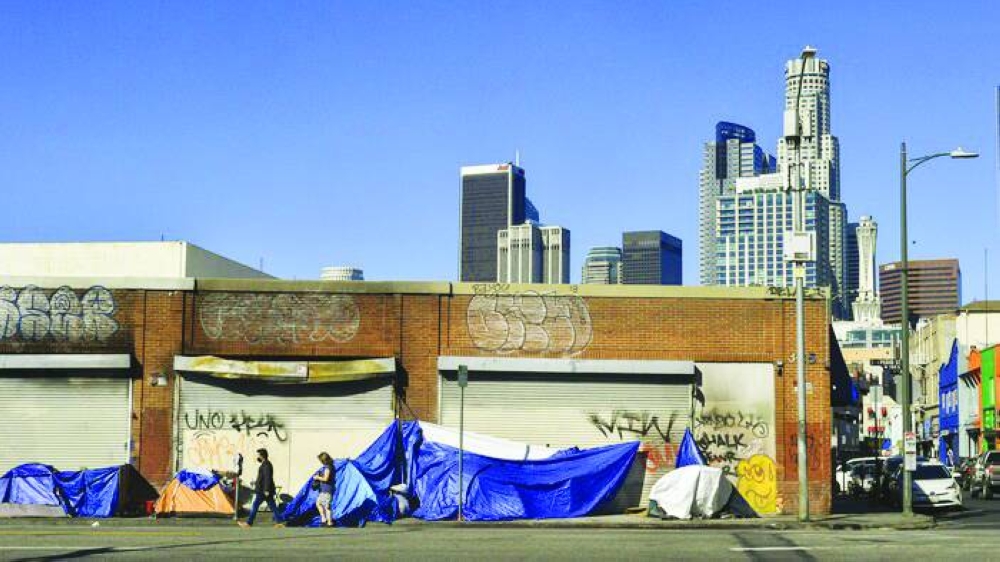

As apprehension grows in China, Europe, and Japan about a possible trade war triggered by the incoming Trump administration, one should also spare a thought for developing countries. Their tried-and-tested method of expanding beyond agriculture to achieve middle-income status has been to embrace low-skilled export-oriented manufacturing. How will these countries fare now?Their prospects may be better than expected, especially if they choose alternative development paths. In the past, poor countries developed through manufacturing exports because foreign demand allowed their producers to achieve scale, and because abysmal agricultural productivity meant that low-skilled workers could be attracted to factory jobs even with low wages. This combination of scale and low labour costs made these countries’ output globally competitive, despite their workers’ lower relative productivity.As firms profited from exports, they invested in better equipment to make workers more productive. As wages rose, workers could afford better schooling and healthcare for themselves and their children. Firms also paid more taxes, allowing the government to invest in improved infrastructure and services. Firms could now make more sophisticated, higher-value-added products, and a virtuous cycle ensued. This explains how China moved from assembling components to producing world-leading electric vehicles (EVs) in just four decades.Visit a cell-phone assembly plant in a developing country today, however, and it is easy to see why this path has become more difficult. Rows of workers no longer solder parts onto motherboards, because the micro-circuitry has become too fine for human hands. Instead, there are rows of machines with skilled workers tending to them, while unskilled workers primarily move parts between machines or keep the factory clean. These tasks, too, will soon be automated. Factories with rows of workers stitching dresses or shoes also are becoming rarer.Automation in developing countries has a variety of implications. For starters, manufacturing now employs fewer people, especially unskilled workers, per unit of output. In the past, developing countries moved steadily to more sophisticated manufacturing, leaving less-skilled manufacturing to poorer countries that were just embarking on the export-led-manufacturing path. But now, a country like China has enough surplus workers to undertake all manner of manufacturing. Low-skilled Chinese workers are competing with Bangladeshi counterparts in textiles, while Chinese PhDs compete with German counterparts in EVs.Moreover, given the declining importance of labour in manufacturing, industrialised countries have come to believe they can restore their own competitiveness in the sector. They already have the skilled workers who can tend the machines, so they are raising protectionist barriers to re-shore production. (Of course, the primary political motive is to create more well-paying jobs for left-behind high school-educated workers, but automation makes this unlikely.)Taken together, these trends – automation, continued competition from established players like China, renewed protectionism – have already made it harder for poor countries in South Asia, Africa, and Latin America to pursue export-led manufacturing growth. Thus, while a trade war would be damaging to their commodity exports, it would not be as concerning as in the past. It may even have a silver lining if it compels developing countries to search harder for alternative paths.That path could be paved with high-skilled services exports. In 2023, global trade in services expanded by 5% in real (inflation-adjusted) terms, while merchandise trade shrank by 1.2%. Improvements in technology during the Covid-19 pandemic enabled more remote work, and changes in business practices and etiquette have minimised the need for physical presence. As a result, multinationals can and do serve clients from anywhere. In India, multinational firms ranging from JPMorgan to Qualcomm are hiring talented graduates to staff global capability centres (GCCs), where engineers, architects, consultants, and lawyers create designs, contracts, content, and software that are embedded in manufactured goods and services sold globally.Every developing country has a small but highly skilled elite who can profitably export skilled services, given the high wage differentials vis-à-vis developed countries. Workers who know English (or French or Spanish) may be particularly advantaged, and even if only a few have these capabilities, such jobs add much more domestic value than low-skilled manufacturing assembly, thus contributing enormously to a country’s foreign-exchange earnings.Moreover, each well-paid service worker can create local employment through his or her own consumption. As more moderately skilled service workers – ranging from taxi drivers to plumbers to waiters – find steady employment, they will cater not just to elite demand but also to each other. High-skilled services exports only need to be the leading edge of broader job growth and urbanisation.All job growth, however, requires improvements in the quality of a country’s labour pool. Some “last-mile” training and upgrading can be done quickly; as long as engineering graduates have basic knowledge of their field, they can be trained in state-of-the-art design software that a potential multinational employer needs. But over the medium term, most countries will need to invest substantial amounts in nutrition, health, and education to augment their peoples’ human capital.Fortunately, these investments can also create employment. With the right development-appropriate policies, governments can substantially improve learning and health across the population. This may mean hiring more high-school-educated mothers in daycares to help teach children basic literacy and numeracy at an early age; or training more “barefoot” medical practitioners to recognise basic ailments, prescribe medicines, or make referrals to qualified physicians when necessary.Developing countries need not abandon manufacturing, but they must explore other paths to growth. Instead of benefiting one sector or another through industrial policy, they should invest in the kinds of skills that are important for all jobs.Services are especially worth exploring, because developed economies are unlikely to erect protectionist barriers against them. As the world’s largest service exporters in 2023, the European Union, the US, and the United Kingdom have much to lose from a trade war in this domain. Insofar as global services competition affects their own workforce, it would be felt most strongly by doctors, lawyers, bankers, consultants, and other high-income professionals, implying a boon for consumers of these services in developed countries and potentially even reducing domestic income inequality. Those would be worthwhile outcomes in themselves. - Project SyndicateRaghuram G. Rajan, a former governor of the Reserve Bank of India and chief economist of the International Monetary Fund, is Professor of Finance at the University of Chicago Booth School of Business and the co-author (with Rohit Lamba) of Breaking the Mold: India’s Untraveled Path to Prosperity.

Thursday, February 19, 2026

|

Daily Newspaper published by GPPC Doha, Qatar.