Guardian News and Media/London

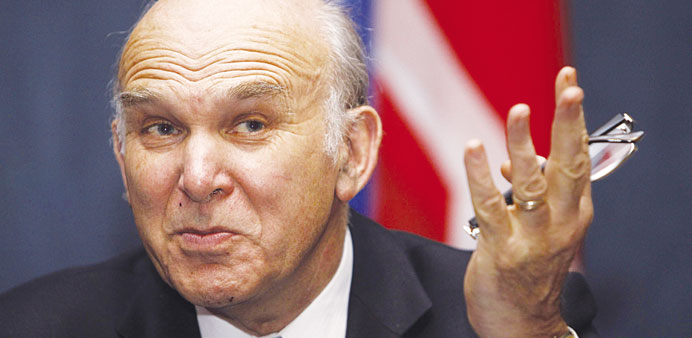

Business Secretary Vince Cable defended the government’s valuation of Royal Mail yesterday after solid results from the newly privatised group sent its shares higher.

Royal Mail was privatised last month when the government sold 60% of its stake to investors in an initial public offering (IPO).

Cable has been under fire over Royal Mail’s sale price since before the flotation.

The company’s shares surged by more than a third on their first day of trading and have risen further since.

Ahead of the group’s stock market debut Cable dismissed a likely jump in the share price as “froth” and said it would take months before the shares settled to their true value.

Giving evidence to the Treasury select committee alongside his advisers, Cable stuck by his description and said market prices were not always rational.

“It will be a long time before we can take a view,” he said.

Cable and Michael Fallon, the business minister who handled the flotation, said they decided against increasing the sale price by 20p a share because the market was already jittery over a potential US debt default.

But Mark Russell of the Shareholder Executive, which oversees state-owned businesses, admitted he and the government were surprised by the size of the rise in Royal Mail shares.

“We did not anticipate the share price to move as much as it did. I don’t think any of us anticipated the size of the jump,” he said.

Royal Mail shares were up 5% by mid-morning yesterday to 559.5p - 70% higher than the flotation price of 330p.

Its market value has increased by £2.3bn since the flotation, which valued Royal Mail at £3.3bn.

In its first set of figures as a publicly traded company, Royal Mail’s first-half profit almost doubled.

The performance was flattered by one-off items but analysts said the company was making progress against its targets. Operating profit for the six months ended September 29 was £283mn, up from £144mn a year earlier.

This year’s figure was boosted by a £35mn VAT credit and restructuring costs £50mn lower than the year before.

Total revenue increased 2% to £4.52mn, helped by growth in Royal Mail’s all-important parcels business.

Royal Mail’s performance depends heavily on increasing parcel volumes, boosted by deliveries of online purchases, and cutting costs to make up for declining letter deliveries, which fell 4% in the first half.

Parcel volumes were flat in the first half, mainly because the hot summer reduced online purchases, Royal Mail said. But the introduction of size-based charges increased parcel revenue by 9%.

Business customers have been wary about signing up to Royal Mail and have switched some business to competitors while the threat of industrial action loomed, the company said.

As a result, parcel volumes may be flat for the nine months to the end of December, which includes Royal Mail’s busiest period over Christmas.

Royal Mail is in talks with the Communication Workers Union over a deal on pay and working conditions after the union called off a strike that threatened to disrupt the flotation.

The two sides have extended the deadline for agreement by a week, until December 3.

MP attacks ‘Ronnie Biggs approach’ to sell-off

An MP yesterday claimed letting investment bank Goldman Sachs advice on the Royal Mail flotation was like taking advice on security from train robber Ronnie Biggs. Chair of the Business Committee Adrian Bailey MP made the comment while grilling Business Secretary Vince Cable over claims Royal Mail was undervalued. During the hearing he highlighted that when Goldman Sachs was advising Royal Mail it was also embroiled in a long-running legal action involving another allegedly undervalued floatation. Cable also said during the session the government may withhold a £4mn bonus from Goldman Sachs and UBS if the advice they offered turns out to have been flawed. He said no decision had yet been made on whether the performance bonus would be paid to Goldman Sachs and UBS.