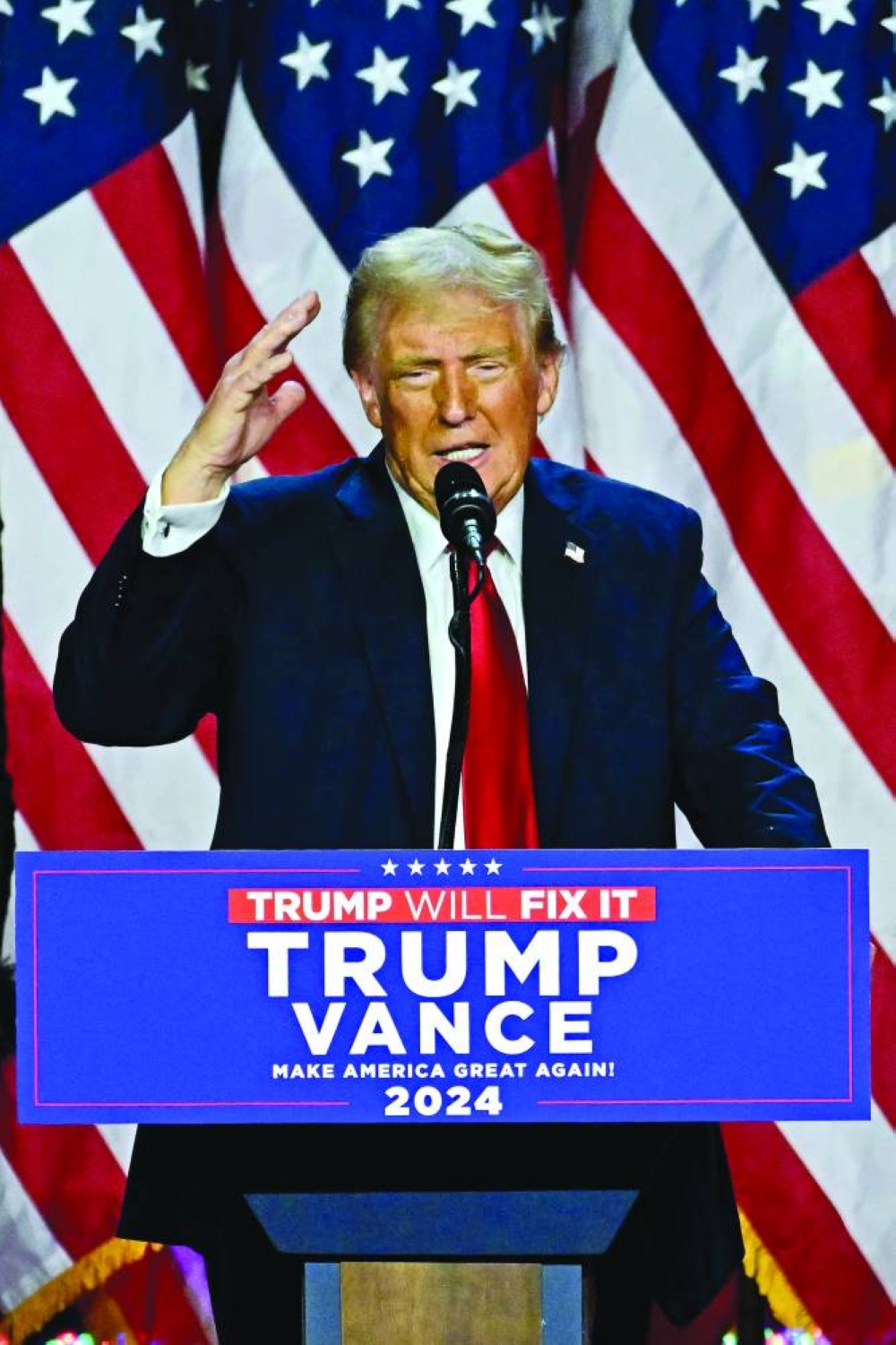

Republican Donald Trump is expected to crack down on illegal immigration and try to restrict legal immigration when he returns to the White House on January 20, following up on campaign promises and unfinished efforts from his 2017-2021 presidency.Here are some of the policies under consideration, according to Trump, his campaign and news reports:Border enforcementTrump is expected to take a slew of executive actions on his first day as president to ramp up immigration enforcement, including deploying National Guard troops to the US-Mexico border and declaring a national emergency to unlock funds to resume construction of a wall on the US-Mexico border.Trump has said he would restore his 2019 “remain in Mexico” program, which forced asylum-seekers of certain nationalities attempting to enter the US at the southern border to wait in Mexico for the resolution of their cases. The program was terminated by Biden, a Democrat who ended his faltering re-election campaign in July, making Vice-President Kamala Harris the candidate. Biden defeated Trump in 2020, pledging more humane and orderly immigration policies, but struggled to deal with record levels of migrants caught crossing the US-Mexico border illegally. Immigration was a top voter issue heading into last week’s election, in which Trump defeated Harris in a stunning political comeback.Edison Research exit polls showed 39% of voters said most immigrants in the US illegally should be deported while 56% said they should be offered a chance to apply for legal status.Trump also would reinstate the Covid-19-era Title 42 policy, which allowed US border authorities to quickly expel migrants back to Mexico without the chance to claim asylum, he told Time magazine in an interview.He would use record border crossings and trafficking of fentanyl and children as reasons for the emergency moves, Time reported, citing comments from advisers.Trump has said he will seek to detain all migrants caught crossing the border illegally or violating other immigration laws, ending what he calls “catch and release”. At an October campaign event, Trump said he would call on Congress to fund an additional 10,000 Border Patrol agents, a substantial increase over the existing force. Harris criticised Trump for helping kill a bipartisan border security bill earlier this year that could have added 1,300 more agents.Trump criticised a Biden asylum ban rolled out last June and pledged to reverse it during a campaign event in Arizona. He said the measure would not adequately secure the border, even though it mirrored Trump-era policies to deter would-be migrants and has contributed to a steep drop in migrants caught crossing illegally. Trump also said at the campaign event that he would consider using tariffs to pressure China and other nations to stop migrants from their countries from coming to the US-Mexico border.Mass deportationsTrump has pledged to launch the largest deportation effort in American history, focusing on criminals but aiming to send millions back to their home countries, an effort that is expected to tap resources across the US government but also face obstacles. As part of his Day One executive actions, Trump is expected to scrap Biden’s immigration enforcement priorities, which focused on arresting serious criminals and limited enforcement against people with no criminal records.During a rally in Wisconsin in September, Trump said deporting migrants would be “a bloody story”, rhetoric that sparked criticism from immigrant advocates.Trump told Time he did not rule out building new migrant detention camps but “there wouldn’t be that much of a need for them” because migrants would be rapidly removed.Trump would rely on the National Guard, if needed, to arrest and deport immigrants in the US illegally, he said. When questioned, he also said he would be willing to consider using federal troops if necessary, a step likely to be challenged in the courts. Trump has also vowed to take aggressive new steps to deport immigrants with criminal records and suspected gang members by using the Alien Enemies Act, a 226-year-old statute last utilised for interning people of Japanese, German and Italian descent during World War Two.Trump called for the death penalty for migrants who kill US citizens or law enforcement officers at an October rally in Aurora, Colorado. Stephen Miller, the architect of Trump’s first-term immigration agenda who reportedly will return in a top White House role, said in an interview last year with a right-wing podcast that National Guard troops from co-operative states could potentially be deployed to what he characterised as “unfriendly” states to assist with deportations, which could trigger legal