Oil

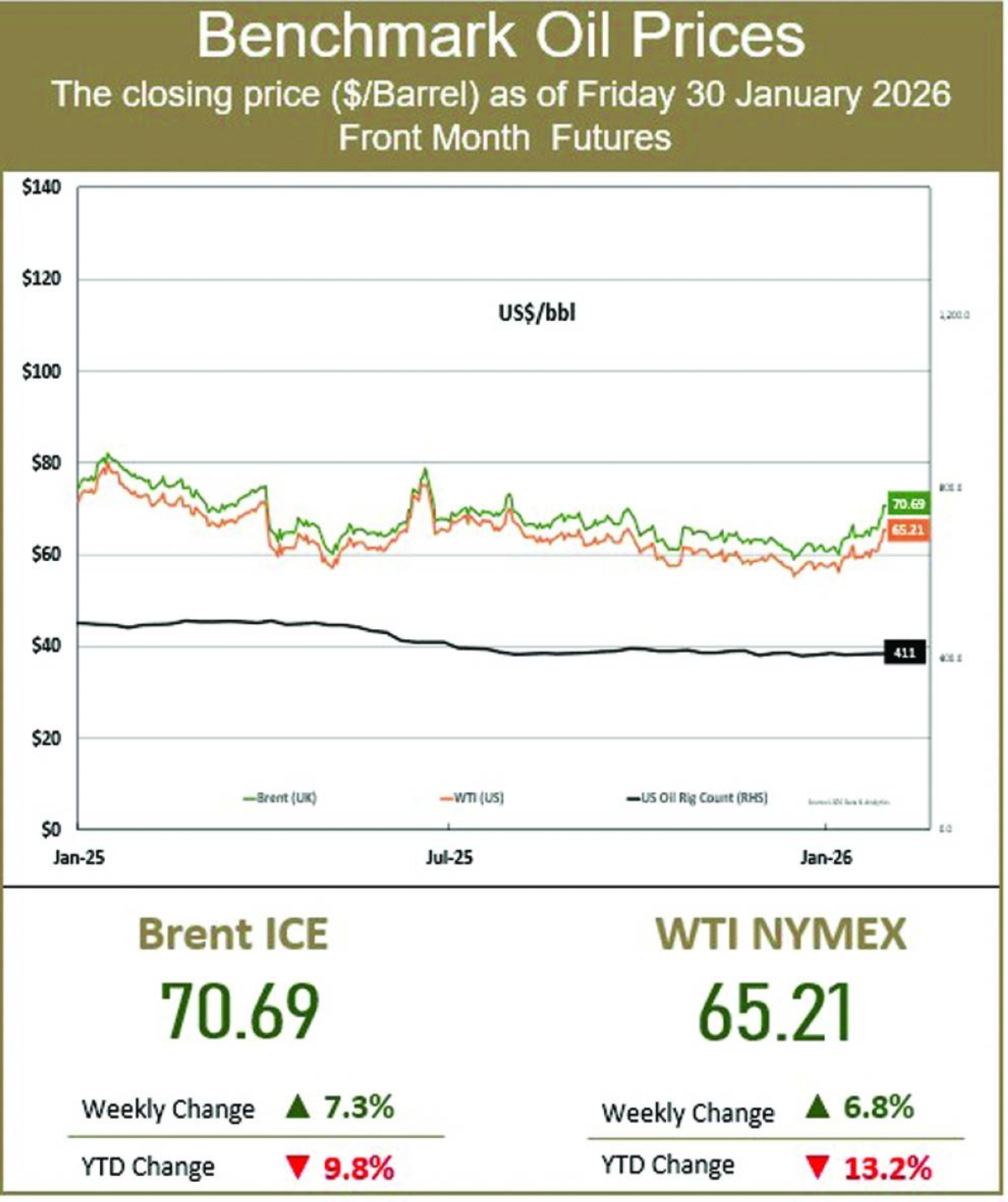

Oil prices dipped a few cents per barrel on Friday, consolidating recent gains and holding near six-month highs on Friday, supported by ongoing tensions between the US and Iran.

Brent crude futures settled at $70.69, and US West Texas Intermediate crude (WTI) finished at $65.21. For the week, Brent rose 7.3%, while WTI gained 6.8%.

Sources said US President Donald Trump was weighing actions against Iran that included targeted strikes, raising concerns about supply disruptions.

Both the US and Iran have since signalled willingness to engage in dialogue, but Tehran on Friday said its defence capabilities should not be included in any talks.

Meanwhile, the US, which has strengthened its military position in the Middle East in recent weeks, issued new sanctions targeting seven Iranian nationals and at least one entity.

