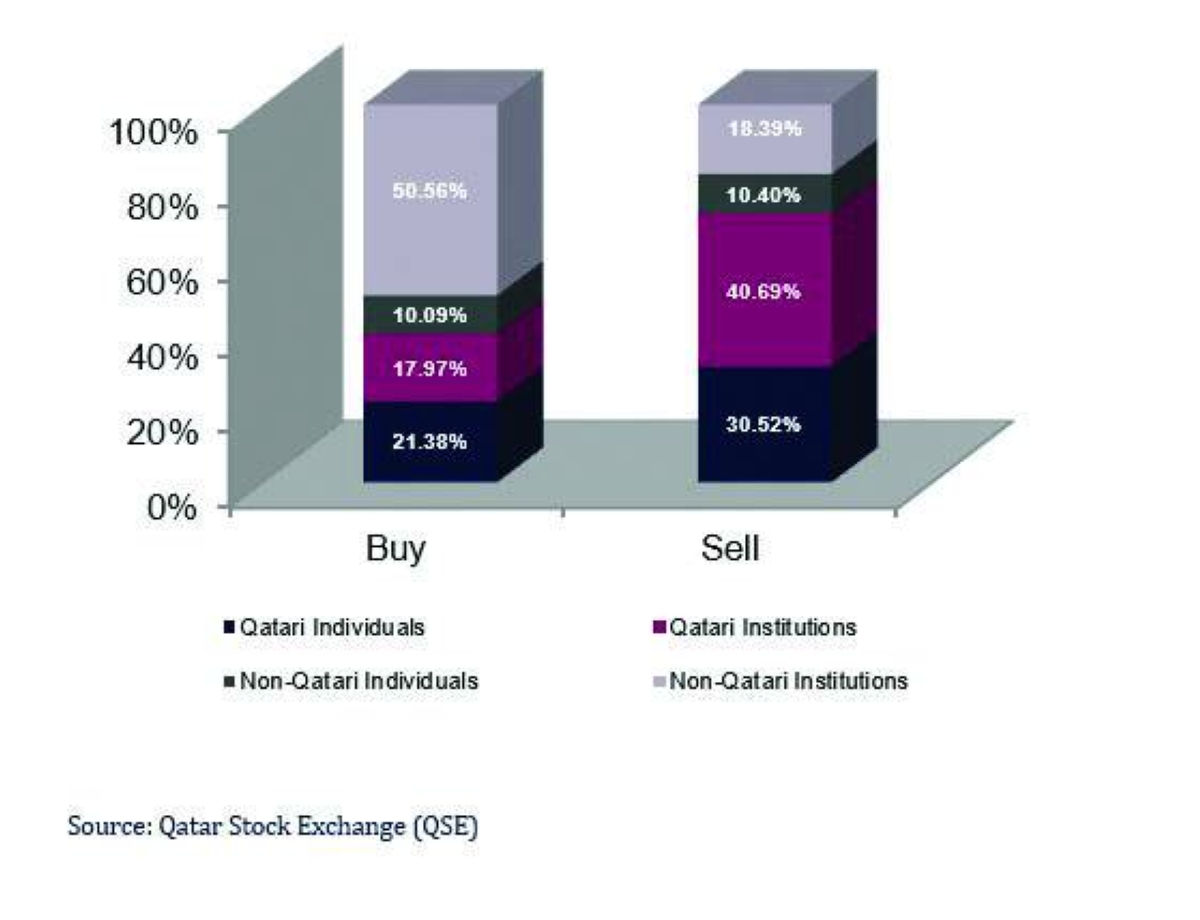

The Qatar Stock Exchange (QSE) Monday reaffirmed its commitment to further develop the debt markets, including deepening it and developing a benchmark yield curve, to make it attractive for the international capital to tap local currency instruments. “The QSE reaffirms its commitment to continuing its collaboration with regulators and issuers to further develop the debt market and enhance the attractiveness of the local market, supporting Qatar’s position as a leading regional hub for capital markets,” a bourse spokesman said after witnessing the listing of QNB Group’s bonds, representing the largest Qatari riyal–denominated bond issuance in the history of the local market. The listing of QNB’s bonds follows a series of notable developments in QSE’s debt market in recent years, including the listing of the first corporate bonds, the first Islamic sukuk, the first sustainable bonds, and the first green sukuk, culminating in the listing of the largest Qatari riyal–denominated bond issuance in the market’s history. “These developments highlight the QSE’s commitment to deepening the market and enhancing product diversification to meet the needs of both local and international investors,” the spokesman said. The listing represents a qualitative addition to Qatar’s capital market, contributing to the deepening of the domestic debt market and enhancing liquidity in local currency instruments.It also supports the development of a benchmark yield curve, improving pricing efficiency for future issuances. For investors, the listing offers a short-term investment instrument with clear returns within a regulated and transparent framework, supporting portfolio diversification and efficient liquidity management. At the broader ecosystem level, the transaction demonstrates the market’s ability to accommodate large-scale issuances and attract a diversified base of international investors, reinforcing QSE’s role as an integrated platform for capital formation in line with Qatar National Vision 2030 and the objectives of financial sector development. The development of an active debt market in Qatar will have far-reaching benefits in deepening the financial infrastructure in Qatar, according to the strategic plan for financial sector regulation. It will help to attract institutional investors and provide an important incentive for local investors to better manage their asset allocation process and therefore retain capital in the country, the plan said, adding a well-developed debt market will also allow companies to diversify their sources of funding and reduce the cost of borrowing. Over the past year, QSE matured from a purely equity-centric market into a more diversified, multi-asset platform with the successful listing of Qatar’s first corporate bond, a QR500mn issuance by Ahlibank, marking an important milestone in developing the domestic fixed-income market and providing investors with new tools for portfolio diversification. This was followed by the listing of the first Islamic sukuk in the exchange’s history, issued by QIIB, reinforcing its commitment to supporting Shariah-compliant finance and broadening access to long-term funding instruments aligned with investor demand. Qatar had achieved ‘lowest yield’ in CEEMEA (Central and Eastern Europe, Middle East, and Africa) region in 2025 for bond and sukuk issuance in international markets, reflecting the deep trust global investors place in the country’s financial stability, strong financial position and its solid medium-term economic growth outlook.

Business

Qatar Chamber participates in 6th Global Conference on Elimination of Child Labour

Sunday, February 15, 2026

Monday, February 16, 2026

Monday, February 16, 2026

Sunday, February 15, 2026

Monday, February 16, 2026

Sunday, February 15, 2026

Market Review and Outlook

Saturday, February 14, 2026

Banks in Qatar to see reduced risk of potential funding outflows if US-Iran issues escalate: S&P

Friday, February 13, 2026