Company executives are sounding remarkably upbeat about the economy this earnings season, even as trade tensions linger and stock valuations look stretched.

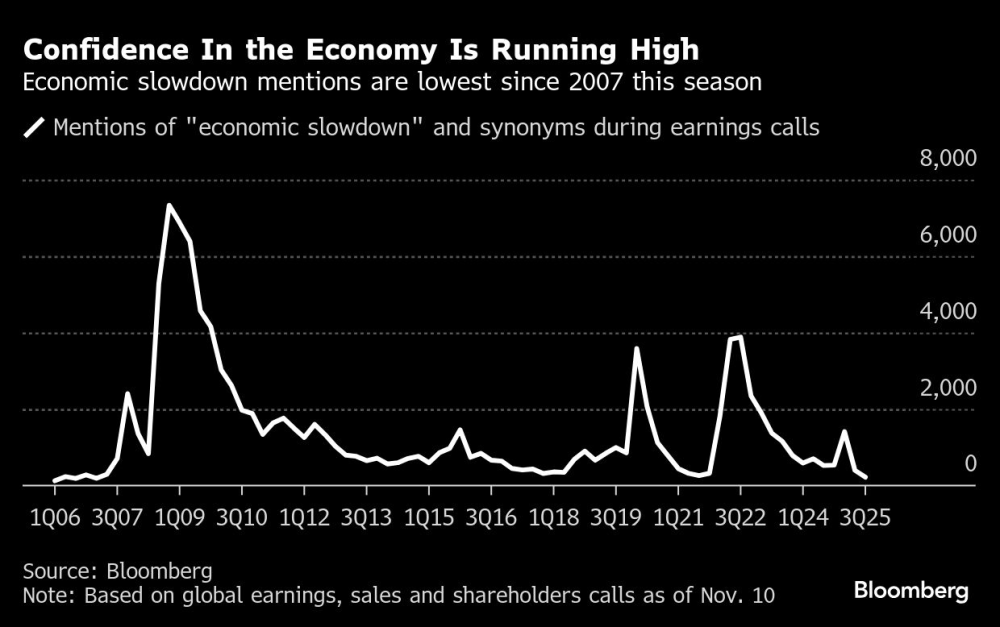

Mentions of “economic slowdown” and synonyms during sales, guidance and earnings calls tracked by Bloomberg are the lowest since 2007. That’s despite the disruption to official US data caused by the government shutdown and the murkier policy outlook it’s led to. And this is playing out as the S&P 500 heads for a third year of high returns, with stocks as expensive as they were at their post-pandemic peak.

Investors’ worst fears of how tariffs would ravage global growth and harm company profits have largely failed to materialise. The third-quarter reporting season has shown how companies have mitigated the impact of levies by increasing prices, reducing costs and streamlining supply chains. Around the world, consumers have proved resilient.

“Corporate sentiment continues to improve post-tariff fall,” said Bank of America Corp strategists led by Savita Subramanian. “Weak demand mentions have declined over the past year but remain above average, while the ratio of companies mentioning better/stronger vs worst/weaker has trended up.”

The S&P 500 is on course for earnings growth of 14.5% this quarter, compared with the 7.4% expected before the season started, according to a Bloomberg Intelligence earnings tracker. Over 81% of companies have beaten estimates.

For the full year, the increase in earnings is estimated to reach 11.4%, followed by 11.9% in 2026 and 13.5% in 2027. Megacap and technology shares have been driving the gains, boosted by a relentless appetite for artificial intelligence related trade.

Aside from rising profits, the stock market has been driven higher by valuation expansion this year. The S&P 500’s forward price-to-earnings ratio has surged to 23, equivalent to the post-pandemic peak and within reach of the record hit prior to the dot-com bubble. Angst over elevated valuations was at the core of the recent pullback.

Meanwhile, recent news coverage captures some of the optimism reflected in earnings calls. Mentions of an economic slowdown in articles have dropped in the past few months to the lowest level since June 2021.

“The tone on outlook has improved, with most firms expecting further margin expansion and capital returns,” said Barclays Plc strategists including Magesh Kumar Chandrasekaran.

The lack of official US data caused by the shutdown — now seemingly close to being resolved — has denied the Federal Reserve key reports that inform policy making, with officials giving conflicting comments about the path ahead for interest rates.

The Washington deadlock placed a greater focus on private readings of the economy, which have proved mixed.

While PMIs tracking activity have been strong, private labor market numbers look shakier. US companies announced the most job cuts for any October in more than two decades, according to figures from outplacement firm Challenger, Gray & Christmas Inc. ADP Research data, on the other hand, signalled stabilisation in private-sector payrolls.

Some strategists see a more uneven picture in company earnings commentary, with RBC Capital Markets’ Lori Calvasina noting disparities between industries. Some companies continued to highlight uncertainties arising from trade policy, along with weak consumer demand and affordability challenges, she said. Others have spoken of soft end-markets including in industrial sectors and that they expect their challenges to continue next year, with corporate customers still holding off on capex.

“Overall, commentary continues to be best described as mixed, with the best tone coming from tech and health care,” Calvasina said. “On the more positive side, some companies continued to highlight their ability to pass through price, their expectations for a better 2026 backdrop due to a better FX and interest rate/mortgage rate backdrop, strong demand or stabilising markets, and strong equity market conditions and increased lending.”

