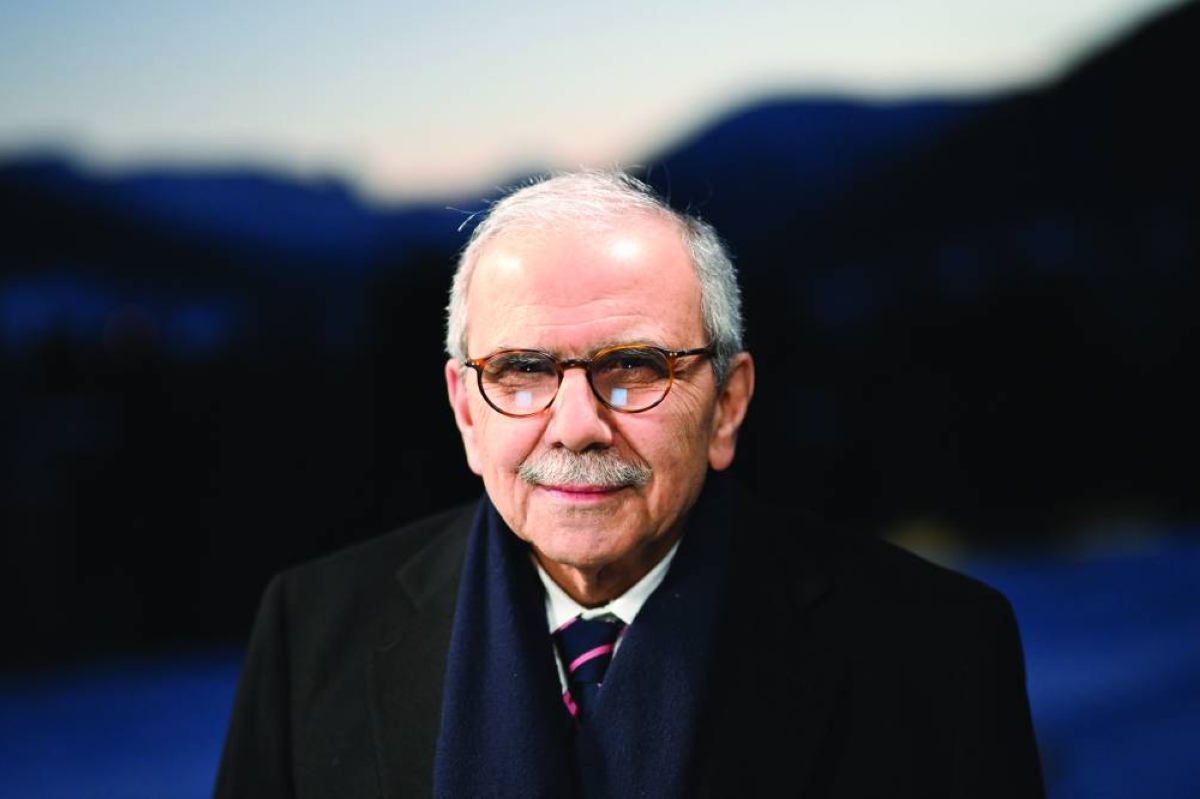

As Web Summit Qatar 2026 concluded its record-breaking run in Doha, one of the most resonant messages for the region came from EmpactUS and its Co-Founder, Hammam Elmasri. In a series of high-level dialogues with regional policymakers and technology leaders, Elmasri articulated a bold vision for post-conflict recovery—one where the MENA region transitions from being a recipient of global aid to a powerhouse of innovation-driven resilience.The participation of EmpactUS in Doha was more than symbolic; it represented a strategic alignment with Qatar’s own vision of becoming a global bridge for technology and social impact.The Power of Economic AgencyAt the heart of Elmasri’s message is the concept of "Economic Dignity." For many communities across the Middle East, the cycle of conflict is compounded by the loss of self-sufficiency. Traditional recovery models often focus on the "what"—rebuilding houses and hospitals—but EmpactUS focuses on the "how"—empowering individuals to build their own futures."Talent exists across this region. What does not exist are the systems to support that talent," Elmasri told the Gulf Times. "We have seen founders building fintech solutions under sanctions and edtech platforms amid school disruptions. They are not asking for charity; they are asking for structured access to markets, mentorship, and ethical capital."Doha as a Global GatewayElmasri emphasized that participation in global platforms like Web Summit is a "recovery multiplier." For founders in Palestine, Lebanon, and Syria, exposure to global ecosystems is not a luxury; it is a necessity to break through the isolation caused by conflict."Doha has provided a unique platform where local resilience meets global innovation flows," said Elmasri. "By connecting our founders to regional investors and global technology partners here in Qatar, we are shortening the learning curve and building the credibility that these entrepreneurs need to thrive on a global stage." **media[418555]**The Strategic Role of Startup EcosystemsEmpactUS advocates for a model where entrepreneurship becomes a form of "Stabilization Infrastructure." When supported by coherent systems—such as incubation, acceleration, and cross-border mentorship—startups do more than create jobs; they create a sense of stability and a platform for regional cooperation.The EmpactUS approach focuses on three core areas:Skill-Building: Aligning training with the needs of the global digital economy.Regional Integration: Ensuring innovation is not geographically isolated.Ethical Growth: Prioritizing community impact and long-term sustainability.A Call to Regional LeadersElmasri’s vision concludes with a call to move beyond the donor-driven cycles of the past. By investing in startup ecosystems, the MENA region can build a more resilient and integrated economy."Post-conflict recovery is not just about rebuilding what was lost; it is about building something stronger," Elmasri noted. "Through the systems we are designing at EmpactUS, we are helping to ensure that the next generation of MENA leaders are architects of their own recovery." About Hammam Elmasri & EmpactUS Hammam Elmasri is a social impact entrepreneur and the Co-Founder of EmpactUS, a venture-building ecosystem dedicated to fostering value-driven entrepreneurship in conflict-affected regions across the Middle East. For more information, visit https://empactus.org.uk/

Business

Restoring dignity: Hammam Elmasri and EmpactUS’ vision for a self-sustaining MENA economy post-Web Summit

Thursday, February 19, 2026

Lufthansa unblocks new business-class seats on its new Boeing 787 aircraft

Wednesday, February 18, 2026

Tuesday, February 17, 2026

Tuesday, February 17, 2026

Wednesday, February 18, 2026

Wednesday, February 18, 2026

Tuesday, February 17, 2026

‘Qatar, Saudi Arabia should create tourism task force to yield bigger economic footprint per tourist’

Wednesday, February 18, 2026

Estithmar Holding establishes “Estithmar Capital” for financial investment management

Monday, February 16, 2026