Qatar’s rising population will have a “large positive” impact on the country’s non-oil growth, QNB has said in a report.

At the same time, the new wave of expansion will have a moderate impact on inflation and produce significantly higher road congestion in the next few years as new expatriates drive up demand for goods and services in the economy.

The new wave, QNB said, is mainly driven by expatriates filling in jobs created by the large ramp-up in infrastructure investment to prepare for the 2022 World Cup. This is similar to other waves of population growth that have been common in the region since the 1950s. This latest wave is similar to the last one in 2004-2009 that came in during the development of Qatar’s hydrocarbon sector.

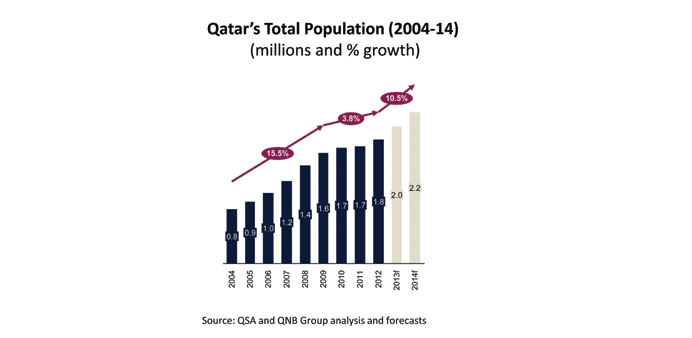

At that time, population grew at an average annual rate of 15.5%. On the back of both the global economic recession and the completion of major gas-related projects, population growth then slowed down in 2010-2011. Now, a new population wave is hitting Qatar’s shores as the country embarks on its ambitious programme of infrastructure investment.

According to population data published by the Qatar Statistical Authority (QSA), population growth began picking up in mid-2012 and rose to double-digits in June 2013 (11.3%). This puts Qatar once again at the top of the rankings for the world’s highest population growth.

Behind this acceleration in population growth lie the jobs created by the large infrastructure investment currently underway. The large infrastructure projects are projected to create 120,000 jobs a year over the next two years. These jobs are mostly being filled by expatriates as there is no slack in the domestic labour market.

Accordingly, Qatar’s population is expected to cross the 2mn milestone in the last quarter of 2013, and reach 2.2mn in 2014. This implies an average 10.5% annual growth rate over the next two years.

The large infrastructure spending will have a direct and indirect impact on economic growth in Qatar. It will directly increase economic growth through higher demand for cement, steel, labour and services.

At the same time, it will also have an indirect effect as the new wave of expatriate workers require food, housing, transportation, and other services, including banking. In turn, higher population growth will also require additional investments in housing, roads, schools, etc, thus pushing up economic growth in the years ahead.

Overall, the direct and indirect impact of this ramp up in infrastructure spending is projected to push up real GDP growth this year to 6.5% and 6.8% in 2014.

At the same time, this new wave of expatriate workers is likely to put upward pressure on rents, which account for nearly a third of the consumer price index. The growing population has already pushed up inflation to 3.1% in the 12 months to August, largely owing to rising residential rents.

As infrastructure-related spending picks up further and the expatriate population increases accordingly, inflation is expected to gradually increase to 3.6% and 3.8% in 2013 and 2014, respectively.

Qatar’s rapidly-expanding population is also putting further pressure on the country’s road networks. With Qatar’s population more than tripling in the last 12 years, there has been a parallel increase in the number of vehicles on the roads (876,039 vehicles in 2012, compared with 287,500 in 2000). As the next wave of expatriates enter the country, it will put further strains on Qatar’s road infrastructure.

The large public sector infrastructure projects envisaged to the lead up to the 2022 World Cup will require a significant expansion in Qatar’s labour force. This is leading to a new population wave, which is expected to push the overall population to over 2.2mn by 2014.

According to QNB Group, this robust growth will produce higher economic growth, moderate inflation, and significantly higher traffic congestion in the years ahead.