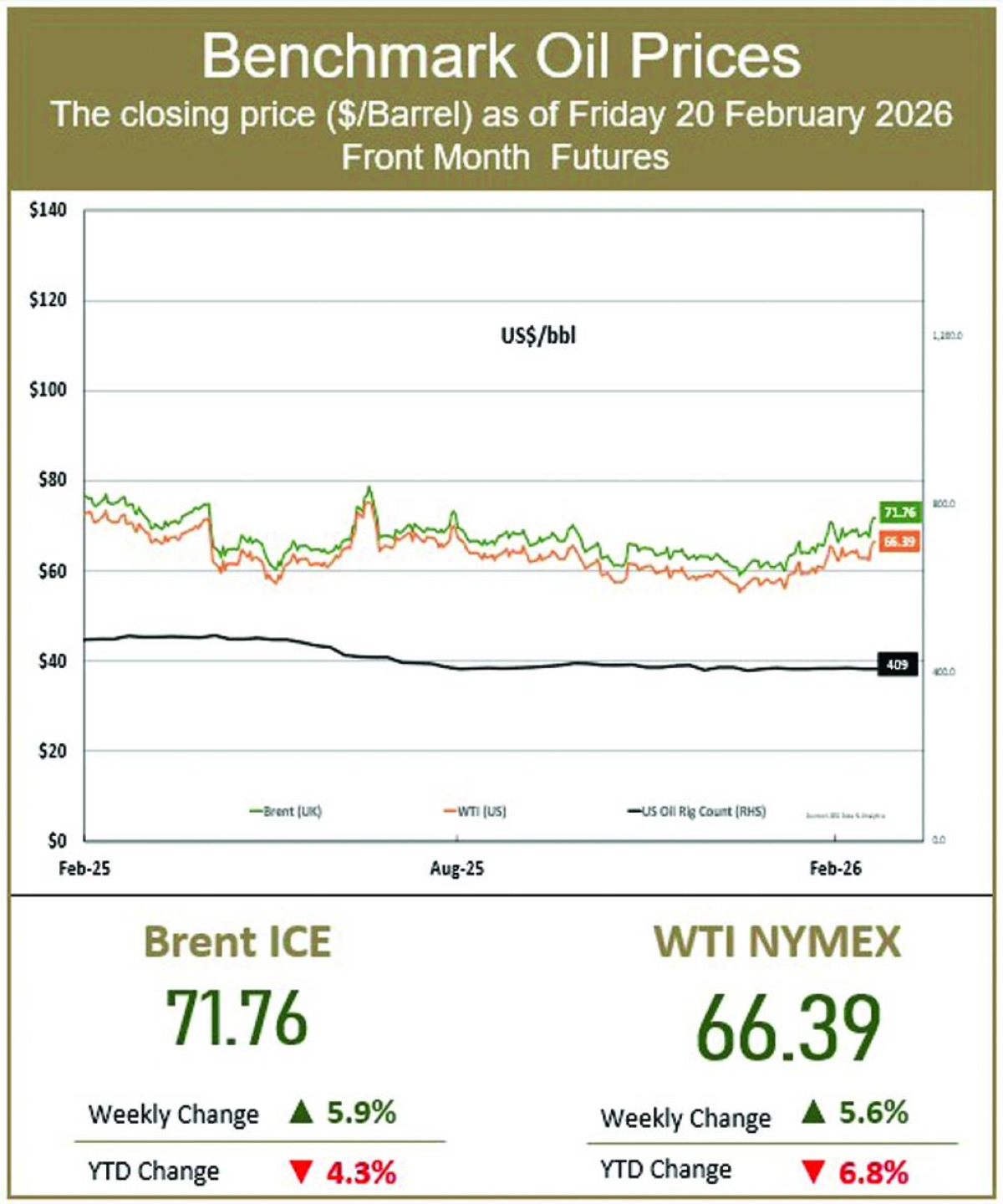

Oil

Brent crude prices rose on Friday as investors worried about potential US military action, with President Donald Trump pressing the Islamic Republic of Iran to halt nuclear weapons development.

Brent crude futures settled at $71.76, and US West Texas Intermediate crude (WTI) finished at $66.39. For the week, Brent rose 5.9%, while WTI rose 5.6%.

Meanwhile, the oil market shrugged off a US Supreme Court decision ruling unconstitutional Trump's use of a law to levy tariffs in national emergencies.

In the US, crude inventories dropped by 9mn barrels as refining utilisation and exports climbed, an Energy Information Administration report showed on Thursday.

Markets were also considering the impact of ample supply, with talks of Opec+ leaning towards a resumption in oil output increases from April.