Gas

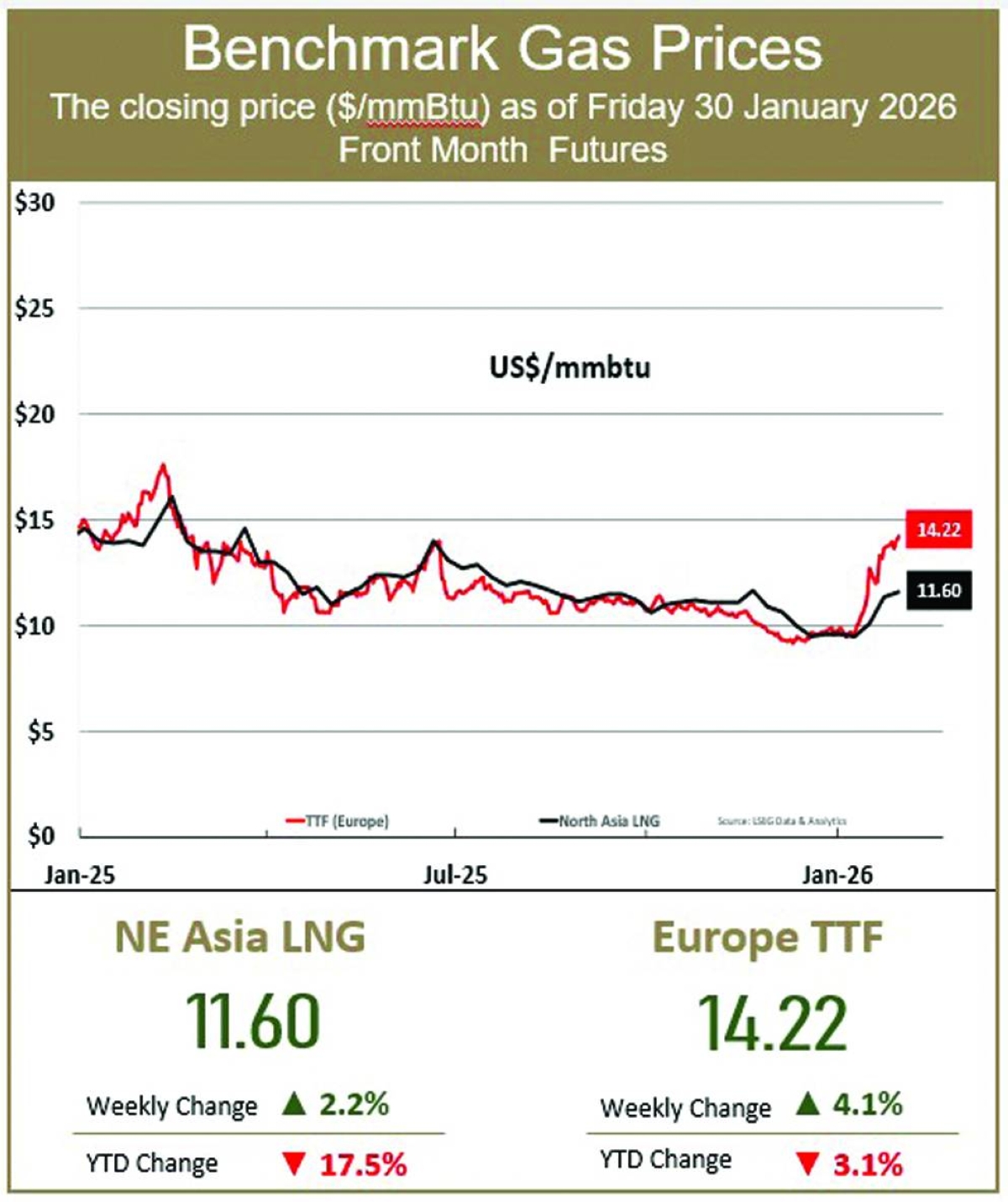

Asia spot LNG rose for a third week on Friday to hold at a nine-week high, as colder temperatures lifted heating demand in the Northern Hemisphere and as US export loadings eased earlier last week.

The average LNG price for February delivery into north-east Asia was $11.60 per million British thermal units (mmBtu), up from $11.35 per mmBtu the week before.

In Europe, the Dutch TTF gas price settled at $13.66 per mmBtu, posting a weekly gain of 14.22%. Europe is experiencing higher year-on-year gas demand, and although LNG send-out remains robust, elevated storage withdrawals are increasing pressure on the system, analysts said.

In the US, natural gas futures surged 140% over the past seven trading days as an Arctic blast spiked heating demand, freezing oil and gas wells and cutting gas output to a two-year low.