupancy fell 1% to 64%, saw their room’s yield (RevPAR) shrink 5.4% to $163 as average rooms’ rate declined 4.8% to QR252 during January-December 2013, it said.

In December alone, Doha hotel rooms’ yield plunged 19.5% to $153, owing to 18.7% fall in average room rate to $245 and 1% in occupancy to 62%.

There has been a “general improvement in the GCC (Gulf Cooperation Council) hospitality market, with the exception of Qatar during 2013”, the EY report said.

Although Manama had the lowest occupancy among the GCC cities, its hotel rooms’ yield surged 10.8% to $87 despite a 1.1% fall in average room rate to $205. Occupancy rather rose 5% to 42% during January-December 2013.

In the UAE, hotels in Al Ain outpaced those in other emirates such as Abu Dhabi and Dubai in rooms’ yield.

In Al Ain, the hotel rooms’ yield surged 13.5% to $103 on the back of 7% rise in occupancy (72%) and 2.4% in average room rate to $143.

In Abu Dhabi, a 1% rise in occupancy (to 77%) and a 6% in average room rate to $207 led to 7.4% improvement in room’ yield to $160 during the 12-month period.

The rooms’ yield in Dubai (overall) grew 5.9% to $223 mainly on a 6.4% rise in average room rate to $278, although occupancy was flat at 80%.

Dubai-City saw its hotel rooms’ yield gain 6.7% to $178 on the back of a 5.8% jump in average room rate to $217 and 1% in occupancy to 82%.

The Dubai-beach hotels rooms’ yield gained 5.3% to $296 on an 8% jump in average room rate to $382. Occupancy had fallen 2% to 77%.

In the case of Saudi Arabia, Jeddah witnessed 9.3% expansion in hotel rooms’ yield to $216 on a 9.6% growth in average room rate to $273 but on a flat occupancy at 79%.

In Madina, the hotel rooms’ yield fell 4.6% to $152 on the back of 3% decline in occupancy (65%) and 0.7% in average room rate to $232.

Makkah witnessed 7.9% contraction in rooms’ yield to $216 as there was a 6% plunge in occupancy (69%) and 0.6% in average room rate to $309.

The Saudi Arabian capital of Riyadh witnessed 2.4% fall in hotel rooms’ yield to $127 on account of 3.7% fall in average room rate to $218. Otherwise, occupancy rose 1% to 58%.

Kuwait saw a 3.7% improvement in rooms’ yield to $163 on 2% expansion in occupancy (55%) and 1.4% in average room rate to $296.

Muscat saw a 3.7% rise in hotel rooms’ yield to $144 on the back of 2.2% gain in average room rate to $210 and 1% in occupancy to 68%.