Visit Qatar has concluded its participation at Outbound Travel Mart (OTM) Mumbai 2026 – India's leading travel trade exhibition held from February 5-7 at the Jio World Convention Centre in Mumbai.Visit Qatar said in a statement that its participation reinforced Qatar's positioning as a high-quality, well-connected tourism destination for Indian travelers, with a clear focus on trade engagement and sustained destination visibility.During the OTM, Visit Qatar signed memoranda of understanding (MoUs) with the Travel Agents Association of India (TAAI), the Outbound Tour Operators Association of India (OTOAI), and ClearTrip, aimed at enhancing destination education, product visibility and joint marketing initiatives.These partnerships are designed to enable Indian travel trade partners to more effectively package and promote Qatar across leisure, weddings, MICE (meetings, incentives, conferences and exhibitions) and premium travel categories."India is a priority source market for us, with direct connectivity from over 13 Indian cities and clear momentum toward longer stays, repeat visits and celebration travel,” said Visit Qatar public relations and communications director Jassim al-Mahmoud. “Our focus is on enabling the trade to convert stopovers into multi-night itineraries and position Qatar confidently for leisure, MICE and destination weddings."The Visit Qatar pavilion featured 14 partners representing leading hotels and destination management companies in Qatar, alongside strategic partner Qatar Airways demonstrating a unified approach to market engagement.Visit Qatar's participation enabled direct engagement with tour operators, travel agents, and industry decision-makers, solidifying the importance of India as a priority source market.The presence at the OTM Mumbai 2026 formed part of a broader programme of market activity, following a targeted promotional roadshow held across three Indian cities in January.Engagement with trade partners focused on positioning Qatar as a standalone destination and encouraging longer stays, supported by strong air connectivity, geographic proximity, and streamlined access for Indian travelers.

