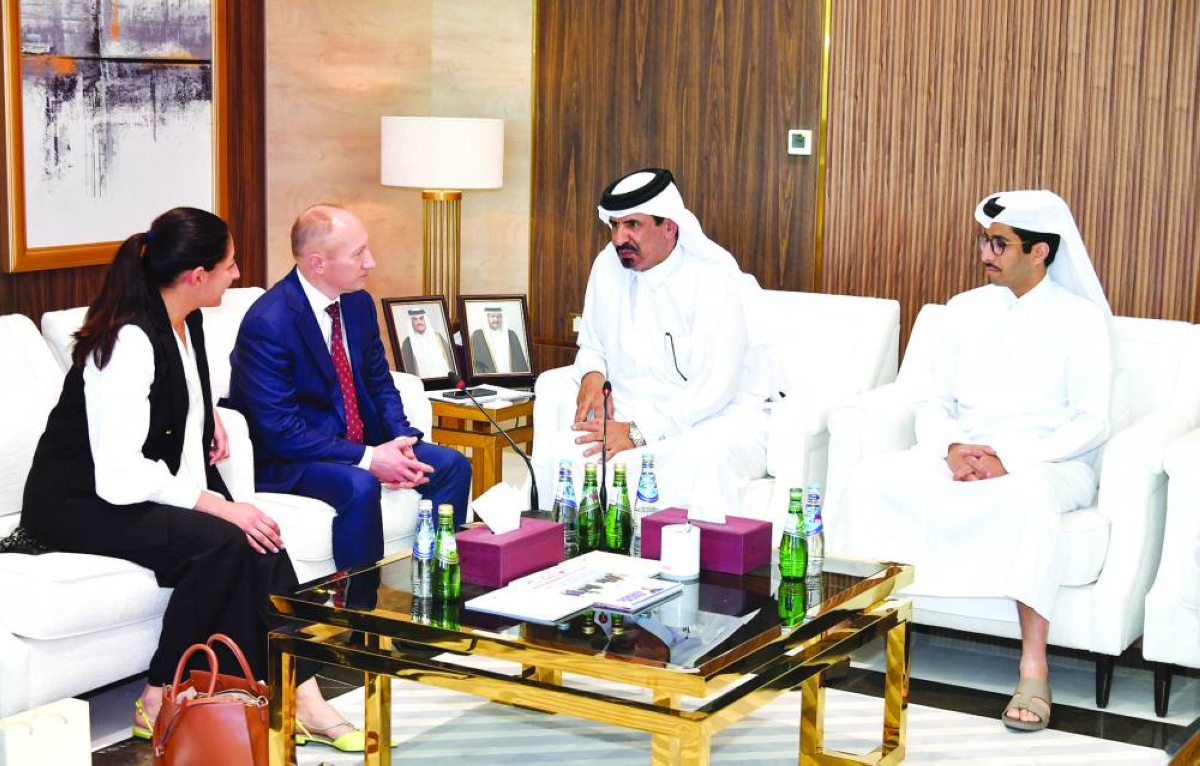

Qatar Chamber hosted on Thursday a trade delegation from the Republic of Tanzania, led by Director of Business Development at Tanzania Agricultural Development Bank (TADB), Afia Mwanahamisi Siggi and Senior Investment Officer at the Tanzania Investment and Special Economic Zones Authority (TISEZA), Juma Ally Nzima.During the meeting, both sides discussed cooperation between the two friendly countries, particularly in the commercial and investment fields, as well as ways to enhance collaboration in agriculture and food security.The delegation was received by Abdulrahman bin Abdullah al-Ansari and Mohammed bin Ahmed al-Obaidli, board members of the Chamber.Speaking at the meeting, al-Ansari stated that the Qatari market welcomes Tanzanian products, especially in the food sector, noting that the Chamber is keen to strengthen cooperation between the private sectors of both countries in a manner that enhances trade exchange.Al-Obaidli stressed that there are broad investment opportunities in the African continent in general and in Tanzania in particular. He noted that the trade balance is tilted in favour of Tanzania, as Qatari imports from Tanzania in 2024 exceeded QR126 mn, most of which consisted of meat products, compared to Qatari exports to Tanzania, which amounted to QR69mn.Siggi said that the Tanzanian delegation's visit aims to strengthen trade relations between the two countries, promote Tanzanian products in the Qatari market, and invite Qatari investors to explore investment opportunities in Tanzania.

Business

Qatar Chamber participates in WEIF 2026, signs partnership with UNIDO to establish entrepreneurship centre

Wednesday, February 11, 2026

Qatar Chamber discusses enhancing trade co-operation with Russian business delegation

Wednesday, February 11, 2026

Wednesday, February 11, 2026

Wednesday, February 11, 2026

Thursday, February 12, 2026

Thursday, February 12, 2026

Wednesday, February 11, 2026

Women empowerment is not social luxury; it is economic necessity: Aisha Alfardan

Wednesday, February 11, 2026

Qatar Free Zones Authority CEO meets Panama’s minister of commerce and industry

Tuesday, February 10, 2026

Magna AI and Zchwantech Announce USD 700M Strategic Collaboration to Power Malaysia’s Sovereign AI Future

Tuesday, February 10, 2026