By Pratap John/Chief Business Reporter

Qatar may see greater demand for credit with the country’s banking sector estimated to see a growth in loan disbursement of up to 15% this year on the back of improved liquidity, a recent study shows.

Liquidity conditions have “materially improved” with the current loan-to-deposit (LDR) ratio at 107% compared with a 2012 high of 124% recorded in April, QNB Financial Services said in its latest report.

But it expects the net interest margin (NIM) to remain under “some pressure” throughout 2013.

However, the local banks have seen a deposit growth of 4.2% month-on-month (MoM) in January 2013, driven largely by the public sector. On the other hand, the sector has seen a loan growth of only 0.2% during the period under review. This means the growth in deposits have clearly outpaced loan growth last month.

A banking industry source said this was clearly a reflection of a “stagnant market”.

“Whatever growth we have seen on deposits and loans have mainly come from the public sector. There was hardly any appetite for funds from the private sector,” the source said.

Many believe the private sector would only benefit once projects get kick-started, which is expected in the second half of this year.

“We will see many more tenders going out as Qatar has committed on many projects related to basic infrastructure, transport, sport and other areas,” a banker said.

Recent reports indicate Qatar plans to award some 30 major road building projects worth QR100bn to construction companies this year.

The transportation sector takes a lion’s share of leading projects in the country with the metro-rail, expressway and Doha Bay initiatives topping the list. In addition, many major projects are expected to be awarded in 2013.

According to QNB Financial Services, the public sector deposits grew by 5.4% and 68.3%, MoM and year-on-year (YoY) respectively in January.

The government and its institutions segments contributed to the bulk of this growth.

The former segment increased by 5% MoM (+46.6% YoY), while the latter (representing 57.8% of public sector deposits) expanded by 7.3% MoM (up 116.7% YoY).

However, the semi-government institutions segment witnessed only a “muted” growth MoM, whereas it was up 7.3% YoY.

Private sector deposits grew by 3.4% MoM (up 13.8% YoY).

The consumer segment experienced “flattish” performance MoM (up 11.5% YoY), while the companies and institutions segment increased by 6.3% MoM (up 16% YoY).

Net total deposits (including deposits outside of Qatar) grew by 4.2% MoM (up 36.6% YoY).

Most of the growth in deposits during 2012 was seen in May and July, QNB Financial Services said.

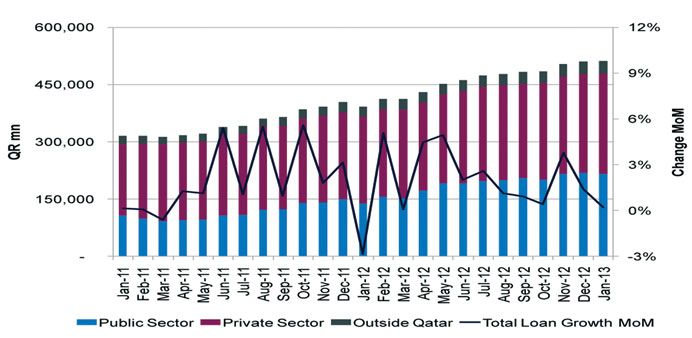

The overall loan book witnessed flat performance MoM (up 30.4% YoY) in January.

Total domestic public sector loans slipped 0.9% MoM (up 57% YoY). The key driver behind this decline was mainly the government institutions segment, which shed 3.6% MoM (up 55.4% YoY).

“We continue to expect growth in public sector loans to pick up in the coming months and then grow thereafter as project mobilisations pick up,” QNB Financial Services said.

The report noted that public sector loans expanded by 26% quarter-on-quarter in Q2, 2012.

Private sector loans outpaced those of the public sector, inching up 0.9% MoM (up 15.3% YoY). Consumption loans slipped by 2.2% MoM (up 3.5% YoY).

The growth across sub-segments under private sector loans was generally positive; industry was flattish MoM (up 44.3% YoY), while services (up 51.6% YoY) and general trade (up 28.3% YoY) increased by 2.7% and 2.3% MoM, respectively.

Qatar’s loan growth. Source: Qatar Central Bank