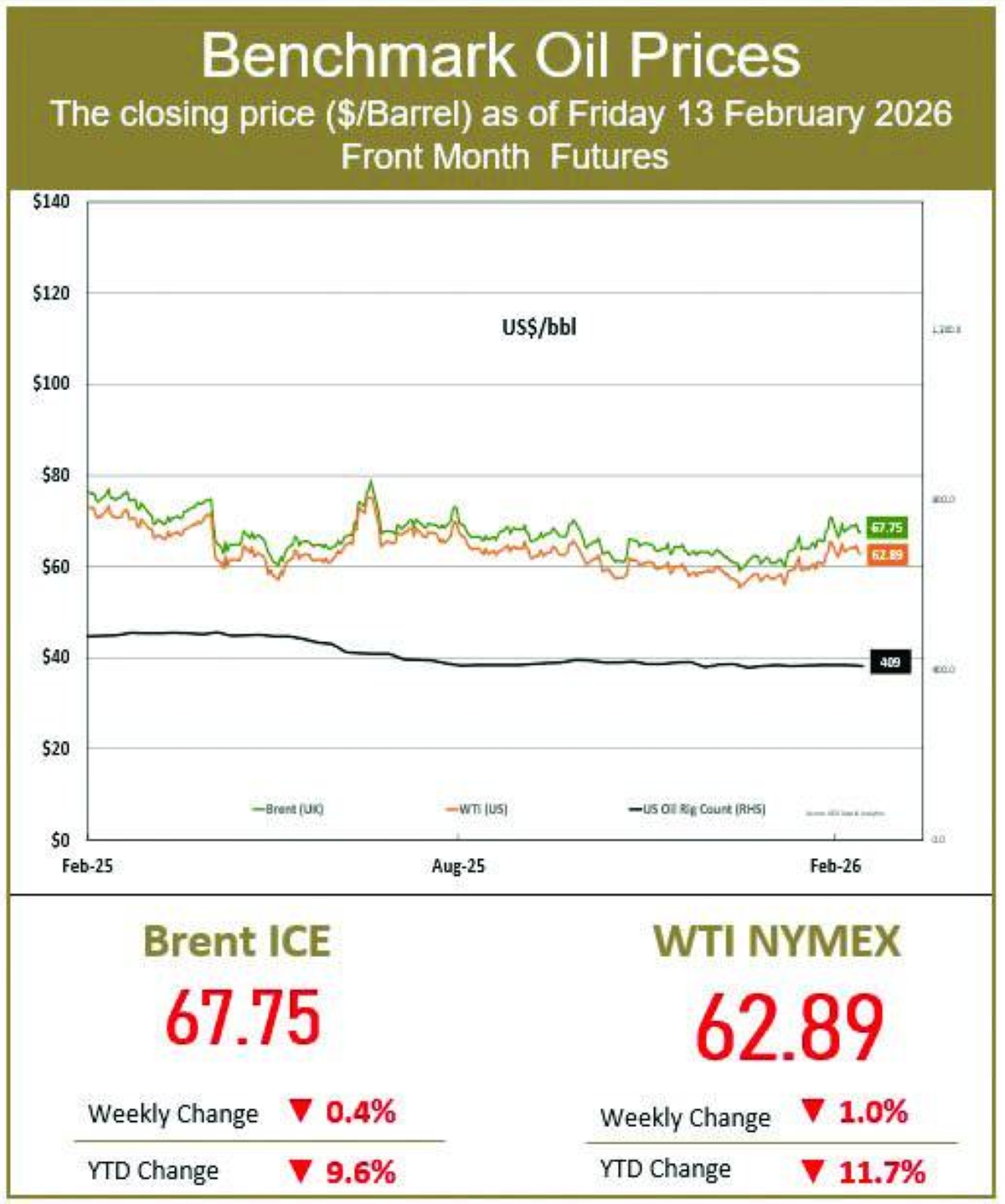

India will need favorable terms to enter into long-term liquefied natural gas purchase deals with the US as the market is highly price sensitive, according to the chief executive officer of the country’s top LNG importer.“India is looking to source energy at the most competitive and affordable price for consumers,” Petronet LNG Ltd’s Akshay Kumar Singh said. “No one is saying you buy at any cost.”The comments comes as US President Donald Trump’s administration pushes New Delhi to ramp up energy purchases — including crude oil, liquefied petroleum gas, LNG and coking coal — as part of an interim trade deal that seeks to boost American exports to about $500bn.The US was India’s third-largest LNG supplier last year — behind Qatar and the United Arab Emirates — accounting for 12% of total imports of 25mn tons, according to Kpler data. India’s overall buying could jump fourfold as the South Asian nation aims to lift the share of gas in its energy mix to 15% from 6% by the end of the decade.For countries such as the US and Qatar, that would open up an important market, particularly as new liquefaction plants start operations and production increases. However, higher freight and logistics risks make US LNG less attractive for Indian buyers. Rigid long-term take-or-pay contract structures add to buyers’ discomfort.Long-term LNG deals aren’t just about settling at a price, but include clauses such