Oil

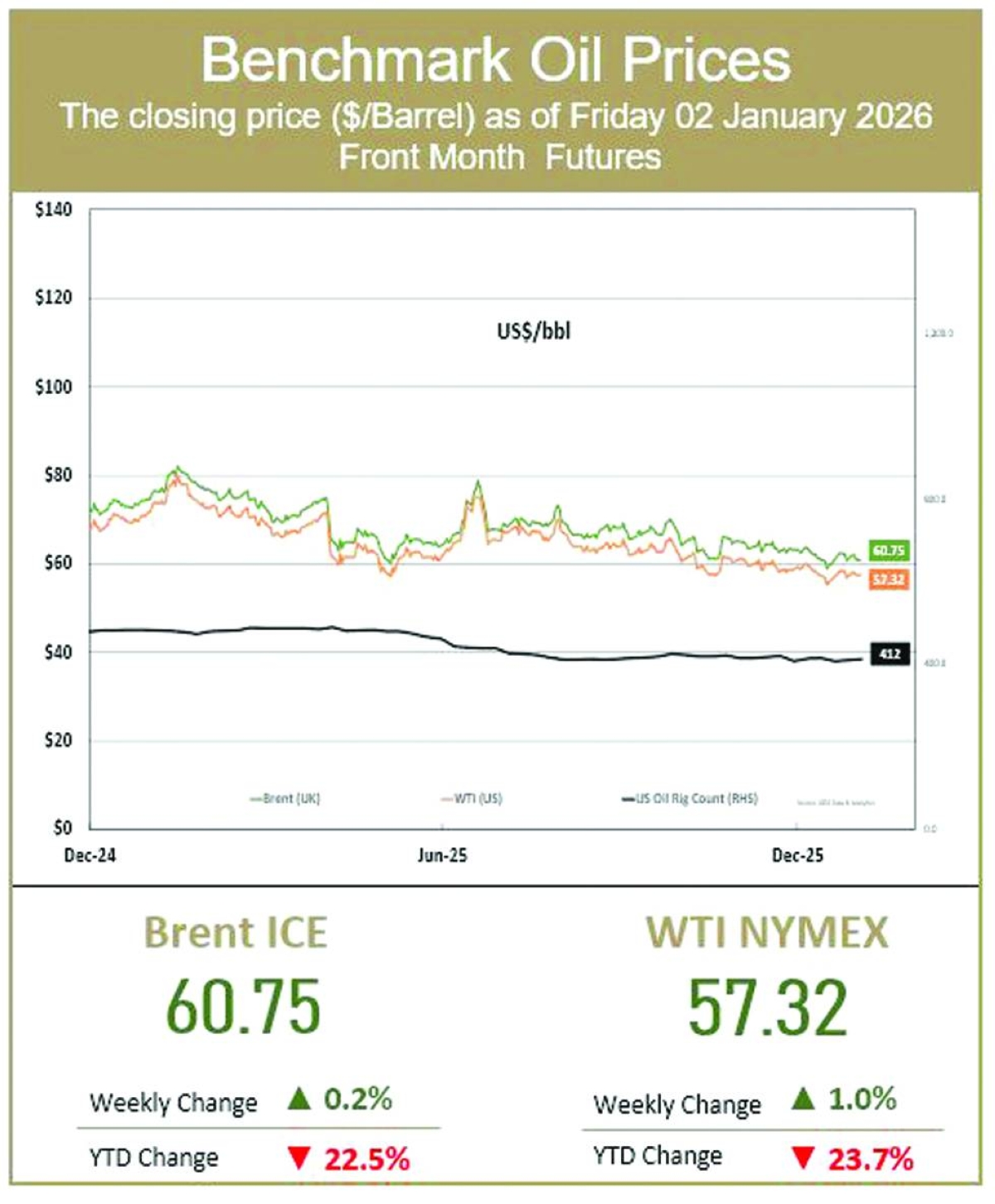

Oil prices settled lower on Friday on the first trading day of 2026 after registering their biggest annual loss since 2020, as investors weighed oversupply concerns against geopolitical risks.

Brent crude futures settled at $60.75, while US West Texas Intermediate (WTI) crude finished at $57.32. For the week, Brent rose 0.2% and WTI rose 1.0%.

Kyiv has been intensifying strikes against Russian energy infrastructure, aiming to cut off Moscow's sources of financing for its military campaign.

Meanwhile, the Trump administration ratcheted up pressure on Venezuelan President Nicolás Maduro on Wednesday, imposing sanctions on four companies and associated oil tankers it said were operating in Venezuela’s oil sector. Maduro said his country is willing to accept US investment in its oil industry and coordinate efforts to combat drug trafficking.

Gas

Asian spot LNG prices started the year steady, as muted regional demand and ample supply kept the market flat following a 34% slump in 2025.

The average LNG price for February delivery into north-east Asia was $9.60 per million British thermal units (mmBtu), unchanged from the previous week.

Market conditions remain relatively calm and are largely dominated by bearish sentiment, while LNG supply likely reached new record levels of 42mn tonnes.

In Europe, the Dutch TTF gas price settled at $9.90 per mmBtu, posting a weekly gain of 2.1%. While milder temperature forecasts and a slower pace of December withdrawals have eased immediate pressure, Europe entered winter with materially lower storage levels than in recent years and will need to attract significant LNG volumes through January and February to remain balanced.