Weekly Treasury Update

Dollar

US dollar bull trend depends on euro and yen reaction to risk. How strong we expect the dollar to be depends on what we are measuring it against. If our benchmark is euro/dollar, the pair has just this past week threatened to change directions on a seven-month bull trend.

Alternatively, the Dow Jones FXCM Dollar Index is at its highest level in nearly two-and-a-half years with serious contributions from both dollar/yen and pound/dollar. In a market where performance is relative, we need to pick the correct measure to establish just how strong or weak the benchmark currency is. We can do that by looking at various pairs, but we can also establish its strength by following its most influential fundamental drivers.

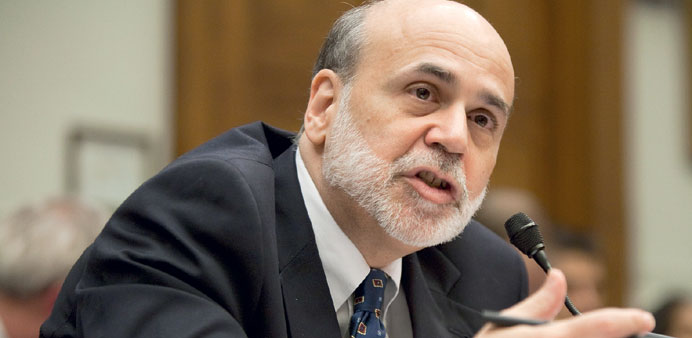

The most promising catalyst moving forward for serious dollar strength is a convincing change in risk appetite trends. Notably, the Dow Jones Industrial Average and S&P 500 both regained ground through Friday and ensured critical turning points (13,875 and 1,495) were left intact for the next bearish assault to second guess conviction. The FOMC (Federal Open Market Committee) minutes have started the conversation about a withdrawal of the unnatural stimulus backing, but it isn’t enough to fully withdrawal support and spark a deleveraging effort. In the week ahead, Fed chairman Ben Bernanke’s (pictured) testimony in Congress will be digested and the sequester countdown will be fretted for the stimulus angle. Fear though, will be a market issue.

Euro

The euro finds little strength in LTRO2 (second Long-Term Refinancing Operation), Italian and Cyprus elections ahead. There wasn’t much encouraging news for the euro through the final 24 hours of this past week. Top headline was the announcement for the planned first repayment of the LTRO2 programme loans. Though the €61.1bn reduction continues to pull the European Central Bank balance sheet down – while others like the Fed continue to add stimulus – it was much smaller than the consensus forecast.

In other news, the European Union downgraded its regional 2013 growth forecast for 0.1% expansion to a 0.3% contraction; and Olli Rehn, European Commissioner for Economic and Monetary Affairs, said further support for Spain would only come with evidence that the budget will stabilise.

We will kick off next week with crowded newswires as investors interpret what the Italian and Cypriot elections mean for the euro. Through it all, remember, the ECB is shrinking its balance sheet.

Range for previous week: $1.3188–$1.3433

Range for this week: $1.3120–$1.3490

Sterling

British pound hammered into the close on Moody’s downgrade. It was a fitting way for the British pound to end the week. Having taken the incredible dive below 1.5250 through the middle of the week – as the market recognised in the Bank of England minutes that there was a growing call to follow through with the stimulus speculators were projecting – it seemed like the bears had accomplished what they needed for the period. Yet, there was an incredible follow up to come in the closing hours of Friday when rating agency Moody’s announced that it had downgraded the United Kingdom from the top AAA rating down to Aa1.

This was another serious aspect of fundamental depreciation for the currency: fear that the austerity-versus-recession balance would introduce an external factor that can disrupt the balance (in other words, a rate cut). Now we look ahead to determine whether there is momentum to be fed after the shock has set in. This development certainly changes the pound’s long-term health, but it has also depreciated sharply these past months.

Range for previous week: $1.5253–$1.5518

Range for this week: $1.5190–$1.5580

Yen

Prime Minister Shinzo Abe plans to hire next BoJ (Bank of Japan) governor. Speculation surrounding the Fed’s eventual withdrawal of stimulus sometime before the end of 2013 was a modest boon for the yen crosses, as Japan’s more distant stimulus efforts seem more credible means for deflating the nation’s currency. Yet, relative gains through expectations that the Fed is moving to a tightening regime will lose momentum quickly.

If the yen is to revive its five-month tumble, it will have to find an active catalyst. That may be difficult. Leveraging the carry trade through risk trends is highly unlikely given the turn in capital markets and fundamentals.

Once again, it’s up to Japanese officials. Prime Minister Abe may decide the next BoJ governor next week, but actual policy change is highly unlikely to occur until the transition policy meeting.

Range for previous week: ¥93.10–¥94.20

Range for this week: ¥92.50–¥94.80