as penalties to be paid if buyers fail to lift agreed volumes, Singh said.Most of the US supply deals are linked to Henry Hub, the benchmark for natural gas prices, that can swing sharply due to weather and storage levels in the domestic market. Indian buyers favor Brent-linked contracts as those prices are generally less volatile.Last month, a US delegation met with Indian energy companies on the sidelines of the India Energy Week conference in Goa to explore opportunities for long-term contracts for US crude oil and LNG, according to a statement by the US embassy.

Business

Banks in Qatar to see reduced risk of potential funding outflows if US-Iran issues escalate: S&P

Friday, February 13, 2026

Saturday, February 14, 2026

Saturday, February 14, 2026

Friday, February 13, 2026

Thursday, February 12, 2026

Wednesday, February 11, 2026

MCIT supports SMEs in digital transformation, AI

Thursday, February 12, 2026

Construction of gas carriers begins; first vessel to be delivered by year-end: Nakilat

Wednesday, February 11, 2026

Women empowerment is not social luxury; it is economic necessity: Aisha Alfardan

Wednesday, February 11, 2026

Qatar Chamber participates in WEIF 2026, signs partnership with UNIDO to establish entrepreneurship centre

Wednesday, February 11, 2026

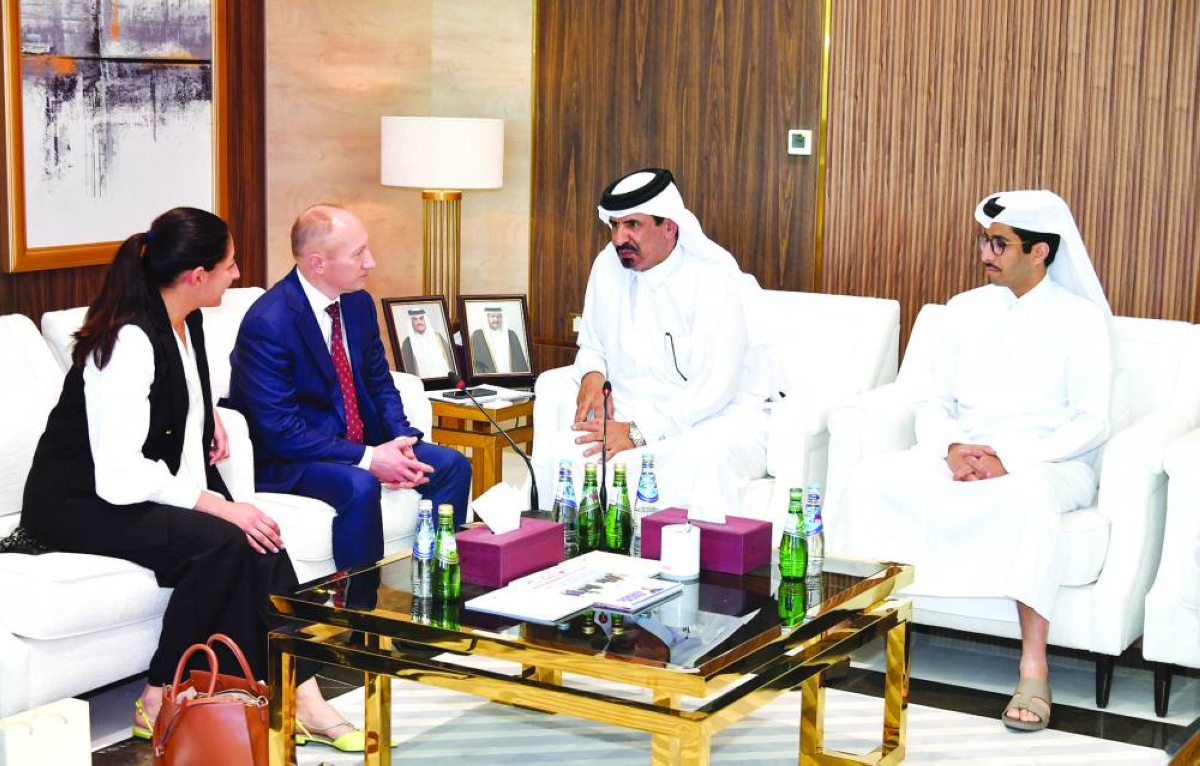

Qatar Chamber discusses enhancing trade co-operation with Russian business delegation

Wednesday, February 11, 2026