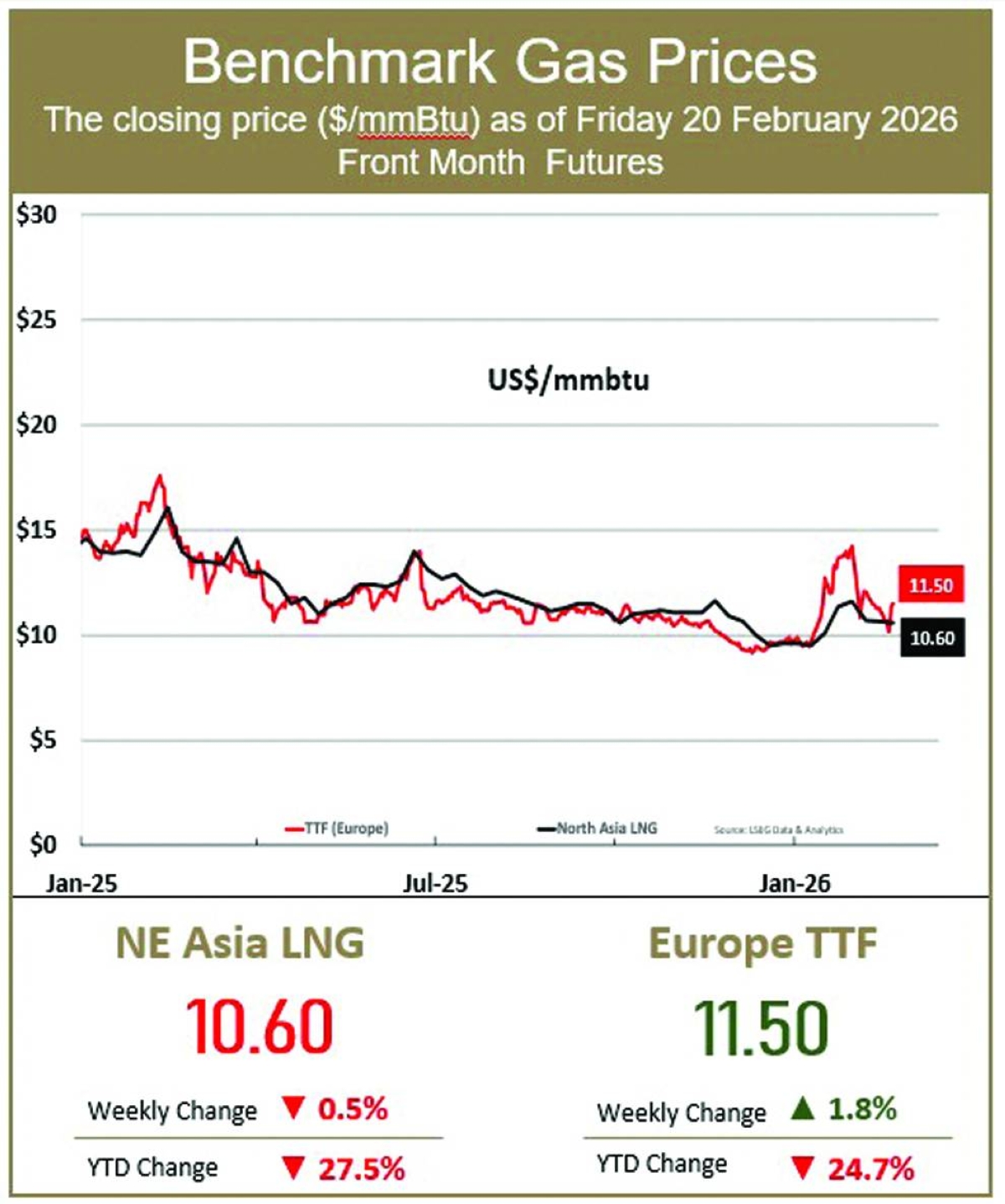

Gas

Asia spot liquefied natural gas held steady on Friday as tepid demand and high inventories during the Lunar New Year lull capped buying interest, though geopolitical tensions between the US and Iran offered some support.

The average LNG price for March delivery into north-east Asia was $10.60 per million British thermal units, down from $10.65 per mmBtu the week before.

Above-normal Northeast Asia temperatures will curb heating demand, while Japan’s Kashiwazaki-Kariwa No 6 reactor restart trims LNG use.

In Europe, the Dutch TTF gas price settled at $11.50 per mmBtu on Friday, posting a weekly gain of 1.8%. Prices were supported by geopolitical tensions and continued pressure on underground gas storage levels, which are around 32% full, the lowest for this time of year since 2022.