Business

Sunday, February 08, 2026

Sunday, February 08, 2026

Sunday, February 08, 2026

Monday, February 09, 2026

Sunday, February 08, 2026

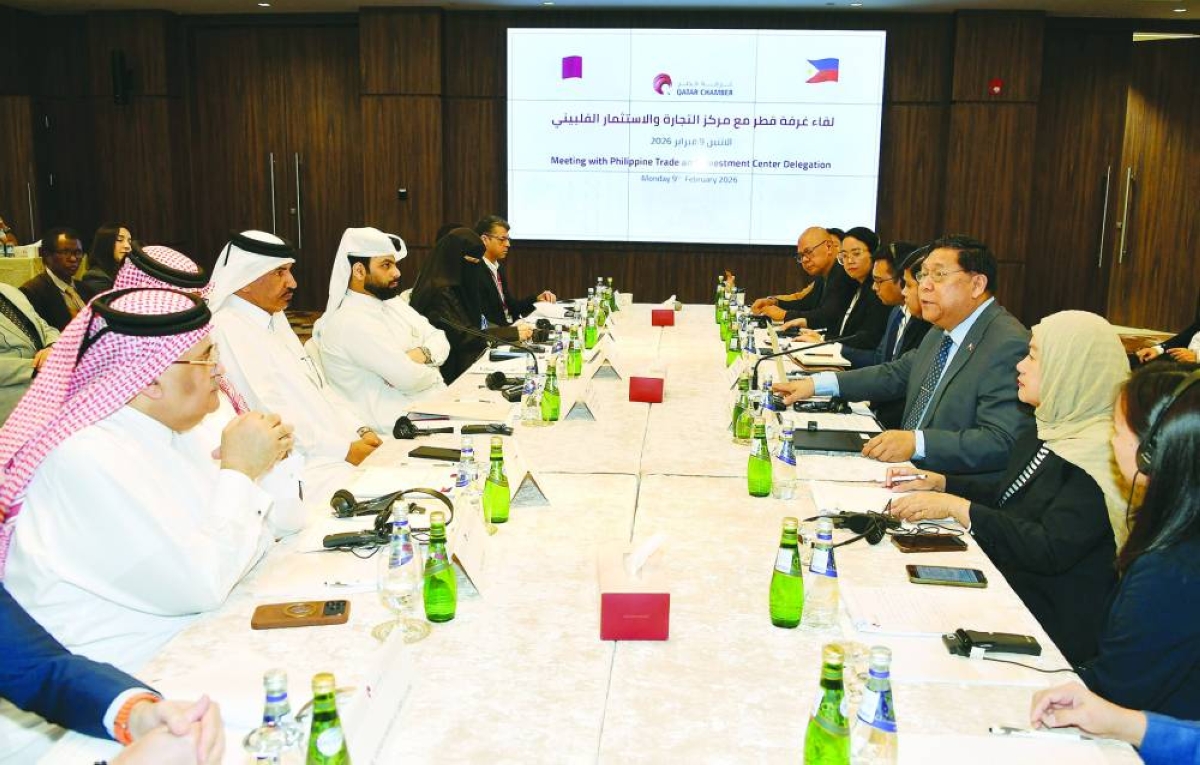

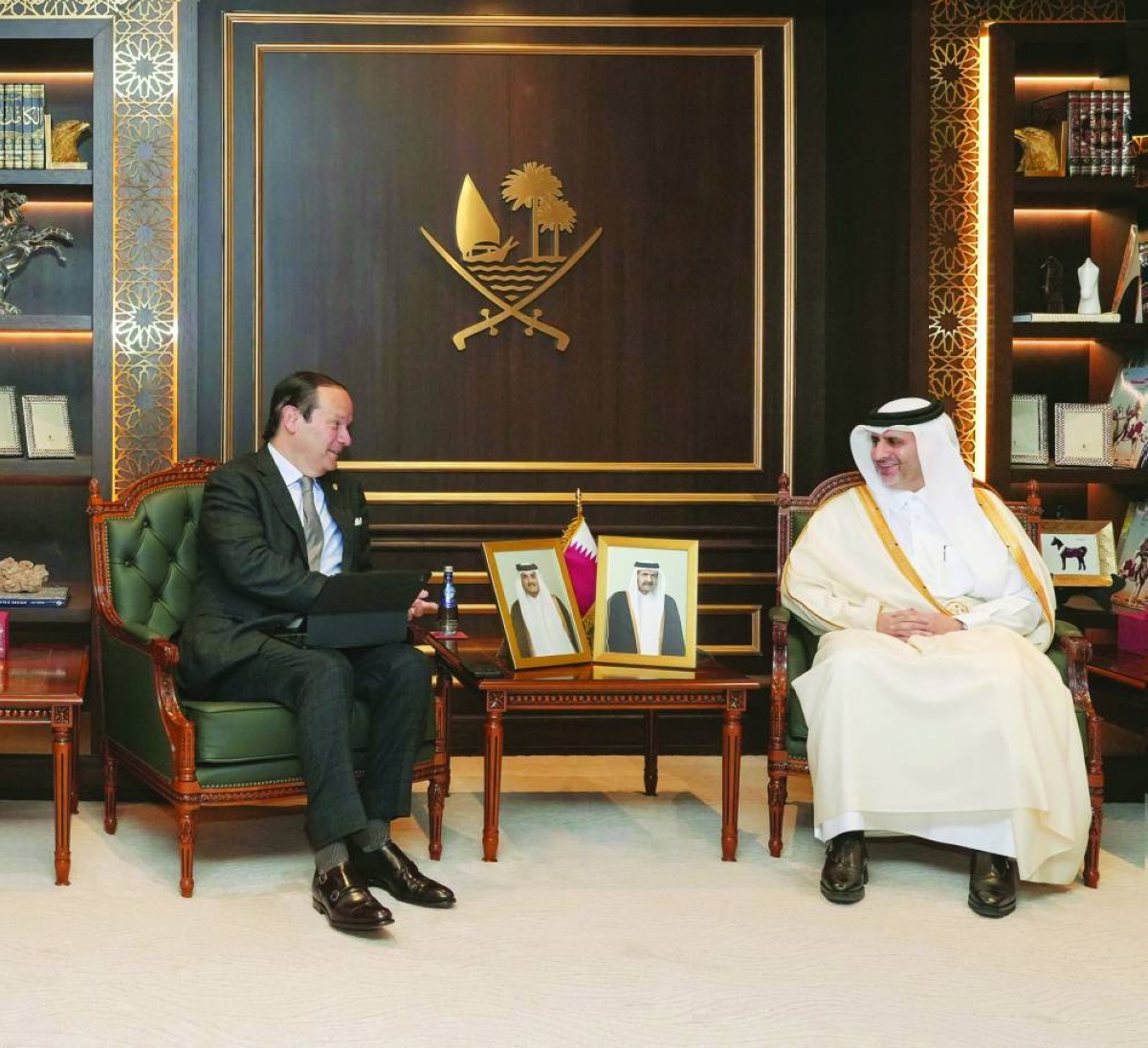

Qatar Chamber discusses commercial co-operation with EU

Sunday, February 08, 2026

Dukhan Bank launches Qatar’s 1st QDI-integrated digital onboarding kiosk

Saturday, February 07, 2026

Saudi Arabia’s Capital Market Authority approves Lesha Capital’s entry, boosting bank’s regional strategy

Saturday, February 07, 2026