|

Iran’s oil sales in October will fall to their lowest in months, according to sources who track tanker loadings, indicating no early petrodollar dividend for Iran despite its apparent willingness to compromise on its disputed nuclear work. |

The Opec-member is reaching out to its mostly Asian oil buyers to start clawing back the million barrels in market share lost to rivals such as Iraq and Saudi Arabia since the US and EU slapped it last year with the toughest sanctions in decades.

But the buyers have been lukewarm to Iranian offers of discounted oil. The Asian market is well supplied, with shipments rising from Russia, West Africa and Latin America as import demand in the West slows, and with other Middle Eastern producers lowering prices to retain customers.

Keeping Iran oil imports at reduced levels will also make it easier for China, India, Japan and South Korea - Tehran’s top clients - to win the sanction waivers the US grants every six months for progressively lower oil buys from Iran.

It is not clear how Washington would react if Iran oil shipments began creeping up, and the importers are unlikely to take chances, especially since US officials have said easing of the sanctions would take time despite the thaw in relations.

“Unless there are clear signals (on the easing of tensions), I don’t think there will be big change in imports,” said a Chinese industry source familiar with the situation. “As long as the US waiver is still there, no one can make a big move.”

The US and EU sanctions aimed at ending Iran’s nuclear programme have cut Iran’s oil exports in half from pre-2012 levels and cost it billions of dollars a month in lost revenue.

The Middle Eastern nation’s crude exports, excluding condensate, are expected to fall nearly 30% from a year earlier to 719,000 bpd in October, according to the sources who track its tanker loading plans.

September loadings were estimated to have come in at 966,800 bpd, according to the sources.

That means a plunge in the exports to near the 636,000 bpd level touched in April, the smallest daily average in decades.

The details are based on preliminary loading plans for October and may differ from the actual imports depending on tanker schedules.

The sharp fall in October will be led by China, Iran’s top oil customer, which is expected to lift just 188,400 bpd, less than half the average imports between January and September.

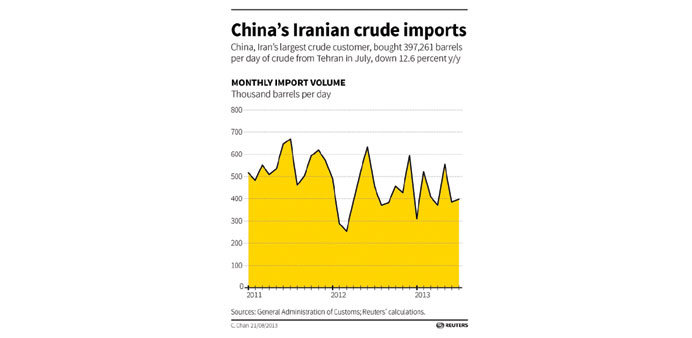

China’s Iranian imports peaked at 555,200 bpd in 2011, before the tougher sanctions were applied in 2012.

China likely lifted 311,060 bpd in September, nearly half of what it did a year ago, the sources said, with those cargoes mostly arriving this month.

Official Chinese customs data may run higher than the loading schedules because it includes about 70,000 bpd of condensate for the Dragon Aromatics petrochemical plant that started up in July.

The Asian powerhouse needs to make steep cuts in Iranian oil imports over the last quarter of 2013, as Reuters reported earlier in the week, if it is to increase its chances of renewing a US waiver that is due for review in December.

China’s daily imports through September are running about 1.4% higher than last year, but it may get some of the cuts it needs due to refinery maintenance at two of Sinopec Corp’s refineries in the fourth quarter.

India would slash loadings 38% from a year earlier to 153,500 bpd in October, the sources said. Iran’s second-biggest oil consumer has slashed purchases 44% to 181,200 bpd in January-August.

India may have lifted 227,500 bpd in September for October arrivals, the sources said.

Japan may load 112,600 bpd of Iranian oil in October, the sources said.

That would be the lowest since imports plunged to less than 10,000 bpd in April after refiners nearly halted shipments, uncertain whether sovereign insurance for tankers carrying Iranian oil would be extended beyond March.

Any decline in Japan’s loadings would help lower its average imports for the year. Japan has cut Iranian crude imports by just 2% over January-August, to an average 187,860 bpd, following a steep cut of 40% in 2012.

Japan’s final September import figures are due on October 31.

The world’s third-largest oil consumer was expected to have loaded 119,800 bpd in September.

“There’s been some slight progress in US-Iran talks, but there’s no knowing whether that would lead to the cancellation of Iran sanctions,” Yasushi Kimura, president of the Petroleum Association of Japan, told reporters.

Kimura is also chairman of JX Holdings.

South Korean loadings are expected to fall about a third to 129,000 bpd in October. That is less than the average daily import volumes of 136,000 bpd in the first nine months of 2013, down 4% from a year earlier. It is expected to have lifted 135,250 bpd of Iranian oil in September.

Taiwan may load 64,500 bpd of Iranian oil in October. It may have taken none in September.

Turkey is expected to lift 70,900 bpd in October, sharply lower than the 105,180 bpd it may have loaded in September.