battles.Vice-President-elect J D Vance said in a New York Times interview published in October that deporting 1mn immigrants per year would be “reasonable”. Biden in the 2023 federal fiscal year outpaced Trump deportation totals for any single year — with a total 468,000 migrants being deported to their home countries or returned to Mexico by US immigration authorities — and is on pace for even more this year, a tally that includes migrants returned to Mexico.Travel bansTrump has said he would implement travel bans on people from certain countries or with certain ideologies, expanding on a policy upheld by the Supreme Court in 2018. Trump previewed some parts of the world that could be subjected to a renewed travel ban in an October 2023 speech, pledging to restrict people from the Gaza Strip, Libya, Somalia, Syria, Yemen and “anywhere else that threatens our security.” During the speech, Trump focused on the conflict in Gaza, saying he would bar the entry of immigrants who support the Hamas and send deportation officers to pro-Hamas protests.Trump said last June he would seek to block communists, Marxists and socialists from entering the US.Legal immigrationTrump plans to end Biden’s humanitarian “parole” programmes, including one that allowed hundreds of thousands of migrants with US sponsors to enter the US and obtain work permits. He has called Biden’s programmes an “outrageous abuse of parole authority.” Trump said last year that he would seek to end automatic citizenship for children born in the US to immigrants living in the country illegally, an idea he flirted with as president.Such an action would run against the long-running interpretation of an amendment to the US Constitution and would likely trigger legal challenges. During his first term, Trump greatly reduced the number of refugees allowed into the US and has criticised Biden’s decision to increase admissions. He would again suspend the resettlement program if elected, the New York Times reported in November 2023.Trump has said he would push for “a merit-based immigration system that protects American labour and promotes American values.” In his first term, he took steps to tighten access to some visa programmes, including a suspension of many work visas during the Covid pandemic. The Trump campaign criticised a Biden programme — currently blocked by a federal judge — that offered a path to citizenship to immigrants in the US illegally who are married to an American citizen and have lived in the US for at least a decade.Trump said on a podcast in June that he backed giving green cards to foreign students who graduate from US colleges or junior colleges, but Trump campaign spokesperson Karoline Leavitt later said the proposal “would only apply to the most thoroughly vetted college graduates who would never undercut American wages or workers.”He would seek to roll back Temporary Protected Status designations, the New York Times reported, targeting a humanitarian programme that offers deportation relief and work permits to hundreds of thousands. Trump tried to phase out most Temporary Protected Status enrolment during his first term, but was slowed by legal challenges. A federal appeals court in September 2020 allowed him to proceed with the wind-down, but Biden reversed that and expanded the programme after taking office.Family separationIn a town hall with CNN last year, Trump declined to rule out resuming his contentious “zero tolerance” policy that led thousands of migrant children and parents to be separated at the US-Mexico border in 2018.He defended the separations again in November 2023, telling Spanish-language news outlet Univision that “it stopped people from coming by the hundreds of thousands.” While Trump has refused to rule out reinstating a family separation policy, Trump’s incoming “border czar” Tom Homan told Reuters last year that the separations “caused an uproar” and that it would be better to detain families together. The Biden administration last year reached a settlement agreement with separated families that would offer them temporary legal status and other benefits while barring similar separations for at least eight years.DACATrump tried to end a programme that grants deportation relief and work permits to “Dreamer” immigrants brought to the US illegally as children, but the termination was rebuffed by the Supreme Court in June 2020. Following the Supreme Court ruling, the Trump administration said it would not accept any new applications to the programme, known as Deferred Action for Childhood Arrivals, or DACA, and would explore whether it could again attempt to end it.Trump plans to try to end DACA if elected, the New York Times reported.

Saturday, February 14, 2026

|

Daily Newspaper published by GPPC Doha, Qatar.