Still, with most reporting now done for this quarter, earnings growth is running strong and positive surprises have become a broader phenomenon.

After hovering a little above its long-term historical average of 5.4% for nearly two years, global earnings growth has surged to its highest in over three years to 11.3%, according to Deutsche Bank AG strategists led by Bankim Chadha. Earnings beats rose across regions to the top of their historical ranges this season. The increase in earnings is all the more surprising, given that it has diverged from GDP growth, the Deutsche Bank team said.

The strong reporting season has kept analysts bullish in the US, with a Citigroup Inc earnings revisions gauge mostly in upgrade territory since the summer.

“Current earnings reports reinforce our core thesis: Profits remain the glue for US equities,” said Societe Generale SA strategist Manish Kabra. He estimates that earnings per share for S&P 500 members will rise to $333 by 2027 from $261 in 2025. He sees the benchmark index at 7,300 points in the first half of 2026. It closed at 6,832 points on Monday.

Kabra added that strong revenue beats support the thesis that nominal growth is robust in the US. “The backdrop of Fed rate cuts, combined with front-loaded fiscal benefits in 2026, should keep corporate commentary constructive.”

Mentions of “economic slowdown” and synonyms during sales, guidance and earnings calls tracked by Bloomberg are the lowest since 2007. That’s despite the disruption to official US data caused by the government shutdown and the murkier policy outlook it’s led to. And this is playing out as the S&P 500 heads for a third year of high returns, with stocks as expensive as they were at their post-pandemic peak.

Investors’ worst fears of how tariffs would ravage global growth and harm company profits have largely failed to materialise. The third-quarter reporting season has shown how companies have mitigated the impact of levies by increasing prices, reducing costs and streamlining supply chains. Around the world, consumers have proved resilient.

“Corporate sentiment continues to improve post-tariff fall,” said Bank of America Corp strategists led by Savita Subramanian. “Weak demand mentions have declined over the past year but remain above average, while the ratio of companies mentioning better/stronger vs worst/weaker has trended up.”

The S&P 500 is on course for earnings growth of 14.5% this quarter, compared with the 7.4% expected before the season started, according to a Bloomberg Intelligence earnings tracker. Over 81% of companies have beaten estimates.

For the full year, the increase in earnings is estimated to reach 11.4%, followed by 11.9% in 2026 and 13.5% in 2027. Megacap and technology shares have been driving the gains, boosted by a relentless appetite for artificial intelligence related trade.

Aside from rising profits, the stock market has been driven higher by valuation expansion this year. The S&P 500’s forward price-to-earnings ratio has surged to 23, equivalent to the post-pandemic peak and within reach of the record hit prior to the dot-com bubble. Angst over elevated valuations was at the core of the recent pullback.

Meanwhile, recent news coverage captures some of the optimism reflected in earnings calls. Mentions of an economic slowdown in articles have dropped in the past few months to the lowest level since June 2021.

“The tone on outlook has improved, with most firms expecting further margin expansion and capital returns,” said Barclays Plc strategists including Magesh Kumar Chandrasekaran.

The lack of official US data caused by the shutdown — now seemingly close to being resolved — has denied the Federal Reserve key reports that inform policy making, with officials giving conflicting comments about the path ahead for interest rates.

The Washington deadlock placed a greater focus on private readings of the economy, which have proved mixed.

While PMIs tracking activity have been strong, private labor market numbers look shakier. US companies announced the most job cuts for any October in more than two decades, according to figures from outplacement firm Challenger, Gray & Christmas Inc. ADP Research data, on the other hand, signalled stabilisation in private-sector payrolls.

Some strategists see a more uneven picture in company earnings commentary, with RBC Capital Markets’ Lori Calvasina noting disparities between industries. Some companies continued to highlight uncertainties arising from trade policy, along with weak consumer demand and affordability challenges, she said. Others have spoken of soft end-markets including in industrial sectors and that they expect their challenges to continue next year, with corporate customers still holding off on capex.

“Overall, commentary continues to be best described as mixed, with the best tone coming from tech and health care,” Calvasina said. “On the more positive side, some companies continued to highlight their ability to pass through price, their expectations for a better 2026 backdrop due to a better FX and interest rate/mortgage rate backdrop, strong demand or stabilising markets, and strong equity market conditions and increased lending.”

Still, with most reporting now done for this quarter, earnings growth is running strong and positive surprises have become a broader phenomenon.

After hovering a little above its long-term historical average of 5.4% for nearly two years, global earnings growth has surged to its highest in over three years to 11.3%, according to Deutsche Bank AG strategists led by Bankim Chadha. Earnings beats rose across regions to the top of their historical ranges this season. The increase in earnings is all the more surprising, given that it has diverged from GDP growth, the Deutsche Bank team said.

The strong reporting season has kept analysts bullish in the US, with a Citigroup Inc earnings revisions gauge mostly in upgrade territory since the summer.

“Current earnings reports reinforce our core thesis: Profits remain the glue for US equities,” said Societe Generale SA strategist Manish Kabra. He estimates that earnings per share for S&P 500 members will rise to $333 by 2027 from $261 in 2025. He sees the benchmark index at 7,300 points in the first half of 2026. It closed at 6,832 points on Monday.

Kabra added that strong revenue beats support the thesis that nominal growth is robust in the US. “The backdrop of Fed rate cuts, combined with front-loaded fiscal benefits in 2026, should keep corporate commentary constructive.”